What Is A Flash Loan Attack In Crypto? Easy Trick Of Crypto Criminals

13 May 2022

The growth of the DeFi lending market has increased the popularity of crypto lending. Flash loans have become a highly desirable kind of credit because they exploit the full potential of presently accessible technology.

A flash loan is a loan that does not need collateral. You may be wondering, “How?” Using a platform’s smart contract, the whole loan and returning procedure happens in a single blockchain transaction.

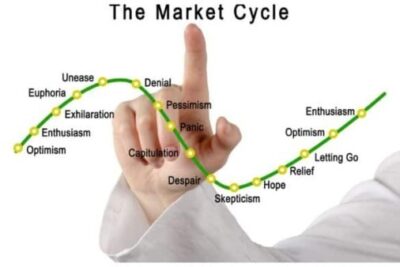

Eventually, creative hackers discovered a method to abuse the system. In a typical flash loan attack, the borrower instantly utilizes a big amount of cash to purchase a huge quantity of a crypto asset, causing a sell-off. This artificially decreases the price on that exchange, at least until the loan payback window ends. During this period, the attackers acquire the devalued cryptocurrency and sell it on a market-price-maintaining exchange.

This article, bePAY will introduce the tricks of scammers when utilizing flash loan attacks, as well as some methods to prevent them.

What Is A Flash Loan Attack In Crypto?

What Is A Flash Loan?

Flash loans are a kind of unsecured peer-to-peer financing. These loans are “secured” by a strict deadline for repayment; if the borrower misses the deadline, the whole transaction is instantly voided. These loans are mostly used by day crypto traders who need to swiftly obtain substantial funds to capitalize on an opportunity.

The theory is straightforward and very applicable. An unsecured loan does not need collateral, a credit score, or administration, unlike standard secured loans. Stablecoin may be acquired and used in a matter of seconds.

This is what some traders on different DeFi sites are doing. Aave customers may get such loans, invest the cash in a flash loan arbitrage, repay the loan, and pocket the gains.

When everything works well, both the lender and the borrower gain from the loan. If anything goes wrong, the deal is voided and neither party makes a profit.

Flash loan

What Is A Flash Loan Attack?

Flash loan attacks are prevalent because they are simple for a hacker to execute and low-risk owing to the minimal likelihood of exposure. According to Coinmarketcap, all that is necessary to perform a flash loan assault is a computer, an Internet connection, and some creativity.

Flash loans may be used to generate flash loan arbitrage opportunities, making them an easy target for DeFi hackers. It includes altering asset prices to exploit arbitrage opportunities on DeFi services that would not otherwise exist.

Due to the potentially endless amount of the loan, the attacker may “boost demand” and raise the price. They may execute a transaction similar to any other arbitrage opportunity (buy cheap, sell high), then repay the loan and retain the gains. The ultimate value of the loan might possibly rise into billions of dollars, depleting the liquidity of the impact pools.

Due to their limitless and immediate nature, a well-planned assault may be undertaken in a single attempt with no risk if it fails (since the loan transaction would instantly reverse if it is not returned).

Flash loan attacks

>> See other shapes of crypto scams in 2022

How Do Flash Loan Attacks Work?

Once the borrower has the cryptocurrency, they must act within seconds. Now, data from such global transactions are packaged into a block and put into the blockchain without any reversal mechanism. Different blockchains need varying amounts of time to create a block. For example, the Bitcoin blockchain requires 5 seconds, but the Ethereum blockchain requires 13 seconds.

The Ethereum blockchain is used by liquidity pools like Aave because its smart contracts streamline and automate the lending and borrowing process. Therefore, you may borrow huge sums of stablecoins, do many transactions inside the 13-second window, and return them to the system while pocketing profits.

The protocol does not care what you do with the funds as long as they are returned to the pool with the associated fees. This encourages hackers to exploit arbitrage possibilities throughout the process. But how might one swiftly acquire cryptocurrency, execute large deals, collect riches, and refund the initial investment within seconds? This seems to be manually impossible. Actually, no.

Smart contracts, the unique characteristic of Ethereum and flash loans, are exploited by hackers. To benefit from a flash loan, hackers manipulate the market to generate arbitrage opportunities. ‘Flooding’ the blockchain with buying and sell order smart contracts causes price discrepancies.

How do flash loan attacks work?

Since these contracts are intended to swap borrowed tokens for other tokens, the sheer volume involved drives up the demand for borrowed tokens and therefore their pricing. The smart contracts then execute the sales at inflated pricing. And because this is entirely automated, it occurs in a few seconds.

Can You Make Money From Flash Loans?

It’s a method to potentially generate large returns without putting your own money at risk. There are instances when the unprecedented speed of a flash loan makes sense. Flash loans may be used for

- Flash Loan Arbitrage: Traders may profit from arbitrage by searching for price differences across many exchanges. Suppose two marketplaces have different prices for pizza coins. It costs $1 on Exchange A and $2 on Exchange B. A user may utilize a flash loan and a separate smart contract to purchase 100 pizza coins for $100 at Exchange A and then sell them for $200 at Exchange B. The borrower then repays the loan and retains the difference.

- Collateral swaps: Quickly exchanging the collateral supporting the user’s loan for another kind of collateral.

- Lower transaction fees: In a way, flash loans combine what would otherwise need many transactions into one. Each transaction incurs a price, therefore quick loans may result in cheaper fees.

Can you make money from flash loans?

>> Explore more about how to maximize crypto arbitrage.

How To Prevent From Flash Loan Attacks?

Flash loan assaults are made feasible by contracts that calculate the value of a token or trading pair entirely internally. Although utilizing the contract’s supply of multiple tokens to calculate the price is the “purest” method of pricing assets, it makes these contracts subject to manipulation and abuse.

The easiest strategy to defend against flash loan assaults is to employ an external pricing oracle to prevent slippage. Smart contracts should change their pricing depending on the supply and demand for different tokens but should restrict this price range based on external variables. This makes it more difficult for an attacker to build sufficient slippage to make an exploit worthwhile.

Flash loan assaults constitute a large proportion of all DeFi hacks. This is not only an indicator that the sector has failed to learn from its failures. The weaknesses that allow potential flash loan attacks are not always visible and may need a comprehensive security assessment to uncover.

The cost of a flash loan attack might be substantial for a DeFi protocol and its users. It is becoming normal for DeFi hackers to siphon tens or hundreds of millions of dollars from DeFi systems.

Protecting from flash loan attacks

Before releasing any smart contract, it is crucial to conduct a security audit that may assist discover and remedy these and other vulnerabilities before they can be exploited by an attacker.

Halborn provides complete audits of DeFi projects, including a thorough analysis of smart contract code for vulnerabilities, such as those that enable feasible flash loan attacks.

FAQs About Flash Loan

How Can I Use A Flash Loan?

Flash loans are accessible on several Ethereum-based DeFi lending platforms, including Aave and dYdX. They began as a tool only for developers who could utilize the command line, a means for sending text instructions to a computer. However, more user-friendly interfaces are now appearing.

What Happens If I Cannot Repay A Flash Loan?

Then you will never get the loan. Remember that the whole flash loan consists of a single transaction. The loan will not be given if both the lender and the borrower fail to follow the regulations. This is the benefit of a smart contract. It will not allow money to transfer until a certain condition is satisfied.

Are Flash Loans Risk-Free?

Multiple assaults on flash loans have resulted in millions of dollars in losses. There are several ways in which malevolent actors might manipulate the lending system.

This exposes a larger issue with Ethereum and DeFi. Smart contracts may be exploited if they are not built to operate precisely as intended or if the data flowing into them is corrupted or vulnerable. The method, on the other hand, is brand new. Others argue that these assaults will remain a chronic problem as technology advances.

Are flash loans risk-free?

Bottom Up

Flash loans are an excellent complement to the DeFi ecosystem. In the future, they will no longer be vulnerable to assault.

As developers create better smart contracts and more systems install security mechanisms like decentralized price oracles, the number of hacker assaults will decline.

We feel that flash loans are worthwhile investments. Remember that there is always at least a low danger of a flash loan attack, therefore employ caution while lending cryptocurrency on DeFi sites.

Learn more about other blockchain technology and cryptocurrency topics for the non-tech user at bePAY insight posts.

Step By Step Guide Of How To Add Fantom To MetaMask

15 July 2022

What Is Taproot Bitcoin? How Does It Affect Bitcoin?

24 June 2022

What Is Polkadot? The Next Generation Of Blockchain

21 April 2022