What Is Polkadot? The Next Generation Of Blockchain

21 April 2022

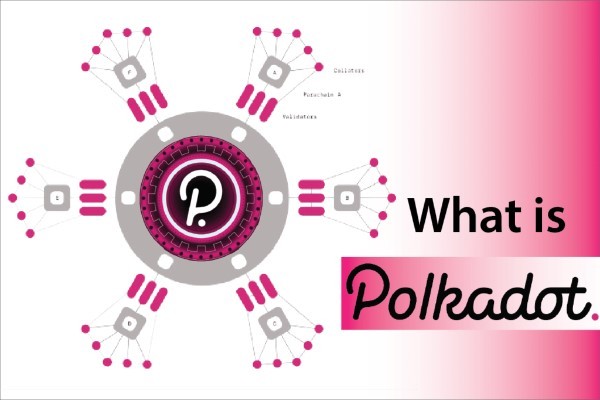

A new blockchain technology, Polkadot, claims to be able to unite numerous specialized chains into a single universal network. With a major emphasis on creating infrastructure for Web 3.0 – and formed by the Web3 Foundation – Polkadot intends to challenge Internet monopolies and empower individual users.

As far back as the genesis of Bitcoin, there has been a blockchain. While it has been dubbed a pioneering technology, there are also significant limitations to take into mind. Individual blockchains are unable to connect with one another. Integrating multiple chains might lead to the interchange of data and, as a result, better applications and services.

Developers have sought to “bridge” blockchains in the past. Doing so enables chain A to operate with chain B and vice versa. Nevertheless, the need to link a large number of blockchains simultaneously (imagine hundreds or thousands) persists. Polkadot’s team, and by extension, the Web3 Foundation, is convinced that an elegant solution can be built over the following years.

To further understand what is Polkadot, let’s look at the Polkadot blockchain in more depth. Keep reading this bePAY’s insight guides to find out all you need to know if you are contemplating investing in Polkadot.

- What Is Polkadot?

- How Does Polkadot Network Work?

- What Is Polkadot Used For?

- Polkadot Vs Cardano: Is Polkadot Better Than Cardano?

- Polkadot Vs Ethereum: How Is Polkadot Different From Ethereum?

- FAQs About Polkadot

- Wrapping Up

What Is Polkadot?

Polkadot Ecosystem Definition

Polkadot is Ethereum co-founder Gavin Wood’s counter-argument to blockchain maximalism. Ever since its debut in May of this year, it has seen an incredible surge in both popularity and revenue. Since then, it has become one of the top 20 cryptocurrencies as of the time of writing, by market cap, according to Coinmarketcap.

But what is Polkadot, and what influence is it having on the industry? Who is utilizing it, and is the hoopla hollow or well-founded? Polkadot (DOT) is a blockchain network that, to put it another way:

- Links many blockchains together and makes it possible for anybody to utilize their Substrate framework to create their own

- Hosts blockchains, managing their security and transactions

- Connects Polkadot blockchains to other networks, including Ethereum and Bitcoin.

To learn more about Polkadot, read Lightpaper. Let’s look at each of these characteristics in greater depth.

What Is Polkadot?

Polkadot’s Cryptocurrency

There is a Polkadot cryptocurrency called DOT. Coinmarketcap has kept it at the top of its list. Polkadot has enjoyed tremendous success since its introduction in May 2020, which is reflected in the native coin’s current value.

These DOTs may be used for a variety of different uses. To begin with, token holders get control over the Polkadot platform as a whole. This involves deciding network costs, voting on general network enhancements, and the deployment or removal of parachains.

DOT is also meant to support network consensus via staking. Like other staking networks, DOT holders have an incentive to follow the rules consistently.

When it comes to bonding, the third choice is DOT. When new parachains are introduced to the Polkadot ecosystem, this is necessary. The bound DOT is locked throughout the bonding phase. It’s released after the bond time has completed and the parachain is withdrawn from the ecosystem.

Polkadot’s Cryptocurrency

How Does Polkadot Network Work?

Below are the main elements that Polkadot Network allows for creation:

- The Relay Chain — The primary Polkadot blockchain, this network is where transactions are completed. Adding new transactions and verifying them are done in different steps in the relay chain. This increases throughput. According to 2020 testing, this architecture enables Polkadot to perform approximately 1,000 transactions per second ̣tps

- Parathreads – Additionally, parathreads are semi-autonomous in their own right. Applications that do not need a continual connection to the Polkadot network may utilize these devices.

- Parachains – Parachains are bespoke blockchains that employ the relay chain’s computer capacity to check those transactions are correct.

- Bridges – Bridges allow the Polkadot network to communicate with other blockchains. Tokens may now be traded without the need for a central exchange thanks to efforts to develop bridges between blockchains like EOS, Cosmos, Ethereum, and Bitcoin.

The Relay Chain

To maintain its network in agreement on the status of the system, the Polkadot Relay Chain employs a variant of proof-of-stake (PoS) consensus termed nominated-proof-of-stake (NPoS).

This system lets anybody who stakes DOT by locking the cryptocurrency in a customized contract fulfil one or more of the following functions vital to its operation:

- Validators – Confirm data in parachain. They also engage in consensus and vote on suggested improvements to the network.

- Nominators — Safeguard the Relay Chain by choosing trustworthy validators. Nominators delegate their staked DOT tokens to validators and so allot their votes to them.

- Collators – Nodes operate that keeps a complete history for each parachain and combine parachain transaction data into blocks for adding to the Relay Chain.

- Fishermen — Keep an eye on the Polkadot network and notify validators of any suspicious activity.

Users who stake DOT and take on these responsibilities are also eligible for DOT prizes.

How Polkadot Operates?

The Governance of Polkadot

Polkadot users fall into three categories, each of which has the potential to have an impact on software development. Among them are:

- Holders – Holders of DOT tokens may use their tokens to propose network modifications and accept or reject significant changes suggested by others. They can also use their tokens to vote on proposed changes.

- The Council – Improvements to the program are offered by council members, who are chosen by DOT holders. They must also decide which DOT holders’ changes will be implemented. Proposals by Council members need fewer votes to be adopted than those by ordinary DOT holders.

- The Technical Committee – Composed of teams actively creating Polkadot, this group may offer extraordinary suggestions in the case of an emergency. Council members elect the members of the technical committee.

What Is Polkadot Used For?

There is a network protocol called Polkadot that enables the transmission of any data, not only tokens, from one blockchain to another.

This implies that Polkadot is a genuine multi-chain application environment, allowing for the creation of cross-chain registries and doing cross-chain computation. Using Polkadot, this data may be transferred over both public and private blockchains.

A private blockchain may now be accessed and used on a public blockchain, making it feasible to construct apps that utilise permission data from the private blockchain. Such evidence might be sent to the degree-verification smart contract on the public blockchain.

Data and asset exchange is only a small part of Polkadot’s approach to interoperability. It’s also a way to introduce new ideas, like rewarding honest token staking and tying tokens together into chains.

What Is Polkadot Used For?

Pledges on the blockchain aren’t anything new. By rewarding users for staking coins on the network, Proof of Stake (PoS) is a consensus model that works by rewarding users for doing so. Polkadot rewards honest gamblers, while bad actors risk losing their entire bet.

Every new parachain is created by tying DOT tokens together. Bonding is the process of securing tokens on the network in exchange for a set amount of time. Defunct or abandoned chains and projects will be wiped out and their bonded tokens returned.

Polkadot Vs Cardano: Is Polkadot Better Than Cardano?

In oder to see is polkadot better than Cardano or not? Let’s see the elements of both chains:

Polkadot Vs Cardano: Scalability

The Scalability of Cardano

Cardano ensures network scalability as the number of validators increases. Hoskinson divided them into blocks and assigned leaders to each. To be a slot leader, you must mine, verify, and pave transactions.

Initially, Cardano could only process 257 transactions per second. With Hydra, Cardano’s layer two solutions, Hoskinson promises 1000 transactions per minute.

Hydra can also access smart contracts, DApps, and other apps. These services will be available on the Cardano blockchain. Waterproofing helps to increase market exposure while reducing costs and storage space.

Aside from that, the Hydra system has many other advantages for large clients. Layer 2 addresses payment, DDoS, identification, and storage networks.

The Scalability of Polkadot

Polkadot can process 166 transactions per second, ten times faster than Ethereum. Polkadot is a new blockchain that will be used to expand the network. Polkadot works well thanks to parachains and relay chains, which provide consensus among validators.

The Parachain slots are expected to be auctioned or leased. Parachains can run in parallel because their blockchains are purpose-built. We’ll add Polkadot DeFi and NFT Parachains to hold DeFi projects and digital assets, respectively.

Parathreads are useful due to the scarcity of Parachains and the affordability of Parathreads. Buying a Parachain space is much more expensive than registering as a Parathread. They must still fight for each block’s inclusion using cost-effective methods like Ethereum.

Polkadot Vs Cardano

>> Read Also: What Is A dApp – The Gateway To Interact Decentralized

Polkadot vs Cardano: The Governance Debate

Governance Under Cardano

Similar to Ethereum, Cardano’s governance system is off-chain. Cardano’s governing organizations include the Cardano Foundation and the IOHK. At IOHK, Charles Hoskinson, the CEO, is devoted to harnessing blockchain’s peer-to-peer breakthroughs to construct universally accessible financial services.

Treasury

Cardano has a treasury in which transaction fees are deposited. Marketing, customer service, and network maintenance are the primary uses of this cash infusion. In addition, they’re anti-inflationary, since they only print 45 billion ADA coins each year.

Governance Under Polkadot

On-chain governance is used by Polkadot. Two separate organizations comprise it: the Technical Committee and the Council. Rare events like protocol upgrades and revisions are also overseen by them. Stakeholders have a say in how decisions are made and are able to cast ballots.

Add a layer of support

In order to make Dapp’s development as easy as possible, Polkadot was designed from the ground up. The platform was built on top of the Substrate. Decentralized systems may be built on top of Substrate, a platform that lets anybody maintain their own private parachains.

Kusama

Kusama, a canary network, illuminates Polkadot. It is Kusama’s responsibility to discover any security holes in the Polkadot code. It was created by the same company that created Polkadot, Parity Technologies. In Kusama, the etiquette is not in the hands of a single influential party. Kusama currency holders vote to manage the network, which is decentralized.

Polkadot Vs Ethereum: How Is Polkadot Different From Ethereum?

Polkadot is compared to Ethereum 2.0, which was released last week. Sharding addresses scalability, latency, and transaction throughput. Blockchains like Ethereum 1.0 use the Proof of Work method. This protocol verifies each transaction in the distributed ledger. PoW blockchains assume that every node (computer) has a copy of every transaction in the chain.

PoW chains are slow because they require a majority of nodes to verify a transaction. VisaNet can handle 1,700 transactions per second while Ethereum 1.0 takes around six minutes.

Sharding eliminates PoW’s lag. Another way of putting it is cutting a larger chain into smaller ones (shards). Instead of all nodes authenticating all transactions, each node is responsible for logging and authenticating transactions in its own shard. In a sharded network, nodes can see each other’s data for authentication purposes.

Beacon And Relay Chains

Although both Ethereum 2.0 and Polkadot are sharded networks, their functionality varies. The Beacon Chain allows Ethereum 2.0’s parallel shards to connect and share information. Only shards with the correct structure can join the Beacon Chain.

Polkadot vs Ethereum

Polkadot uses a Relay Chain to connect shards (parachains). Each parachain link is self-contained. Relay Chain, on the other hand, is more tolerant of shards than Beacon Chain. Each shard (parachain) has its own set of rules (Meta Protocol). In addition to the Beacon chain, Relay Chain Validators can run multiple parachains using standard WebAssembly. The Ecosystem uses bridged chains to connect external chains.

As a result, Polkadot apps can connect to Ethereum 2.0, but not the other way around. This may be due to the lack of bridging in Ethereum 2.0’s Beacon Chain, which is absent in Polkadot’s Relay Chain.

An Ethereum 2.0 application can use the Moonbeam, an Ethereum-based bridged parachain. Also, the Bitcoin parachain is said to be wrapped. Polodot users can now create 1:1 bitcoin-backed assets for decentralized exchanges, stable currencies, and lending protocols.

Scalability

Unlike Ethereum 2.0, Polkadot is more open (dApps). It allows developers outside the Polkadot network to create applications. It is scalable due to its interconnection with other chains and programming languages.

Polkadot has a significant interoperability advantage over Ethereum 2.0. Other chains may be used to access Polkadot’s Ecosystem and wider network. Ethereum 2.0’s limited interoperability has yet to solve this scaling issue.

Bridging allows for BYOT. Polkadot has built bridges to connect chains that are economically and technologically distinct. Creating Polkadot apps does not necessitate mastering the Substrate framework. They may use existing resources instead of purchasing new ones to speed up the development process.

So is scalability. In contrast to existing proprietary networks, financial applications can be built on a sharded network that can be expanded.

FAQs About Polkadot Ecosystem

Is Polkadot Coin A Good Investment?

Polkadot is a one-of-a-kind cryptocurrency that has swiftly risen to prominence. You may establish new chains using breakthrough technologies that progressively decentralize the blockchain. Polkadot’s opponents, on the other hand, are well-funded and might eventually overtake it.

Is Polkadot Coin A Good Investment?

Polkadot Was Developed By Whom?

Ethereum co-founder Gavin Wood is one of the people behind Polkadot. On May 26, 2020, it went on sale. Nonprofit Web3 Foundation is responsible for maintaining the open-source code of Polkadot.

How does Polkadot’s staking function?

Since Polkadot does not utilize the proof-of-work technique used by Bitcoin, the network is safe and transactions are verified, as well as new DOTs are generated as they are distributed. In order to use the staking mechanism, holders of DOT must decide how much time, technical expertise and money they are willing to invest which may include validators, Collators, Fishmen, and Nominators.

Wrapping Up

On paper, there are several aspects that might make Polkadot interesting to developers. It’s a system that can serve the needs of lone programmers as well as small and medium-sized enterprises and multinational organizations. An innovative idea that might be beneficial to the whole crypto field is the ability to install and modify specialized blockchains to meet particular requirements.

Despite this, the Polkadot ecosystem is still in its infancy. While many initiatives may be under development, this should take some time before the first large ventures debut. According to PolkaProject, there are hundreds of projects being built, ranging from wallets to infrastructure projects, tools, DApps, and more.

And so far as DOT is concerned, the Polkadot developers have declared this is not a token created for speculation. Although it has a financial value on exchanges, it’s mainly meant for the objectives described above.

Detailed Guide Of How To Add Arbitrum To Metamask

15 July 2022