DeFi Lending And Borrowing Protocol – Its Strengths And Limitations

16 March 2022

What is DeFi lending? Decentralized finance has brought to users the new method to interact with many sources of funds without the help of middlemen, and the DeFi lending and borrowing protocol act a vital role.

The construction of a DeFi lending and borrowing platform is one of the top five initiatives in the blockchain sector. There is a lot of interest in establishing these solutions, and firms are looking into building DeFi lending platforms. bePAY will show you how DeFi lending platforms utilize best practices in this post.

What Is DeFi Lending?

DeFi Lending Definition

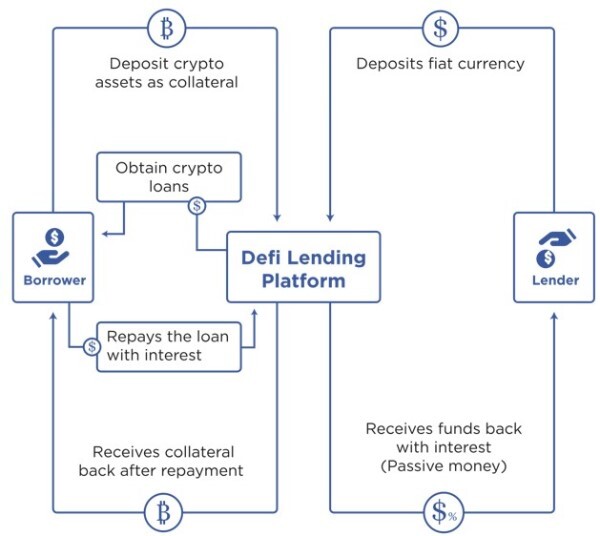

Users may lend and borrow crypto assets using the DeFi lending protocols. In a typical system, the platform makes a loan to the borrower. However, in this case, the platform facilitates peer-to-peer lending among network users while eliminating the requirement for third-party engagement.

Lenders may earn income on their crypto assets by lending them via the site. In addition, the platform allows long-term investors to earn significant DeFi lending rates. As a result, both borrowers and lenders stand to gain from the DeFi lending protocol.

The fact that anybody may become a lender and earn interest is a significant benefit of DeFi lending protocols. Users may also become borrowers by registering up for the site and linking their digital wallets. Furthermore, the lending protocol enables the lender to earn a return. DeFi has the fastest loan growth rate and is the most common contributor for locking crypto assets among all decentralized apps (Dapps).

What is DeFi lending?

These DeFi lending protocols operate on the following model:

- Borrowers start the procedure by putting up cryptocurrency as collateral.

- The site makes loans using self-regulating smart contracts.

- Borrowers pay different DeFi lending rates when they borrow cryptocurrency.

- Borrowers’ interest payments are made to lenders.

Traditional Lending Vs DeFi Lending

Blockchain is the underpinning technology for DeFi lending; DeFi takes use of all of its unique characteristics and outperforms conventional lending. DeFi financing provides total transparency and easy access to assets for any money transfer transaction that does not involve a third party.

It has the simplest borrowing method; the borrower just has to register an account on the DeFi platform, have a digital wallet, and open smart contracts. DeFi provides a censorship-free environment, which means no preferential treatment while maintaining preservation.

Traditional lending vs DeFi lending

Both lenders and borrowers gain from DeFi financing. It lets long-term investors lend assets and earn greater DeFi lending rates by providing margin trading choices. It will also provide users with access to fiat currency credit, allowing them to borrow loans at cheaper DeFi lending rates than decentralized exchanges. Furthermore, users may trade it for a cryptocurrency on a centralized market before lending it to decentralized exchanges.

>> Learn more: What is behind smart contract technology – Smart contract example

How Does DeFi Lending Work?

Digital assets in a wallet do not earn interest. The underlying value may rise or fall, but you will not profit from owning that specific coin. DeFi loans come into play here.

Take into account lending your cryptocurrency to another individual and earning interest on the loan. That is how banks now operate, but it is a service that few people have access to. Anyone may become a leader in the world of DeFi.

You may create interest in your crypto assets by lending them to others. There are several methods to do this, but the most common is via lending pools. These are basically standard bank lending offices. That is how DeFi Lending operates. Now that you’ve learned about the model’s operation, it’s time to consider the advantages and disadvantages it offers.

How does DeFi lending work?

DeFi Lending Protocol Strengths And Risks

DeFi Lending Strengths

Among the key benefits of DeFi lendings are:

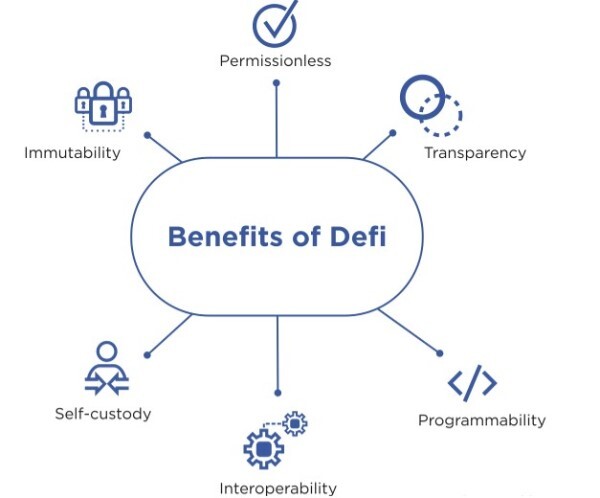

- Faster: DeFi lendings are quick because of blockchain and smart contracts. A transaction without middlemen or verification is virtually immediate. Whereas bank loans might take weeks to be disbursed. Loan delivery ease to apply for a DeFi lending, just register on an appropriate site like Aave or Maker and deposit.

- No middlemen needed: Smart contracts connect lenders and borrowers. It not only speeds up and simplifies the process, but also enables lenders to earn more and borrowers to save money.

- Easy to market access: Anyone with an internet connection and a crypto wallet may join DeFi. Regardless of your geographic region or credit history.

- More asset control: The loss of user cash might occur owing to inefficient financial behaviour, system failures, or hacker assaults. As a result, DeFi lending platforms have far greater control over their customers’ Bitcoin holdings and personal data.

- Attract more lenders: In conventional finance, you may either extend private credit (which isn’t necessarily legal and dangerous), form a credit cooperative (which takes time and money), or invest in bank deposits (which is not always profitable and often risky). Whereas with DeFi lending it takes just a few minutes, with little risks and huge percentages.

- Process programmability: These smart contracts eliminate the need for ongoing monitoring by contractors and are simple to tailor and automate.

The strengths of DeFi lending

- Interoperability: DeFi’s protocols and apps are compatible, allowing them to work together as a unified ecosystem.

- Better process logic and objectivity: Decentralized lending ensures better uniformity and decreases heterogeneity in the appraisal of applicant qualities and transaction structuring by underwriters.

- Market openness: Because DeFi lending platforms utilize public blockchains, everyone can see smart contract terms and learn how the system works.

- More analytics efficiency: Digital DeFi lending enables you to trace all procedures and data. This improves the quality of analytics for both the lender and the borrower.

- Respect for the rules: Unlike banks and other conventional financial organizations, where human error cannot be guaranteed. Laws and regulations may be specified in a smart contract that ensures their enforcement.

- Immutability: The inability to modify data on the blockchain is another advantage of DeFi. This assures data synchronization, security, and auditability.

- Anonymity: Users may borrow and lend money anonymously with DeFi lending without authentication or identity. This might be handy if you don’t want to attract crooks or competition.

Defi Lending Risks

Besides the aforesaid benefits, how risky is DeFi lending? You should be aware of DeFi lending risks. The key ones are:

- Smart contracts hacking: Although uncommon, users of DeFi platforms need to have basic technical and blockchain expertise to spot a fraudulent scheme. Or they should only utilize DeFi platforms that have been audited.

- Higher DeFi rate: DeFi enables you to make DeFi loans cheaper by removing middlemen, but this does not always work since the lack of intermediaries raises the chance of default, which increases the cost of credit.

- Legal concerns: Many authorities may deem DeFi platform transactions unlawful or at least suspicious since they do not need user identification or evidence of money source.

DeFi lending risks

Top Best DeFi Lending Platforms You Can Trust

Aave

This is a decentralized, open-source, non-custodial liquidity market system in which both lenders and borrowers may participate. It is a cryptocurrency based on Ethereum that enables borrowing via a simple and user-friendly interface. It generates a dual-token DeFi model, namely aToken and LEND.

aToken model is an ERC-20 token that allows lenders to compound interest, whereas LEND is a governance token that enables different sorts of loans and lending services such as rate switching, uncollateralized loans, and flash loans.

Aave

Maker

It is a decentralized lending and borrowing platform that has grown to be one of the greatest DeFi lending systems available today. Maker is often referred to as the Multi-Collateral DAI (MCD) system. It has almost $7 billion in smart contract-encrypted tokens.

MKR and DAI are the Maker’s primary assets, and both are ERC-20 tokens. Once the smart contracts are adhered to, DAI is linked to the dollar for lending and borrowing.

DAO is an Ethereum-based decentralized lending service that supports the DAI, a stable token tied to the US dollar. Additionally, it enables users with access to ETH and MetaMask to lend in the DAI system.

Maker

Uniswap

It is one of the most popular decentralized exchanges built on the Ethereum blockchain. It lets users conduct on-chair trades between ETH and ERC-20 tokens or earn a fee for providing any amount of liquidity; consequently, it utilizes liquidity pools for token swaps. The good news is that there are currently no restrictions on Uniswap.

ERC20 tokens are exchanged through a simple user interface in a secure, undamaged, and non-custodial manner. You may use this platform to exchange any ERC20 token or to give liquidity to the process and earn a fee. Additionally, you may add liquidity to an existing pool or create a new one.

Each liquidity pair is represented by a unique and freely transferable ERC20 token. As a result, creating a liquidity pool on Uniswap is simple; all you need to do is offer a token pair for markets. Exchange rates are determined by market makers who operate in accordance with the standard product market maker procedure.

Uniswap

>> Read also: What is Uniswap and how does it work?

Compound

This decentralized money market system enables borrowers and lenders to contractually safeguard their crypto assets. It is built on the Ethereum blockchain and enables holders of digital assets to borrow and lend crypto in exchange for collateral.

It is distinct from those other DeFi lending platforms in that it allows for the locking of tokenization assets inside their system through the use of cookies. Additionally, consumers may add assets to their liquidity pool and begin earning compound interest.

Compound enables consumers to get over-collateralized DeFi loans and maintains a diverse portfolio of assets, in addition to having been vetted and properly validated. It retains 10% of interest earned as reserves and distributes the remainder to liquidity providers.

Compound

DYdX

It is a non-custodial Ethereum-based trading platform intended for experienced traders. It acquired margin trading, derivatives, and options in the blockchain environment, which are typically associated with fiat markets and traditional investing.

DYdX is lending, trading, and borrowing platform for DAI, ETH, and USDC. Additionally, it enables cross margin and isolated margin trading through a perpetual market contract for BTC/USDC with a 10x leverage. Unlike other DeFi lending systems, it does not have a native token and does not charge trading fees in the accepted coins.

They provide DeFi loans with a 125 % collateral requirement and a 115 % self-liquidation requirement. DYdX processes over $35 million in daily trades, making it one of the world’s largest decentralized exchanges for cryptocurrencies and their derivatives.

DYdX

Some FAQs About DeFi Lending

What Happens If You Don’t Pay Back A Defi Loan?

When the borrower defaults on the loan, the bank seizes the car. The same holds true for the decentralized system; the only difference is that the system is anonymous and does not need physical collateral. To obtain a loan, the borrower must provide collateral that is more valuable (may up to 200% of the loan) than the loan amount.

What happens if you don’t pay back a DeFi loan? Because the pool’s regulations say that they will not lose money, if the price of the collateral falls below 120% of the loan, the pool will begin liquidating the collateral to pay the debt.

How Risky Is DeFi Lending?

The three most significant hazards associated with DeFi lending include temporary loss, DeFi rug pulls tactics, and flash loan assaults. Allow us to throw some further light on the hazards associated with DeFi financing.

- Temporary loss

- Rug pulls DeFi

- Attacks on short-term DeFi loans

How risky is DeFi lending

Is DeFi Lending A Safe Bet?

DeFi lending is highly safe, since customers’ cash is not stored on the site, and all transactions are conducted using open-source smart contracts. As a result, the loan and borrowing procedure at DeFi has become more open and secure. However, only to the degree that smart contracts are transparent and safe in and of themselves. That is why all DeFi projects must undergo code testing by an independent auditor.

Final Thoughts

DeFi is a unique idea that has swiftly gained traction. DeFi lending and borrowing systems provide several advantages that people like. Every day, corporations and enterprises strive to improve their DeFi lending policies and gain benefits. As a result, if you want to get into this lucrative industry, now is the time. Find the perfect firm to assist you in developing your DeFi lending and borrowing platform.

DeFi, like any new or developing sector, has advantages and disadvantages. However, being among the fastest-growing products in the decentralized ecosystem, it is evolving quickly. The issue of whether decentralized financial will replace the old system or if the traditional finance sector will embrace DeFi is one for another day. Still, one thing is certain: DeFi has the capacity to claim the future.

What Is A DApp – The Gateway To Interact Decentralized

22 March 2022