What Is Market Psychology Cycle In Crypto Meaning To Trading Decision?

25 August 2022

From the first coins minted in ancient Lydia to current cryptocurrencies, money has been used for trade throughout history. In addition, the fundamental market rules of demand and supply have not altered since the initial transaction. However, we now have a greater understanding of the psychological underpinnings of many human activities. They are the driving factors behind your choices in crypto trading and the decisions of millions of other traders.

And in the later part, we can also review some tips to solve how traders control their emotions with the psychology of a market cycle crypto. Now let’s jump to the first part of the informative article what is market psychology

bePAY team is aware of the significance of the market psychology cycle. Therefore, we will discuss our emotions, their effects, and techniques to manage them in more detail. Let’s go!

What Is Market Psychology?

Market psychology refers to the notion that market movements reflect (or are affected by) the emotional state of market players. It is one of the primary themes of behavioral economics, which is a multidisciplinary study that explores the different variables that underlie economic choices.

Many feel that emotions are the primary driver behind financial market fluctuations. The so-called psychological market cycles result from the changeable investor attitude as a whole.

In a nutshell, market sentiment is the collective opinion of investors and traders on the price movement of an asset. A bullish trend exists when the market’s attitude is optimistic and prices are increasing continually (often referred to as a bull market). The antithesis of a bull market is a bear market, which occurs when prices continue to fall.

Therefore, sentiment comprises the unique perspectives and emotions of all traders and investors in a financial market. It may also be seen as the average of the sentiments of all market players.

Market psychology definition

However, like with any organization, no one viewpoint is dominant. According to market psychology theories, an asset’s price tends to fluctuate often in reaction to the dynamic overall market attitude. If not, it would be considerably more difficult to conduct a successful deal.

When the market rises in practice, it is typically because traders’ attitudes and confidence have improved. A favorable market mood increases demand and decrease supply. In turn, the increasing demand may result in an even more aggressive disposition. Similarly, a significant downturn tends to generate a pessimistic attitude that decreases demand and increases the supply.

>> Learn more tips to survive through a bear market in cryptocurrency

The Psychology Of A Market Cycle Crypto

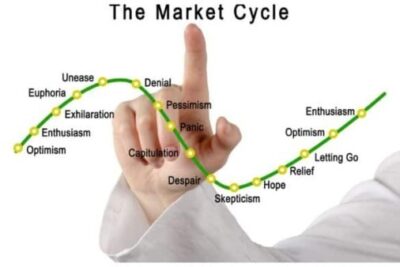

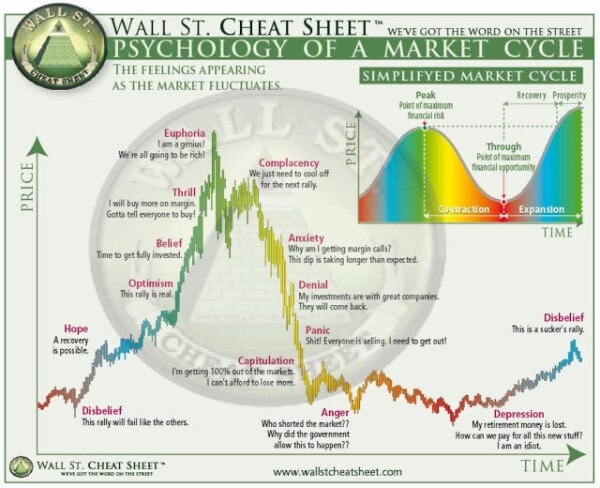

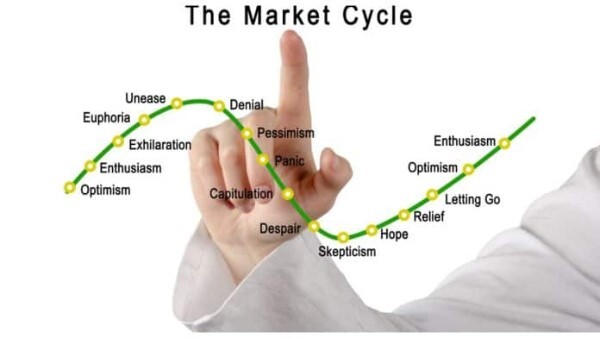

The most prevalent market cycle model consists of thirteen distinct phases that outline the major moments from the cycle’s trough to its peak and back down again. Each stage of the current market cycle is characterized by a catchphrase that summarises the mentality of traders at that time.

Psychology market cycle explanation

Stage 1: Disbelief

The market is exhibiting very preliminary indications of movement, but since prior rallies have failed to acquire traction, investors are hesitant to assume that this move will be different.

Stage 2: Hope

After severe incredulity, the first indication of healing is the emergence of hope. The market is displaying favorable indicators for a fresh bull run, but investors remain wary.

Stage 3: Optimism

The price has perhaps surpassed the past unsuccessful rallies, and investors are now hopeful that this quick increase is genuine.

Stage 4: Belief

Momentum continues to increase. Investors are eager to spend a substantial amount of their capital on potential initiatives.

Stage 5: Thrill

The price is currently rising. Investors are ecstatic since the value of their portfolios has improved dramatically since they first invested. Some speculators are taking out loans to purchase even more cryptocurrencies.

The market cycle psychology

Stage 6: Euphoria

Almost every market’s prices are over the top. The portfolio worth of investors has never been greater than it is now. This level marks the market’s peak performance.

Stage 7: Complacency

Immediately after the onset of euphoria, there is a dramatic price decline as whales begin to take gains and bears begin to short. Many investors stick to their coins or purchase more, assuming that the current decline is temporary. Indeed, the price rises again, but it does not surpass the prior peak.

Stage 8: Anxiety

After the complacent rally fails to surpass the previous high, the price starts to decline once again, this time below the prior support. The majority of investors are close to breaking even or losing money on their investments, causing them to experience anxiety.

Stage 9: Denial

Now that they have lost money on their investments, investors deny that the market is in a downward trend.

Stage 10: Panic

The price continues to decline, clearly proving the existence of a bear market. Now that investors are aware of the facts and realize they must exit, they are unwilling to sell at such a significant loss.

Stage 11: Capitulation

The market is reaching new lows constantly. Investors learn to accept their predicament for what it is.

Stages of psychology market psychology cycle

Stage 12: Anger

There is often a brief relief rally at this point, which some investors hope marks the beginning of a trend reversal. However, the rally cannot retain its pace, and the market falls once again. Investors feel unhappy because they did not quit the market when they could have.

Stage 13: Depression

This is the most difficult and often longest stage. The vast majority of investors have given up hope. They feel they have been defrauded or the bubble has burst, and that the market will never recover. This is when the market reaches its lowest point throughout the cycle and there are the greatest financial opportunities. After a lengthy bout of despair, the market will re-enter disbelief and restart the cycle.

How Can Investors Take Advantage Of The Market Psychology Cycle?

Assuming that the notion of market psychology is accurate, a trader may be able to join and exit positions at more advantageous moments by knowing it. The overall market mentality is counterproductive: the time of greatest financial opportunity (for a buyer) often occurs when the majority of people are despondent and the market is at its lowest point. In contrast, when the bulk of market participants are exuberant and overconfident, financial risk is often at its maximum.

Thus, some traders and investors attempt to interpret the market’s attitude in order to identify its many psychological cycles. Idealistically, they would utilize this knowledge to purchase during fear (lower prices) and sell during greed (higher prices) (higher prices). In reality, however, identifying these ideal spots is seldom simple. What may seem to be the local support (bottom) may not hold, leading to much deeper lows.

Taking advantages of market psychology cycle

When reviewing past market cycles, it is simple to discern how the prevailing mentality evolved. Analyzing historical data reveals which activities and choices would have yielded the most profit.

However, it is far more difficult to comprehend how the market is evolving in real-time and to forecast what will happen next. Numerous investors utilize technical analysis (TA) to try to forecast the future direction of the market.

Indicators of technical analysis are, in a sense, instruments that may be used to gauge the psychological condition of the market. For example, the Relative Strength Index (RSI) may indicate when an asset is overbought owing to a high bullish market sentiment (e.g., excessive greed).

The Moving Average Convergence/Divergence (MACD) is another indicator that may be used to identify the various psychological phases of a market cycle. In summary, the relationship between its lines may signal a change in market momentum (e.g, purchasing power, is deteriorating.).

>> What is Arbitrage Trading? Let’s take a quick look at this bePAY’s guide

When Should I Buy Or Sell?

Investors sell when the market is buying and buy when the market is selling, they are participating in contrarian investing.

Buying

The accumulation period is the optimal time to purchase market assets. This may occur when new projects are originally presented or after the previous cycle’s run-down phase concludes. This occurs when the price stops decreasing but the market remains negative. Also known as “buying on the downturn.”

Selling

Contrarian investing dictates that the optimal moment to sell is between the conclusion of the run-up and the start of the distribution phase. This is the most bullish period for the market, as prices continue to rise and everyone, including the media, is talking about it. For prudent investors, this is the moment to sell.

Buying and selling time

The Actuality

Unfortunately, we all want prices to continue to rise, particularly in the cryptocurrency market, making it tough for most investors to sell when prices continue to rise. However, reality dictates that the price will always decline. The bell curve reflects our reality. This is why the contrarian approach to investing is so crucial, particularly in the cryptocurrency markets.

>> Take a glance at margin trading crypto

How Do Traders Control Their Emotions?

Create Your Strategy

Every trader is unique. Formulate a trading strategy based on your requirements and market knowledge to keep your emotions in control. Identify and establish your risk thresholds and entry and exit benchmarks. Repeatedly revise the strategy to verify you are on the correct road.

Block Market Noises

A person’s emotions might be triggered by market sounds that approach them. Whether the market is bullish or bearish, you will hear a great deal of noise. Not all sounds are trivial, but permitting all of them might have an effect on your trading approach and judgment. Therefore, you must filter the noises in order to maintain emotional control.

Reason Logically

Thinking logically may help you keep your emotions under control. When you think rationally, you are more likely to make profitable judgments based on reason. Always consider if your choice is influenced by your emotions or by rational considerations.

How do traders control their emotions?

>> Recommend: Learning more about impermanent loss

FAQs About Market Psychology Cycle

What Make Investors Fear The Most?

Most individuals are first apprehensive to engage in the stock market. Fear of financial loss is a large portion of their worries and one of the most important difficulties for the majority of investors. New investors often have legitimate concerns about investing.

How Can I Comprehend The Market Psychology Cycle?

Stock market psychology is the capacity to recognize and control emotions and actions that may occur while trading.

- Create a trading strategy

- Create a checklist

- Maintain a journal

- Set reasonable expectations and foster trust

- Practice risk management.

Why Do Individuals Fear Trading?

A trader might acquire a fear of losing money and a reluctance to join the market at the optimal moment if he or she lacks a suitable trading strategy and a tolerance for financial loss. Neglecting to submit the best submission due to self-doubt might be a devastating habit.

Some FAQs about the market psychology cycle

Final Thoughts

Learning to recognize the stages of crypto market cycles and knowing when there is a full market cycle is crucial for trading effectively. The optimum moment to purchase is during the accumulation period when prices have stopped decreasing and investors are still fearful.

When the market gains momentum during the markup phase, the clever investor HODLs and waits for eager investors to push the price higher. In the distribution phase, which signifies the end of the markup stage (when feelings are most positive), the smart money begins to sell its stake.

Armed with a strong grasp of the many phases of the crypto market cycle, you’ll be better positioned to take advantage of these stages to earn a profit. Keeping an eye on market cycles helps lessen the possibility that you’ll purchase high or sell cheap.

What Is Polkadot? The Next Generation Of Blockchain

21 April 2022

Detailed Guide Of How To Add Arbitrum To Metamask

15 July 2022

What Is Taproot Bitcoin? How Does It Affect Bitcoin?

24 June 2022