Boosts Earnings By Maximizing The Best Passive Income Cryptocurrency

16 March 2022

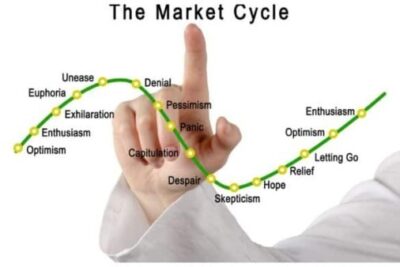

Passive Income Crypto is a smart strategy for making money or surviving in a volatile market. Cryptocurrency, like most assets, can be used to generate passive income as well as profit from buying and selling it.

Passive income crypto may come from many sources. Simply putting money or digital assets into a specific crypto investment strategy or platform is all it takes. A person’s income can be predetermined. It’s possible to lose control of certain variables.

To make money from the cryptocurrency market with little or no effort, many people HODL (buy and hold). An investor will buy a digital asset expecting a large future value increase. These investors are willing to hold their investments for six months to five years. This transaction does not require a crypto investor.

Purchase the digital asset and store it securely, preferably unsupervised. However, there are still many methods to help you boost your earnings besides HODLing. Passive cryptocurrency income is the topic of bePAY’s post, today.

How To Make Passive Income With Crypto?

What better place to learn about making money with cryptocurrencies than right here? There are some methods to solve how to make passive income with crypto

- Investing or trading in the crypto exchange market. As with stock market investments, you do not need to own any cryptographic assets personally to do this.

- As a second option, you may stake and lend your coins to the system or other users, using the coins you currently possess.

- You may contribute to the blockchain system by mining or by getting currency incentives for system work.

Using this framework, here are passive income generators that profit from cryptocurrency:

- Staking

- Lending

- Yield Farming

- Mining

- Dividend-Earning Tokens

- Special Events

Passive income cryptocurrency

>> Do you know: What is Algorand and how does it work?

Best Passive Income Cryptocurrency Strategies

Staking

Staking is one of the passive income generators. As well as making it easier to maintain a decentralized system’s consensus, Proof-of-Stake (POS) provides a new option for currency holders to receive a return: passive income crypto staking.

A validator node must be set up and a predetermined minimum quantity of coins must be locked up to participate in securing the network or powering it, depending on the cryptocurrency and whether it employs basic POS, Nominated-Proof-of-Stake (NPoS), or Delegated Proof of Stake (DPoS), or some other version.

Regardless of the method used, stakers get a return on their passive income crypto staking.

Staking incentives are currently offered by a wide range of cryptocurrencies. The minimum stake and lock-up time imposed by some of these services might be a deterrent for some players.

To be sure, once a stake is made, the income it generates is almost entirely passive, requiring nothing more than occasional monitoring. However, if you feel your coins will rise in value, you may wish to liquidate your dividend on a regular basis or store them for the long term.

Staking

How much can you earn? If you stake a significant amount of the supply, your return will be impacted by any commissions you may have to payout. In most cases, you may anticipate an APY of between 5% and 15%.

What should you care about? For example, you’ll get back more of the digital tokens you staked when your bet is successful. If the value of the cryptocurrency you are staking drops, you may end up net negative in fiat terms if the staking incentives do not cover the losses.

Yield Farming

With the development of decentralized exchanges, which depend on smart contracts and liquidity supplied by investors. Investors put their tokens into a “liquidity pool,” a specific kind of smart contract, to get a return on their investment in the farm. Those that supply liquidity in this fashion gain a share of the fees collected from traders using the pool.

Yield farming is one of the more sophisticated choices given here and will need a lot of more study for those interested. But it might also be one of the most profitable alternatives accessible to create passive income with bitcoin.

Yield farming frequently needs some Ethereum (ETH) paired with a DeFi token of some form like Uniswap (UNI) or Pancake Swap (CAKE) or even a stablecoin like Tether (USDT) (USDT).

Yield Farming Is A Cryptocurrency Passive Income Strategy

How much can you earn? Yield farms usually pay in volatile cryptocurrency. If this cryptocurrency crashes in value then the average APY may be quite low, however, if it increases in value then it can be pretty high. If you routinely liquidate your yields, you may typically anticipate an APY of between 5% and 20%.

What should you care about? Many yield farms initially provide extraordinarily high yields, however, this soon lowers when the total amount staked climbs and if the reward token sinks in value. Keep an eye on your expected yields by checking them often.

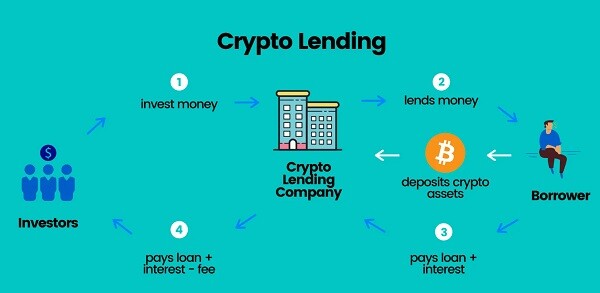

Lending

Another passive income generator when you are participating in the crypto world is lending. In both the centralized and decentralized portions of the crypto business, lending is now one of the most popular crypto services. You may earn income on your digital assets by lending them to other investors. You may choose from four different loan options:

Systems that allow users to create their own conditions, pick the amount they wish to lend, and set their own interest rates on loans are known as “peer-to-peer lending.” P2P trading systems pair buyers and sellers, and this platform does the same.

Here is where lenders and borrowers are connected. In terms of crypto lending, such platforms provide consumers with a certain amount of say over the process. You must, however, first put your digital asset into the custodial wallet of the lending platform.

An example of centralized lending would be relying on the lending facilities provided by third parties. Fixed interest rates and lock-up periods are in place here. To begin earning interest, you must transfer your crypto to the lending site.

Lending

With decentralized or DeFi lending, customers may perform lending services directly just on the blockchain. There are no middlemen involved in DeFi lending, unlike P2P and centralized lending approaches. Smart contracts are also known as programmable and self-executing contracts instead of lenders and borrowers engaging with autonomous and regularly set interest rates.

Finally, you may lend your crypto assets to traders who want to trade with borrowed money. These traders enhance their trading positions with the assistance of borrowed funds and repay the loans with interest. The majority of the work is done for you by the crypto exchanges. Keep your digital asset accessible and you’ll be good to go.

How much can you earn? – Lending APY on bitcoin might range from 3% to 8%. Smaller “alt-coins” are producing double-digit returns on their investments. Stablecoins like USD Coin, which aim to keep the value of a single dollar constant, may also see an increase in value of 10%.

What should you care about? You shouldn’t go into crypto lending without doing some research beforehand. Whenever it comes to default or security issues, there are always hazards. You should bear in mind that folks who are drawn to these types of loans may have a poor credit history and are considered a high risk of defaulting.

Mining

When it comes to passive income generator. Mining is another choice, the initial pioneers did it via mining. Proof of Work relies on mining, and it will continue to do so. Crypto mining passive income value is created here.

As a reward for mining a cryptocurrency, you will get fresh coins. To mine, you’ll need a lot of technical know-how and a lot of specialized equipment.

Mining also entails the operation of a master node. A great deal of knowledge and money is required, both at the beginning and over time.

Crypto mining passive income

However to avoid the costly equipment and lots of experience in technology, besides crypto mining passive income, cloud mining is the alternative method that you can take into account

Instead of putting up new mining equipment, users may simply “rent” hashing power from an existing company. For an exchange, a specific amount of cryptocurrency, customers may acquire cloud mining contracts that entitle them to a given hash rate for a certain length of time. The contract owner gets fresh coins in accordance with the amount of their contract.

How much can you earn? Cryptocurrency’s profitability in terms of mining varies from every day, and it might even fluctuate daily. Your precise profitability relies in large part on the cost of your energy usage and your so-called “hash rate,” or how rapidly your computers can solve issues.

What should you care about? Many cryptocurrency cloud mining frauds exist. Those interested in cloud mining would be well to conduct as much research as possible and make sure the firm selling the contract is reputable.

Dividend-Earning Tokens

Token holders may be entitled to a share of the company’s profits, depending on the token. To earn a share of the company’s profits, all you have to do is keep your token in your possession. A person’s part of the income is based on the number of tokens they hold.

VeChain, NEO, Reddcoin, Kucoin, NAVCoin, and Decred are a few cryptocurrencies that pay dividends in several coins (or tokens), as well as their yearly dividends in aggregate. As such, cryptocurrency dividends are distinct from stock dividends insofar that they are paid in tokens rather than cash.

Holding dividend-earning tokens

How much can you earn? Although yields vary widely across dividend-earning tokens, you can generally anticipate APYs of 5-10% from some of the more popular alternatives.

What should you care about? Holding may be a good strategy but the price of your coins/tokens could be affected by the market’s volatility

Special Events

Of all, buying high and selling cheap is hardly new advice for the astute investor. Consider the following events and chances if you really want to optimize your cryptocurrency investments.

- Airdrops: When a new currency is sent to existing cryptocurrency investors, either for free or in return for favorable PR or social media mentions. Republic often brings these to market.

- Forks: A circumstance in which a regulatory agency compels a cryptocurrency’s software to be updated, resulting in the creation of a new currency.

- Buybacks: When a business purchases its own crypto assets, it reduces the supply and increases the asset’s total value.

- Burns: When a business transfers part of its bitcoin to an outdated wallet or account, hence increasing its scarcity and value.

Earn cryptocurrency while doing other activities, such as shopping. Some platforms and applications allow you to earn cryptocurrency while shopping at popular retailers or online stores.

>> Read also: What is GameFi and why GameFi is crypto’s hot new thing?

Some FAQs About Passive Income Cryptocurrency

Can You Make A Living Off Crypto?

Can you make a living off crypto? Yes, it is possible to earn money using cryptocurrency. However, it’s important to remember that cryptocurrencies are still in their infancy and that investing in them carries a significant degree of risk. Having said that, there are several methods to earn money with bitcoins.

FAQs about crypto passive income

Several of these methods include investing in cryptocurrency-related firms, trading cryptocurrencies on internet exchanges, and mining new coins. In general, it’s critical to do your own research and to be aware of the hazards associated before investing in any cryptocurrency.

Is Crypto Staking A Passive Source Of Income?

It’s a widely held belief that staking cryptocurrency may provide some kind of passive income. When you stake crypto, you’ll get your money in the native token of a certain network, therefore it’s vital to know that. This adds a new danger. Users might still lose money even if they receive a high rate of return via staking if the token’s price decreases.

Are Cryptocurrencies A Viable Source Of Passive Income?

Yes. With a variety of options, you can do this. These include lending, staking proof-of-stake coins, and utilizing digital asset accounts with interest. For the most part, you’ll need a significant amount of cryptocurrency, or you’ll need to know a lot about how DeFi protocols work or how to operate mining equipment.

Closing Thoughts

Above are some of the ways that show you how to make passive income with crypto. There are lots of strategies to earn more passive income crypto. Earning passive income is an intelligent strategy, depending on your taking risk level, you may choose amongst the above strategies, cause the market is always volatile, make sure that you make all your tactics before investing. Picking up cryptocurrency is a significant operation that demands all the study and information.

Before buying up the crypto, ensure you check out for its future in the market. Long-term and short-term are a component of the research. Thus, it boils up to completing a comprehensive investigation and observing the history and the current performance of the cryptocurrency you are prepared to join.

Detailed Guide Of How To Add Arbitrum To Metamask

15 July 2022

What Is Taproot Bitcoin? How Does It Affect Bitcoin?

24 June 2022

What Is Web 3.0 And How Does It Affect The Future?

16 March 2022

Step By Step Guide Of How To Add Fantom To MetaMask

15 July 2022