What Is A Limit Order In Cryptocurrency – Detailed Information About Limit Order

25 August 2022

Investing in cryptocurrencies has become a regular subject of conversation worldwide. Due to the sector being less than a decade old and having the potential to disrupt the financial industry as we know it, the crypto space has seen a large number of new entrants since the debut of Bitcoin in 2009.

The widespread acceptance of cryptocurrencies has also increased traders’ need for more trading alternatives on cryptocurrency exchanges. Given the many uses of cryptocurrencies, crypto exchanges have enthusiastically accepted the task of creating diverse trading possibilities.

In this post, bePAY will go through the explanation of what is a limit order and how it works for you, as well as many other questions surrounding order limits.

What Is A Limit Order?

Some new users are likely to jump on what is a limit order. By setting a limit order on an asset, it is possible to purchase or sell it at a certain price or higher in the trading market. For purchase limit orders, the order will only be executed at the limit price or a lower price, while for sell limit orders, the order will only be executed at the limit price or a higher price. This criterion gives retailers more autonomy over the price of their goods and services.

By placing a buy limit order, an investor guarantees that he or she will pay no more than the stated sum. The price is guaranteed, but order execution is not, and limited orders will not be executed unless the asset’s price meets the order’s qualifying criteria. It is possible for the investor to incur a loss if an asset fails to reach the specified price and the order is not executed.

Explanation of what is a limit order

What Is The Function Of Limit Orders In Cryptocurrencies?

Considers the situation of a trader who intends to acquire Bitcoin at a particular price in order to better comprehend the significance of limit orders in the field of cryptocurrency trading. To benefit from the market, the trader would issue a limit order for Bitcoin at that exact price.

Example: If the price of Bitcoin falls to $20000 and the trader wishes to acquire 1 Bitcoin (BTC), the trader sets the limit price to precisely $20000. Alternatively, if a trader wishes to sell when Bitcoin hits $30000, the minimum sell-side limit price should be set at $30000.

However, investors should be aware that if the price is set higher than the current price for buys or lower than the current price for sells, it may result in an instant fill since a better price than the maximum price indicated is available.

Limit orders have the disadvantage that if the limit price is not reached by a buyer or seller within a certain time frame, the order will not be executed and will be canceled. The significance of time cannot be emphasized enough when placing limited orders and is perhaps more critical. In exchange, timestamps are given to every order entered in an order book.

Later-approved orders take priority over earlier-made trades, even if they have the same limit price as an order placed earlier in the trading session.

Limit order in cryptocurrency

>> Recommend: learn more about arbitrage trading

How Does A Limit Order Work?

How does a limit order work? When a limit order is filed, it will be instantly entered into the order book. However, it will not be filled until the coin price hits the maximum price (or better). For instance, suppose you want to sell 10 BNB for $400 each, but the current price is $300.

You may put a Binance limit order at $400 BNB sell limit order. Your order will be executed when the BNB price hits or exceeds the target price, subject to market liquidity. If other BNB sell orders were made before yours, the system would execute those orders before yours. Your limit order will then be filled with the remaining available liquidity.

When establishing a limit order, you should also consider the order’s expiry date. Binance limit orders may often last up to 90 days. Due to market volatility, you may wind up purchasing or selling at a less acceptable price if you do not regularly monitor the market.

For instance, if the current BNB market price is $300, and you put a sell limit order for 10 BNB at $400. A week later, the price of BNB increased to $500. Your order was processed at $400 since the market price exceeded the limit price you established.

In this instance, your earnings were limited by the price objective you set a week earlier. Therefore, it is important to periodically examine your open limit orders to stay up with the constantly changing market circumstances.

What is a limit order working mechanism?

>> More information about what is margin trading. Take a glance at this bePAY’s guide

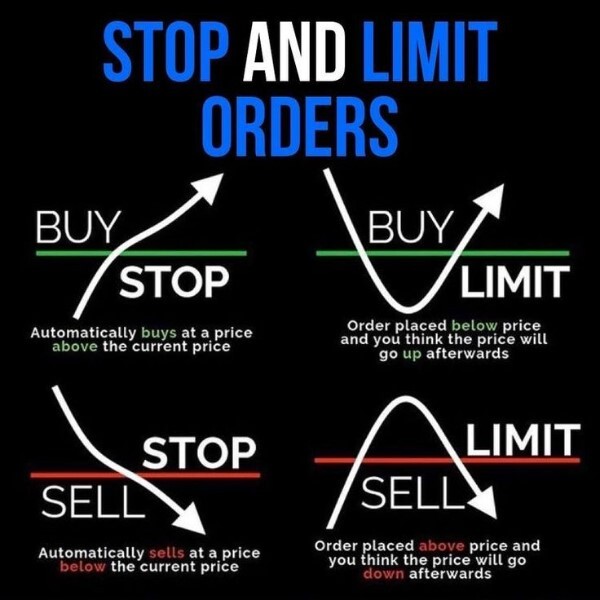

Stop-Limit Order Vs Limit Order In Comparison

Stop-limit orders combine the characteristics of stop orders with limit orders. Once the stop price is achieved, a limit order is immediately triggered. The order will then be executed if the market price meets or exceeds the specified limit price. If you lack the time to constantly monitor your portfolio, you may want to consider using stop-limit orders to reduce your potential trading losses.

You must provide two prices when creating a stop-limit order: the stop price and the limit price. Stop-limit orders will only place a limit order if the stop price is achieved, while limit orders will be put on the order book immediately.

For instance, if BNB is trading at $600 and you execute a sell stop-limit order with a stop price of $590, the order will be executed at $590. This indicates that if BNB falls below $590, the system will automatically place a sell limit order with a price equal to or more than the limit price you provided (for example, $585).

However, fulfillment of your purchases is not guaranteed. If the market moves too quickly, there is a possibility that your order may not be completed.

Stop-limit order vs limit order

>> Exploring perpetual swap working mechanism

Stop Loss Vs Limit Order In Comparison

There are many kinds of stop orders, but they are all conditional based on a price that is not yet accessible on the market at the time the order is issued. As soon as the future price becomes available, a stop order will be executed.

Once your stop price is hit or surpassed, a stop loss will transform into a standard market order. A stop order may also be configured as an entrance order.

Consequently, if the price of a cryptocurrency is increasing, a stop market order might be placed above the current market price, and the deal would be completed after the stop price was reached.

The primary distinction between stop loss vs limit order is the transaction’s visibility. The former is visible to the market as a whole, but the latter is not until the transaction is initiated.

Stop loss vs limit order

>> What is impermanent loss, read this post to explore now!

FAQs About Limit Orders

Are Limit Orders Cancellable?

Once a limit order has been made, it may be revoked before execution.

Do Limit Orders Expire?

No, limit orders don’t really expire. Once established, the order will either be executed or stay open until the limit price is achieved unless the investor cancels it.

Multiple Limit Orders For A Single Coin Are Permitted?

Yes, multiple purchases and sell orders may be submitted for a single coin.

What Is The Highest Price A Limit Order May Be Put In For?

In contrast to quick orders, limit orders do not have a maximum order value.

Will The Order Be Carried Out In A Single Operation?

Depending on the number of buyers or sellers at a certain price point, limited orders might be partly or entirely fulfilled.

Frequently asked questions about limit orders

Closing Thoughts

There are several variables involved in investing. However, it does not have to be intimidating when beginning. Developing an investing plan that incorporates your short and long-term objectives helps simplify the process. In addition, it is essential to comprehend how various order kinds and other trading aspects might assist you, optimize your profit, and offer hazards.

Limit orders are useful when you want more control over the price at which you acquire stock and the price at which you are ready to sell it. Limit orders are beneficial for novice investors learning the stock market, as well as those with a larger stake in the game.

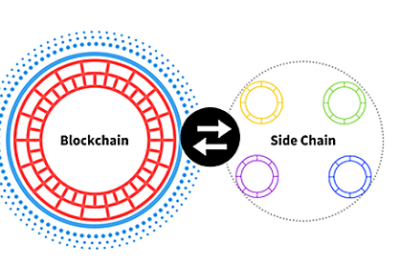

What Are Sidechains? In-depth Compared With Layer 2

10 June 2022