Cardano Vs Ethereum In-depth Comparison Of Two Big Blockchain

15 March 2022

Cardano vs Ethereum is two famous names that attract many users when early-adopting blockchain technology. It could say that both are big ones in the ranks about market cap as well as popularity. Do most newbies usually wonder about these blockchains whether which one is better?. However, there is a lot of information on the internet, and it could make it much more difficult when exploring the cryptocurrency world. Don’t worry bePAY‘s here to help

It’s easy to understand why Cardano (ADA) may be considered an “Ethereum (ETH) killer.” However, there are certain important distinctions that might give one of them an advantage over the others. Cardano was created as a solution for Ethereum’s shortcomings. Ethereum, on the other hand, remains the second-largest cryptocurrency in the world, and the benefits it provides are indisputable. Is Cardano Better Than Ethereum?

Cardano Vs Ethereum Two Big Blockchain

To determine which crypto is “better,” we must examine how each of them was established, and the technical specifications that differentiate them.

The network was founded on Cardano by Jeremy Wood and Charles Hoskinson, the latter of whom was a co-creator of Ethereum. ADA was developed via a research-based process. This implies that everyone on the network is peer-reviewed, which is made simpler by the fact that Cardano is written in Haskell, a programming language selected specifically for its auditability.

Ethereum, on either side, employs Solidity, a highly specialized programming language that makes peer review considerably more difficult.

Another notable difference between Cardano and Ethereum is that Cardano is built on a two-layer architecture. Simply expressed, this implies that calculations and settlements are carried out independently. Ethereum is a single layer environment, where calculations, smart contracts, settlements, token transfers, happen at the same time.

In principle, this division should improve the efficiency of ADA, resulting in speedier transactions at a reduced cost when users compare Cardano Vs Ethereum Transaction Speed.

The history of Cardano vs Ethereum

ADA utilizes practically minimal energy owing to its PoS technology. Cardano employs the Ouroboros algorithm. This is a physically correct representation of the PoS process since ADA utilizes a closed-loop mechanism.

While ETH now operates on a PoW model, once it has completely moved to a PoS model, this could be as convenient as ADA.

Finally, it’s important noticing the distinctions between Ether and ADA’s monetary policies. Ethereum has an infinite supply, with the supply intended to grow at a rate of 4.5% every year. Meanwhile, similar to Bitcoin, ADA has a finite quantity. There are now 31 billion ADA in circulation, with around 14 billion still to be mined.

To summarize, let us examine the advantages and disadvantages of each cryptocurrency:

Advantages of ETH

- The world’s largest network of smart contracts

- Host to the greatest number of tokens and NFTs

- Advantage of the first mover

- The planned transition to ETH 2.0 will improve efficiency.

Disadvantages of ETH

- Congestion in the network as a result of high volume

- Excessive gasoline costs

- System with a single layer

- Ethical technology development is inefficient and difficult to peer-review.

ETH pros and cons

Advantages of ADA

- Transactions are more efficient when they are divided into two layers.

- Already on a point-of-sale system that is ecologically friendly

- Increasing traction via fresh user cases

- Supply is limited.

- The programming language that is more inclusive and readily peer-reviewed

Disadvantages of ADA

- For the time being, its network supports just a few decentralized apps.

- ADA Smart contracts are being introduced slowly.

- Adoption as legitimate money has been slow.

>> Read also: What are Ethereum gas fees – Pinnacle explained for newbie

The Difference Between Cardano And Ethereum

While both Cardano and Ethereum are geared at decentralized apps and the DeFi industry, both blockchain technologies have major distinctions. Let’s compare Ethereum problems to Cardano problems, as well as their advantages. We shall examine and contrast the following major areas:

- Smart Contracts

- Consensus Mechanisms

- Architecture

- Scalability

- Security

- Market Capitalization

Smart Contracts

The smart contract is Ethereum’s most important breakthrough. Smart contracts enable developers to build decentralized apps; they have transformed FinTech and fueled the emergence of the decentralized finance movement. Ethereum is the worldwide market leader in smart contracts. Nevertheless, Ethereum is not the only platform that allows for the execution of smart contracts.

ADA vs ETH what’s different?

Cardano ADA smart contracts are also supported. The major distinction here is that Cardano smart contracts are intended to be more useful and accessible than Ethereum smart contracts. Cardano’s objective is that anybody, utilizing Cardano smart contracts, would be able to construct their own decentralized apps.

To establish a smart contract at the moment, you’ll need a developer that is familiar with and proficient in programming languages such as Solidity (Ethereum) or Haskell (Cardano).

Consensus Mechanisms

Ethereum presently validates payments on the network using a proof-of-work (PoW) consensus system. Bitcoin invented the Proof-of-Work (PoW) consensus technique. While this system is well-known for its security, major concerns have been raised concerning the amount of energy used and the speed with which transactions may be verified.

When comparing Cardano vs Ethereum transaction speed Cardano invented and pioneered the consensus algorithm known as proof-of-stake (PoS). Cardano’s PoS process is much more energy-efficient, scalable, and speedier than Ethereum’s existing PoW mechanism. Ethereum is aware of this shortcoming, and the network intends to address it with the release of Ethereum blockchain 2.0.

Architecture

Cardano’s blockchain is comprised of two layers. There is a layer that handles ADA transactions and another that handles smart contract transactions. Cardano’s dual-layer architecture offers it a competitive edge over Ethereum.

Due to the fact that Ethereum manages smart contracts and Ether transactions on the same layer, network problems and excessive transaction fees are often encountered. Bear in mind that the fee of Ethereum payments is directly proportional to the price of Ether. Not only is Ethereum the second most valued cryptocurrency, it is also heavily traded, resulting in network congestion.

Another feature of Cardano’s dual-layer architecture is that each layer may be updated separately without affecting the performance of the other layer’s transactions.

Scalability

Scalability is one of Ethereum problems, however, Ethereum 2.0 is a multi-year improvement. Cardano is a more scalable cryptocurrency than Ethereum. This is true even after taking into consideration the upcoming Ethereum 2.0. When Ethereum 2.0 is published, it will have a maximum transaction rate of 100,000 per second.

ADA vs ETH who’s the winner

The Ouroborus Hydra upgrade for Cardano will enable the network to perform over 2 million transactions per second. Nonetheless, Cardano continues to outperform both networks’ current transaction capacity estimates. Cardano currently has a transaction rate of 250 per second, compared to Ethereum’s 100 transactions per second.

Scalability may become a serious challenge for Ethereum if more organizations and consumers use blockchain technology in the future.

Security

Due to its focus on peer review, Cardano is more secure than Ethereum. However, Ethereum’s concept of frequent updates enables it to evolve more quickly. The Ethereum ecosystem is continually developing. In contrast, each update to Cardano undergoes extensive peer review before production and deployment.

Additionally, Cardano makes use of the Haskell programming language. Haskell is more commonly used rather than Ethereum’s Solidity, making it simpler and more interoperable to a wider academic audience to audit Cardano’s code.

Market Cap

Despite Cardano’s advantages over Ethereum, Ethereum continues to dominate the dApp development and decentralized applications (DeFi) industries. Additionally, Ethereum serves as the primary blockchain platform for NFT development and commercialization. Ethereum has a market capitalization of 442 billion dollars, whereas Cardano has a market capitalization of 45 billion dollars.

It is worth noting, however, that Cardano is substantially invested in developing regions of the globe, most notably Africa and South Asia. Cardano is concentrating its efforts on locations with low DeFi and dApp penetration in order to organically build its network.

>> Read also: What are stablecoins and why do you need them?

FAQs About Cardano Vs Ethereum

Should I Buy ADA Cardano?

Cardano has established itself as one of the most active and dynamic digital assets in the cryptocurrency space over the last year. With this in mind, it’s reasonable to conclude that ADA is a viable investment choice.

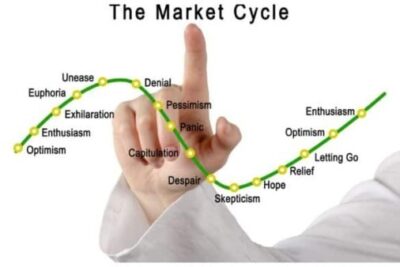

Numerous analysts anticipate that Cardano will have a prosperous future in 2022. Regardless, you should analyze your options before making a choice, since the market is always volatile and fluctuating. Consider your options carefully based on the level of risk you are prepared to accept. As Cardano is a high-risk investment.

Should I buy ADA Cardano?

Is Cardano Better Than Ethereum?

Which one is a good investment? It’s mostly up to the customer, of course. Cardano may be a better fit if you favor tokens that are still in their infancy. Ethereum is a better option if you want a more established platform since it has a higher level of security.

Both Ethereum and Cardano, of course, have the potential to rise or fall significantly in the coming months. Each of these cryptocurrencies has a significant amount of risk, but it also has a large potential reward.

Is Cardano A True Ethereum Killer?

No, the fact is that Cardano cannot yet be considered a competitor to Ethereum, since ETH is still very much alive and remains the dominating L1 in crypto. However, ADA has undoubtedly absorbed a sizable amount of the ETH market. Both platforms, however, have the opportunity to develop in this sector. It’s impossible to say if ADA will ever approach the market value of Ethereum, much alone “kill” it.

Closing Thoughts

To summarize, it seems as if the ADA’s “fundamentals” are becoming stronger in the future. The dual-layer structure, proven Proof of Stake, and more user-friendly programming language should all contribute to a more favorable environment for hosting currencies and DApps.

Ethereum, on the other hand, does offer something that Cardano problems do not: first-mover advantage & network effects. Ethereum is indeed the place to go, with hundreds of DApps currently available. At the present, it just makes more business sense to create an app on Ethereum.

The question remains: fundamentals or would be at the right place and time? With that in mind. Find out other topics here.

Step By Step Guide Of How To Add Fantom To MetaMask

15 July 2022

What Is Polkadot? The Next Generation Of Blockchain

21 April 2022