What Is A Market Cap? The Critical Element When Investing To Understand

28 April 2022

What Is A Market Capitalization In Cryptocurrency? – Market capitalization (or market cap) is a word used in the blockchain industry to refer to a statistic that indicates the relative size of a cryptocurrency. It is determined by multiplying the current market value of a currency or token by the total number of coins in circulation.

While market capitalization may provide insight into the size and success of a business or cryptocurrency project, it is important to remember that it is not synonymous with money inflow. As a consequence, it is an inaccurate representation of market capitalization. This is a widespread fallacy since the market value computation is closely related to price, although a very little change in price may have a huge effect on the market cap.

bePAY will introduce you to What Is A Market Cap In Cryptocurrency? The critical indication that investors use to choose whether to invest in a coin or a token, as well as in-depth information about the crypto market cap.

- What Is A Market Capitalization In Cryptocurrency?

- How To Calculate Market Cap Crypto?

- The Correlation Of Crypto Market Cap And Crypto Price

- Why Is Market Cap Important In Crypto Space?

- The Importance To Understand Market Cap Cryptocurrency For Investors

- FAQs About Market Cap In Cryptocurrency

- Final Thoughts

What Is A Market Capitalization In Cryptocurrency?

Understanding market cap crypto meaning? When it comes to judging a project’s genuine potential and worth in the cryptocurrency market, the price alone might be deceptive. Even Bitcoin, the biggest crypto by market capitalization, may see dramatic swings in price due to variables such as public excitement, rapid changes in circulating supply, or even a crypto ban in some countries. These kinds of events often have an effect on the overall image of a cryptocurrency’s eventual potential.

What experienced cryptocurrency investors want to see is a coin or token with a small quantity but a high value. Having said that, crypto investors rely heavily on the market cap to compare the worth of cryptocurrencies and forecast their future development. In general, large market capitalization assets indicate that an investor is ready to pay a premium for them.

For instance, when crypto aficionados discuss a cryptocurrency’s entire supply, they often use the phrase completely diluted supply (FDV). A completely diluted market capitalization is derived by taking the total worth of all coins in a cryptocurrency, not just those in circulation. One reason Bitcoin (BTC) continues to perform well is that its completely diluted supply is limited to 21 million units.

Market Cap Crypto Meaning

There are now under two million of these currencies available for mining, while the overall circulating quantity of BTC exceeds 19 million. As a consequence of its scarcity and usefulness, BTC is one of the best-performing assets. When discussing a token’s supply, it’s crucial to distinguish between FDV and circulating supply. By considering market capitalization, one may have a better understanding of the macroeconomic picture and make more educated investing choices.

How To Calculate Market Cap Crypto?

Market capitalization is calculated by multiplying the current price of a cryptocurrency by the total supply:

Market Cap Crypto= Price * Circulating Supply

In terms of keeping track of the market value of cryptocurrencies, Coinmarketcap is now the most often used website. All essential financial indicators for cryptocurrencies may be found here, as well.

A weighted average of all exchange prices is used to compute the prices on Coinmarketcap, which is based on total volume. Remember that the circulating supply of a cryptocurrency is more significant than the overall supply. However, it is just a circulating supply that is now on the market.

How To Calculate Market Cap

The Correlation Of Crypto Market Cap And Crypto Price

Market capitalization is an indicator that measures and maintains track of the market value of a cryptocurrency. The larger the market cap of a cryptocurrency, the more dominant it is perceived to be in the market. For this reason, the market cap is typically considered the single most essential statistic for rating cryptocurrencies.

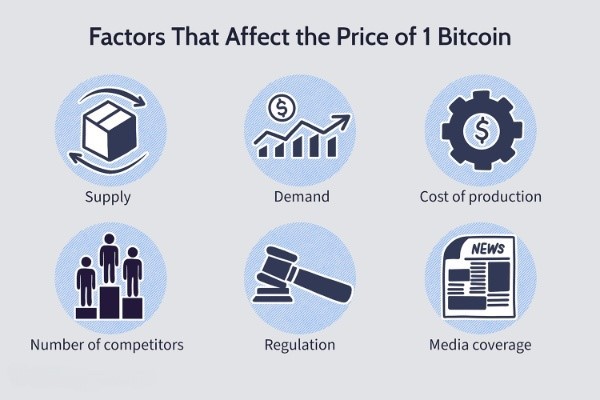

How Does Market Cap Affect Crypto Price?

The price of a cryptocurrency is influenced by supply and demand. For example, Bitcoin has a finite quantity of 21 million coins that will be created by 2140. That is, the primary variables affecting its price are demand and the number of individuals who prefer to keep Bitcoin rather than sell it; in other words, demand.

We want to emphasize that the market cap has no effect on the price of Bitcoin other than on the mentality of Bitcoin buyers and sellers. Here are a few ways to show How Does Market Cap Affect Crypto Price?

- Ranking

Significant cryptocurrency websites such as CoinMarketCap or CoinGecko rate cryptocurrencies according to their market capitalization. A coin’s position on the list indicates how much attention it will get. If a cryptocurrency is at the top of the list, it will get considerable attention. If a coin is positioned on the second or third page, it will get less attention. Increased attention equals increased investor interest, and increased investor interest equals increased price!

- The impression

The greater the number, the more amazing the achievement. When we consider the Bitcoin market capitalization, this is a significant figure. When compared to a lesser currency, Bitcoin seems to be more significant. If a coin is seen to be valuable, it will attract more investors, and more investors equal a higher price!

The Correlation Of Market Cap And Crypto Price

- Control of the network

It will take billions of dollars to become a Bitcoin whale. Becoming a whale is significant because whales have the ability to quickly alter the price of a currency and impact the growth of particular currencies. Because Bitcoin is so vast and costly, becoming a Bitcoin whale is far more difficult than breaking into a little currency.

A huge market capitalization indicates that a coin will be difficult to manipulate. A little market capitalization indicates that it could be. A greater market cap indicates a more secure currency and a more secure coin attracts more investors, which increases the price!

>> Read Also: What Is A 51% Attack & Its Effects On The Blockchain Network

How Does Crypto Price Affect Market Cap?

When talking about market cap, it’s more important than when we talk about How Does Crypto Price Affect Market Cap? Let’s take this example, Bitcoin’s market capitalization is found by multiplying the current number of coins in existence — over 19 billion — by Bitcoin’s price at a given time.

As the price of Bitcoin varies, as it constantly does, so does its market capitalization. In the past few weeks, Bitcoin’s price has been between around $37,000 to $50,000 (at the time of writing), which translates into a significant range in market capitalization:

- $37,000 x 19 million = $703 billion

- $50,000 x 19 million = $950 billion

- $65,000 x 19 million = $1.235 trillion

In terms of market capitalization, here’s how Ethereum compares to Bitcoin: the cost of a $3,000 and a circulation of about 117 million, Ethereum has a market capitalization of about $351 billion. Ethereum’s market capitalization is higher despite the fact that it has a bigger number of circulating coins than Bitcoin.

The Relation of Crypto Price and Market Cap

Why Is Market Cap Important In Crypto Space?

The price of a cryptocurrency is just one method of determining its worth. In order to present a more full narrative and evaluate the worth of different cryptocurrencies, investors utilize market capitalization (MC). Key stats, like as the number of transactions per second, may tell you if a cryptocurrency has the potential for development or whether it is safe to invest in.

Let’s compare the market capitalization of two fictitious cryptocurrencies to show this.

Cryptocurrency A has 400,000 coins/tokens in circulation, each worth $1, and its market value is $400,000. The market capitalization of Cryptocurrency B is $200,000 if there are 100,000 coins in circulation, each worth $2.

Despite the fact that Cryptocurrency B’s individual coin price is greater than Cryptocurrency A’s, the aggregate worth of Cryptocurrency A is double that of Cryptocurrency B.

The volatility of various cryptocurrencies may cause their market caps to fluctuate considerably, which is something to keep in mind.

Why Is Market Cap Important In Crypto Space?

The Importance To Understand Market Cap Cryptocurrency For Investors

With an understanding of a cryptocurrency’s market capitalization, you can compare the entire worth of one cryptocurrency to another, enabling you to make more informed investment choices. According to their market capitalization, cryptocurrencies are categorized into three groups.

- Small-cap: Small-cap cryptocurrencies have a market capitalization of less than $1 billion and are most susceptible to market sentiment changes.

- Mid-cap: Cryptocurrencies with a market capitalization of between $1 billion and $10 billion are considered mid-cap. In general, mid-cap cryptocurrencies provide more upside potential but also carry a larger risk.

- Large-cap: Cryptocurrencies with a market capitalization of more than $10 billion, such as Bitcoin and Ethereum, are considered large-cap. These are considered the lowest-risk investments due to their demonstrated track record of growth. Additionally, big caps can endure greater quantities of investors cashing out without adversely affecting the price.

Understanding what a cryptocurrency’s market cap is and how it may help you estimate risk while investing in cryptocurrency is critical, particularly given the current market’s volatility.

Understanding Market Cap Brings Many Benefits

FAQs About Market Cap In Cryptocurrency

What Factors Might Affect the Market Capitalization?

Supply and pricing are the two elements that impact market capitalisation. A soaring price results in a large increase in market capitalisation. With supply always a factor, investors may get a more accurate view of a cryptocurrency’s future by eschewing fleeting enthusiasm over price and instead focusing on market cap statistics.

What Is A Good Market Cap For Cryptocurrency?

According to some consultants, new businesses should have a market capitalization of less than $200 million in order to provide greater possibilities for growth. It is decided by your choices. While investing in large-cap crypto may seem safer, the return is much smaller than that of mid-and low-cap coins or tokens.

However, there are a plethora of cryptocurrencies available, some of which may be hidden jewels or fraudulent enterprises. Attempting to disregard the majority of them and selecting wisely will significantly safeguard you when investing in cryptocurrency.

What Is A Good Market Cap For Cryptocurrency?

>> Read Also: Surviving Through Crypto Bear Market – What Are The Tips For Yourself?

Final Thoughts

Now you are have been explained what is a market cap in crypto – Market capitalization may be an extremely useful investing instrument. As is the case with any investment, individuals interested in the crypto sector should rely on genuine facts.

It’s all too easy — particularly with cryptocurrencies — to make emotional judgments. The media exaggerates each bull run in Bitcoin and other cryptocurrencies but seldom covers extended downturn markets with the same zeal. A cryptocurrency trader who is prepared to consider market cap is acting similarly to a pilot who examines their instrument panel at the first hint of danger.

Rather than panicking and gazing outside, this pilot understands that monitoring the most recent data will assist them in making sound judgments that will allow them to fly into the skies once again.

What Is ICOs? How Can Investors Take Profit From It?

22 March 2022

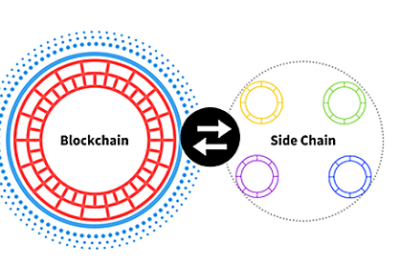

What Are Sidechains? In-depth Compared With Layer 2

10 June 2022