What Is A 51% Attack & Its Effects On The Blockchain Network

15 March 2022

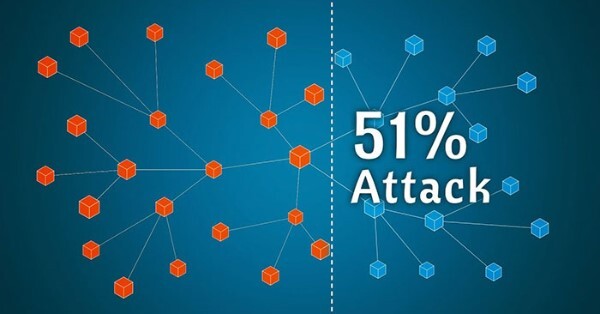

One or a group of people can gain control of more than half of the hashing power on a blockchain, known as a 51% attack or a majority attack In most cases, this is accomplished through the use of third-party rented mining hash rate power.

Immutable blockchains are the foundation of cryptocurrencies? As a result, thieves have found new ways to target the underlying blockchain as a result of cryptocurrencies’ rising popularity.

“51% attack” is one of these methods, and it’s shown to be highly effective in recent years.

When a new, fast-growing, promising technology like bitcoin or blockchain is introduced, there is always the potential for risks and weaknesses. The dangers of 51 % attacks will be discussed in this article. So, let’s bePAY help you to learn about this.

What Is A 51% Attack?

When a single cryptocurrency miner gains control of more than 50% of the network’s blockchain, this is known as a 51 % attack. Cryptocurrency users and buyers face a significant risk from such attacks.

There are very few 51 % attacks because of the logistical, hardware, and 51% attack cost issues involved. However, a successful block attack could have far implications for cryptocurrencies and their investors.

When compared to traditional investments like stocks and bonds, cryptocurrency trading has a higher level of risk, but the rewards could be greater as well. A 51% attack on a digital currency should be taken into account by any investor considering adding digital currencies to their portfolio.

51% attack definition

>> Read more: Fear and greed index crypto – The momentous indicator for traders

51% Attacks Background

When a digital ledger known as the blockchain is breached, it is called a 51 % attack. A chain of data is created when information is grouped together in blocks and linked together. Using blockchain technology, digital currency transactions and crypto-coin mining are recorded in a secure way.

To add blocks to the chain, “miners” in Bitcoin, for example, use a mining machine to solve mathematical problems. A network of computers is what these machines are really made up of. Bitcoins are awarded to miners who are successful in adding a new block to the chain.

The Bitcoin hash rate is a measure of the combined processing power of all the computers in the network. The health of a network can be gauged by its hash rate.

With More than 50% of a network’s mining power, computational capability, or hash rate is considered a “51 % attack” by one or more miners. Those responsible for a 51 % attack have complete control over the network and all transactions that take place on it.

51% attack background

How Does A 51% Attack work?

There must be a consensus of nodes or computers attached to the blockchain to validate newly mined blocks when a cryptocurrency transaction occurs. The block can then be added to the chain after it has been validated.

All transactions are recorded in the blockchain, which anyone can access at any time. There is no single entity in charge of this record-keeping system, which makes it decentralized. The hash rate of a particular network is also decentralized because different nodes or computers work together.

As long as one or more miners control more than 50% of the hash rate, nevertheless, the cryptocurrency network is vulnerable. Those who were responsible for a 51% attack would be able to do the following

- Prevent the recording of new transactions

- Rearrange the transactions in a different order

- Prevent the validation or confirmation of transactions

- Prevent other miners in the network from mining coins or tokens.

- Reverse the transaction To double-spend coins.

Block attacks can have a variety of unfavorable effects on cryptocurrency users and businesses that accept digital currencies as a form of payment.

Double-spend scenarios, for example, would allow someone to pay for something with cryptocurrency, then reverse the transaction after the fact. It is possible that they will be able to keep their purchase and the cryptocurrency they used to make it, thereby defrauding the seller.

How does 51% attack work?

51% Attack Examples

There were 51% attack examples on two Ethereum-based blockchains in August 2016, Krypton and Shift.

The 26th-largest cryptocurrency, Bitcoin Gold, suffered a 51% attack in May of 2018. Despite Bitcoin Gold repeatedly trying to raise the exchange thresholds, the attackers managed to double-spend for several days and steal more than $18 million in Bitcoin Gold thanks to the malicious actor or actors controlling a large amount of Bitcoin Gold’s hash power. A new attack on Bitcoin Gold occurred in 2020.

In August of 2021, a cyberattack was launched against the Bitcoin SV (BSV) blockchain.

Has Bitcoin Been Attacked 51%?

To attain consensus, all nodes in a blockchain network must work together to sustain the network. Because of this, they tend to be quite safe. Attacks and data corruption is less likely to occur if the network is large.

To solve Proof of Work blockchains, the higher a miner’s hash rate, the more likely they are to come up with a legitimate solution to the following block’s puzzle. This is accurate because mining includes a large number of hashing attempts, and the more processing power available, the more trials per second can be carried out each second.

Several early Bitcoin miners joined the network in order to help it expand and keep it secure. Bitcoin’s value has increased, resulting in a large number of new miners entering the network to compete for block rewards. Another of reason Bitcoin is safe is because of the competitive nature of the market. If the block reward isn’t at stake, there’s no reason for miners to put in the time and effort necessary to earn it.

Bitcoin 51% attack?

Due to the size of the network, Has Bitcoin been attacked 51%? is extremely implausible. The probability of a single individual or group gaining enough computational power to overpower all the other participants in a blockchain dramatically decreases as the network becomes larger and larger.

To make matters more complicated, as the chain grows longer, the cryptographic proofs linking individual blocks become increasingly difficult to break. A block with more confirmations has greater fees for modifying or reversing transactions within it, for the same reason Consequently, a successful attack would likely only be able to alter the transactions of a few recent blocks for a limited time.

As an extreme case, let us consider a Bitcoin 51% attack on the Bitcoin network that has no regard for the financial gain it could bring a cause of 51% attack cost Bitcoin’s software and protocol would be immediately adjusted and altered in response to any attack on the network, no matter how well the attacker succeeds in disrupting it.

This would necessitate the other network nodes to agree to these modifications, although this might be accomplished rapidly in the event of an emergency. Cryptocurrencies like Bitcoin are known for their high level of security and dependability.

>> Read more: “Yield farming” what it is and is yield farming profitable?

FAQs About 51% Attack

How Much Would A 51% Attack Cost?

While it is possible for attackers to double-spend millions of dollars worth of cryptocurrencies by controlling 51% of the hash rate on a blockchain, the resources needed to manage the computational power essential for such operations are not inexpensive.

Due to the greater computer power needed to obtain a majority of a large blockchain’s hash rate, 51% attacks are more common on smaller blockchains. One hour’s 51% attack cost may be calculated as the cost of acquiring the market’s supply of hash rate during that period of time.

You can check How Much Would A 51 Attack Cost? here

How much would a 51% attack cost?

Is It Possible For A 51% Attack To Recur?

If the attacker inserted a defect into the blockchain’s code, there is a good chance that a 51 % attack will recur. The second attack can be facilitated by manipulating the blockchain to create new blocks more quickly.

In the end, an attacker has the ability to re-infiltrate a blockchain. It is the responsibility of the blockchain to make its systems safe and robust.

How Do I Stop The 51 Attack In Blockchain?

How do I stop the 51 attacks on the blockchain? is an unresolved question. Because you cannot stop it. However, to prevent a 51% attack, you need to increase the number of nodes and miners on the network to make it more difficult for someone to acquire enough hash power for a successful attack. PoW chains are easier to hack than Proof of Stake (PoS) chains.

Closing Thoughts

Understanding how a 51 % attack works will help us understand how a blockchain network can be hacked. Because of this, the Bitcoin network serves as an example of how secure blockchains can be when they’re large enough. Based on its 12-year history of unbroken operation, the Bitcoin network should be able to withstand a 51 % attack for some time.

In the future, new technology is expected to fix these security issues and perhaps enhance the system. These 51% attacks, on the other hand, should aid businesses and sectors in discovering new defences and methods to strengthen their current platforms in the future. We can’t wait to see what the future has in store for us in this sector.

What Is A DApp – The Gateway To Interact Decentralized

22 March 2022

What Is SegWit? And What Does It Solve For Bitcoin

25 March 2022