What Is Wrapped Token Ultimate Information You Need To Know

22 March 2022

You may have heard of “wrapped Bitcoin” or “wrapped token” in the crypto sphere. As a crypto trader and investor, you should know about the many kinds of wrapped tokens on the crypto market, their purpose, and what they represent to you. Don’t worry bePAY is here to help you.

What Is Wrapped Token?

A cryptocurrency that has been tokenized. For instance, what is wrapped bitcoin? Bitcoin (BTC) is wrapped into WBTC for use on the Ethereum network. Ethereum’s Ether cryptocurrency (ETH) was established before the adoption of ERC-20 and wrapped Ethereum (WETH) enables interoperability with ERC-20. Holders of WBTC and WETH indirectly possess BTC and ETH. A smart contract is constructed that securely stores the main cryptocurrency and trades it for the wrapped version.

Wrapped token explanation

What Is Wrapped Bitcoin?

Wrapped Bitcoin (WBTC) is the most common wrapped token. Wrapped Bitcoin is helpful because it enables Bitcoin investors to connect their asset (or a synthetic asset with the same exposure to bitcoin’s price) to Ethereum’s DeFi protocols. This allows Bitcoin to become a yield-bearing asset, earning returns from things like liquidity pools like Uniswap or Yearn Finance.

To get wrapped Bitcoin, locate a WBTC merchant like DeversiFi, Kyber, or Ren. The retailer delivers your Bitcoin to a custodian who wraps it and keeps it. For a Bitcoin redemption, the merchant sends a burning request to the custodian, who destroys the WBTC and returns your Bitcoin.

Every WBTC in circulation has precisely one Bitcoin behind it, thanks to this technique of minting and burning. This is how pegged-value stablecoins function. You may also purchase WBTC on controlled or decentralized exchanges. WBTC isn’t an ideal answer since it adds centralization. If you own wrapped Bitcoin, you entrust it to BitGo.

Wrapped Bitcoin

What Is Wrapped Ether?

Not all wrapped tokens are usable? Wrapped Ethereum (WETH), created by 0x labs in 2017, is very popular. What is wrapped Ethereum? WETH, unlike WBTC, allows users to exchange synthetic Ether on the Ethereum network. For one thing, it transforms ETH into an ERC-20 token, which is a marketable version of the cryptocurrency. Ethereum’s native token, ETH, does not meet the ERC-20 standard.

These standards define the requirements for tokens to be interoperable with other Ethereum-based Dapp and platforms. To construct non-fungible tokens (NFTs) or fungible tokens (FTs), multiple standards are employed.

A new universe of decentralized money is now available to ETH holders. They may use WETH to trade with other Ethereum-based cryptocurrencies and donate to DeFi protocols.

Wrapped Ether

Unlike WBTC, you don’t “wrap” ETH. A smart contract or a digital wallet such as MetaMask may be used to exchange ETH for WETH. This project seeks to phase out wrapped Ethereum after Ethereum’s codebase is upgraded to comply with the ERC-20 token standard, or if the ERC-20 standard is redesigned.

>> Learn more: What is behind smart contract technology?

How Do Wrapped Tokens Work?

Here is the process of how to create a wrapped token – Consider Wrapped Bitcoin (WBTC), an ERC-20-compliant form of Bitcoin that enables quicker and more affordable transactions? WBTC is tied 1:1 to the price of BTC. For every WBTC that exists, a custodian holds a Bitcoin. In other words, owning WBTC essentially acts as a proxy for BTC. How to create a wrapped token? It is a two-step procedure as follows:

- Step 1: The merchant commences the minting process by paying BTC to the custodian, a third-party firm that holds an equal amount of wrapped assets in reserve.

- Step 2: The custodian then mints BTC on Ethereum and returns to the merchant the corresponding amount of WBTC (1:1 linked to the price of BTC).

Similarly, the merchant may transfer WBTC to the custodian and get BTC in exchange. By now, you’re probably aware that wrapped tokens on Ethereum must adhere to ERC-20, a technical standard for token issuance on Ethereum.

How to create a wrapped token?

Wrapped Tokens Pros and Cons

There are several benefits to using wrapped tokens:

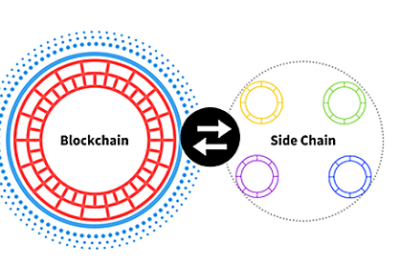

- Many tokens can’t be utilized on other blockchains since each one has its own set of rules. Non-native tokens may be utilized on other blockchains thanks to wrapped tokens.

- When your automobile is in the shop, consider wrapping to be a compatibility patch or a loaner car. It’s a fast cure for an ongoing problem.

- Exchanges benefit from the increased trading alternatives provided by wrapped tokens in terms of liquidity and capital efficiency.

- Finally, you may take advantage of the fact that transaction costs and timings differ per chain. We all know how long it might take to transfer a Bitcoin, but doing it in WBTC is far faster.

Wrapped tokens have several restrictions:

- Staking using wrapped tokens is not decentralized since a custodian is required to keep the tokens in the vault.

- When you purchase tokens pre-wrapped they will save you money on the expense of wrapping tokens.

Advantages and disadvantages of wrapped token

Some FAQs About Wrapped Tokens

How To Get Wrapped Tokens?

You may just purchase tokens that have been wrapped and placed on the chain of your choice. Because the wrapped tokens are sufficiently liquid, you may easily purchase WBTC on ETH using DEX. You may, however, wrap your Bitcoin from its home chain and get WBTC on the Ethereum network.

>> Read also: What is a DEX? Top best DEX on market

How Do Your Tokens Fare After They Are Wrapped?

Contrary to the term, the tokens are not “wrapped,” allowing them to be transferred across blockchains. Staked tokens are kept in a vault that is secured. Once you do this, an equivalent value new token is produced for you on the “target” blockchain, and this new token is a direct reflection of the original asset’s worth. Unstake tokens to reveal their contents, or remove them from this “vault” to reclaim the original.

Is Wrapped BTC Safe?

Technically, a wrapped Bitcoin token is secure. It’ll probably be stored on Ethereum or BNB chains, and once transformed into an ERC-20 or BEP-20 token, it’ll hold the network’s security.

One of the major problems with wrapped BTC tokens is the necessity to trust the custodian. If indeed the custodian unlocks and distributes the actual Bitcoin to another party, the ERC-20 compliant wrapped BTC token holders lose all value.

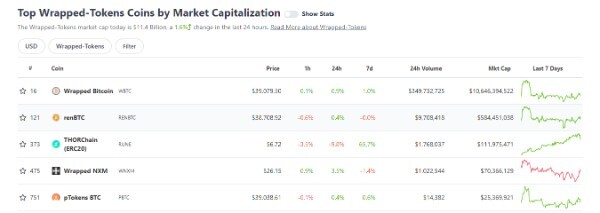

What Is Top Wrapped Tokens List?

Below is the top wrapped tokens list by market capitalization according to Coingecko that you can take as references

Wrapped Tokens List

Source: https://www.coingecko.com/en/categories/wrapped-tokens

Closing Thoughts

Wrapped tokens are linked to the original asset’s value and may be as volatile as the underlying crypto asset. Traditional cryptocurrencies may be a better choice if you want to utilize crypto as a wealth store with future growth. Don’t forget to conduct your homework before investing in any asset, and make sure you’re okay with losing money. Be careful not to overinvest and remember that previous success is no guarantee of future profits.

Wrapped crypto may be an option for regular users interested in DeFi. Your own needs and risk tolerance should influence your decisions.

What Are Sidechains? In-depth Compared With Layer 2

10 June 2022

What Is A DApp – The Gateway To Interact Decentralized

22 March 2022