The Rendering Of What Is BUSD – BUSD Rank In The Stablecoins World

21 April 2022

Stablecoins are a significant type of cryptocurrency that has been gaining appeal among traders and investors alike? BUSD is one of the few stablecoins that is audited regularly, making it a highly regulated asset. Discover what is BUSD, how BUSD is utilized, the benefits it provides, and the accomplishments it has made in the space.

BUSD is regulated and backed stablecoin denominated in the US dollar? Every BUSD currency is issued app with one US $1 in reserve. In other words, the supply of BUSD is pegged to the US dollar in a 1:1 ratio. Holders can swap their tokens for money and vice versa. Paxos firm is the issuer of the token and also publishes the findings of the monthly check on the status of the project of BUSD.

As a stablecoin, BUSD is meant to guarantee value stability in the market. It allows advisers and traders to maintain a less volatile asset on the blockchain, without the need to extract the product from the crypto realm.

Now that bePAY has reviewed the fundamentals of BUSD, let’s look at what it’s used for and why it’s quickly becoming a market leader in the cryptocurrency industry!

What Is BUSD?

Binance USD is a regulated, collateralized, and fiat-backed stablecoin linked at a 1:1 ratio to the US dollar. The USD-denominated stablecoin was recognized by the New York State Department of Financial Services after being founded by two big businesses – Paxos and Binance (NYDFS). Notably, it was one of the few stablecoins allowed in the United States.

Paxos is a regulated blockchain technology firm that provides external businesses with its stablecoin as a service. In this instance, they serve as the third-party reserve for Binance stablecoin in a US bank that is FDIC-insured.

BUSD was established, like other wrapped stablecoins, to facilitate transactions inside the decentralized finance (DeFi) ecosystem. And, while it adheres to the ERC-20 token standard and includes compatibility for the BEP-2 wallet, the fiat-backed stablecoin is compatible with a variety of blockchains.

For each BUSD token owned by an individual, an equivalent amount is maintained in a physical bank account. As previously stated, Paxos holds an amount equivalent to the real BUSD supply in an FDIC-insured US bank as a third-party reserve.

What is BUSD?

Additionally, being a wrapped token, BUSD is susceptible to the same market activity as its cash equivalent. In other words, when the value of the fiat currency changes, the BUSD token has the same effect. BUSD exists on three distinct chains: Ethereum, Binance Smart Chain, and Binance Chain, and it possesses three key characteristics: accessibility, flexibility, and speed.

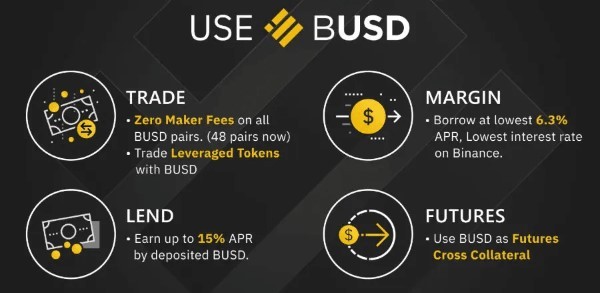

What Is BUSD Used For?

Paxos and Binance launched the BUSD stablecoin in an effort to establish a cryptocurrency backed by the US dollar. A distinguishing feature of Binance USD is that one unit is equal to one US dollar. Paxos owns a quantity of US dollars equal to the complete supply of BUSD to sustain this value.

As a result, the stablecoin’s price varies in lockstep with the price of the US dollar. BUSD offers an audited report of reserves every month in accordance with severe regulatory criteria to ensure the protection and safety of user assets.

Due to its relative stability to the US dollar, BUSD enables traders and crypto users to transact with other digital and blockchain-based assets while limiting the risk of volatility. Due to the nature of cryptocurrencies, holders may encounter dramatic swings in the value of their holdings. Utilizing a stablecoin such as BUSD can considerably assist in mitigating market volatility.

What is BUSD used for?

Because of its intrinsic capabilities as a stablecoin, Binance USD has performed very well and established itself as a pioneer in the cryptocurrency market. Since the stablecoin’s inception in 2019, it has grown in value to the point that it currently has a market valuation of $17 billion (at the time of writing).

>> Read also: What is wrapped token ultimate information you need to know

What Is The Difference Between USDT And BUSD?

What Makes USDT And BUSD Different?

The increasing popularity of these stable currencies has resulted in several modifications to their functionality. Additionally, there are numerous additional characteristics that have resulted in the rising adoption of stable currencies by crypto traders and investors in recent months.

Due to the fact that these stable currencies are processed more quickly, they enable speedier transactions. Additionally, users benefit from increased anonymity and security as a result of the coins’ price stability.

There are several advantages to dealing with stable currencies, but determining which one offers the most benefits requires careful selection and knowledge of the distinctions between them. However, if you’re unfamiliar with the difference between USDT and BUSD, you’ve come to the correct spot.

Auditing

BUSD is subjected to audits on a regular basis to maintain its security. BUSD conducts monthly audits through the Withum auditing business to guarantee that the BUSD supply corresponds to the money in banks linked to the tokens. USDT, on the other hand, does not go through as stringent an auditing procedure.

What is the difference between USDT and BUSD?

While USDT constantly displays its reserves, it does not make auditing information available to the public. This might be a source of concern for someone’s security requirements.

Reserves’ Location

USDT tokens are backed by offshore banks, whilst Binance USD tokens are backed by US banks. Offshore banks provide lower operating costs and tax advantages, but they aren’t necessarily as safe as the FDIC-insured US banks that BUSD utilizes. USDT is also supported by secured loans, corporate bonds, and a variety of other assets. In comparison to what BUSD controls, the amount of actual currency reserves utilized to sustain USDT is tiny.

Trading Pair

Because USDT is more widely accessible, it supports more trading pairings and makes deals easier to complete. BUSD, on the other hand, is expected to become more apparent as people recognize its benefits and demand for such stablecoins grows.

Blockchain USDT is based on the Ethereum blockchain, whereas BUSD is based on numerous blockchains, including those controlled by Binance. Binance’s extra support makes it safer because there is no need to worry about one chain being accountable for all activities.

Trading Volume

USDT has a bigger trading volume since it has been operating for a longer period of time. As of September 2021, the average trading volume for USDT is over $83 billion, whereas BUSD is approximately $12 billion.

BUSD and USDT

What Are The Similarities Between BUSD And USDT?

- Value: There is no need to be concerned about volatility because both BUSD and USDT are tied to the US dollar at a 1:1 ratio.

- Acquisition: These two currencies are minted in the same way. Instead of mining, the organization behind one of these tokens adds your money to their reserves and then mints fresh currencies for you.

- Transactions are processed swiftly: USDT and BUSD transaction speeds are extremely rapid. These two can be transferred at any time of day or night, without the need for a bank.

- Reduced Transaction Fees: Because these stablecoins are connected to a fiat currency, there is no need to be concerned about high transaction costs. Transferring USDT and BUSD is inexpensive, especially when compared to other cryptocurrencies, which can be costly to handle.

- Smart Contract: The two stablecoins are powered by smart contracts. Specific regulations and requirements must be followed before a transaction may proceed, providing a safe and secure procedure.

No banks involved BUSD and USDT both function without the need for assistance from a bank. Working directly with your counterparty allows you to conduct a transaction.

>> Read also: What is behind smart contract technology – Smart contract example

Here are some main different traits of BUSD and USDT.

| Feature | BUSD | USDT |

| Released | 2019 | 2014 |

| Type | Stablecoin | Stablecoin |

| Blockchain | Ethereum and Binance | Ethereum |

| Auditing | Monthly | Not sure |

| Maximum supply | No limits | No limits |

| Rank (MarketCap) | No.13 | No.3 |

FAQs About BUSD

Is BUSD A Good Stablecoin?

The answer for is BUSD a good stablecoin? It absolutely yes, BUSD is fully guaranteed by US dollars stored in FDIC-insured US institutions. BUSD is a stablecoin with a value tied to the USD or USDT. The USD is supported by complete trust in the US government, whereas the USDT is backed by nothing.

As a result, BUSD is more secure than USDT. This is entirely correct. However, if you are an ordinary trader, this doesn’t really matter whether you trade the BTC/BUSD pair or the BTC/USDT pair, but if you want to store particularly big sums of money in stablecoins, holding simply BUSD or splitting the money between BUSD and USDT may be a better choice.

Does BUSD Have Fees?

There are no fees connected with producing or redeeming BUSD, as there are with PAX.

Does BUSD have fees?

Is BUSD Safe?

Some people are curious whether is BUSD safe – because BUSD is one of the few stablecoins that is subject to frequent third-party audits and it’s carefully controlled to maintain a 1:1 BUSD to USD ratio, many believe it to be one of the safest stablecoins currently on the market.

Sum It Up

Since its launch in September 2019, the Binance USD has acquired traction among traders and investors, as well as significant support from organizations outside of its own ecosystem. Because of its fully regulated status, it has developed to be seen as a safe connection between fiat and crypto-assets.

Furthermore, the BUSD provides various benefits to the financial industry, spanning from DeFi to wealth management & account settlements. There are also global use case applications for payments as a result of the automated redemption and minting method enabled by smart contracts.

The exponential increase of BUSD in the first six months following its launch shows that the market was ready for a stablecoin alternative to the existing stablecoins. The stablecoin may be used as a medium of value transfer between the Ethereum and Binance chains, as well as inside the Binance exchange. Binance has also indicated that full online payment functionality would be available shortly.

BUSD has several advantages over other stablecoins, including more transparency, because it is a fully regulated stablecoin. It also provides price stability, is fully collateralized and audited on a regular basis, is scalable, and is fully supported by the Binance ecosystem, all of which almost guarantee its continued growth and adoption.

What Is Bitcoin Cash In Comparison With Bitcoin?

10 June 2022

What Is Tendermint? What Makes Tendermint Great?

30 July 2022