What Is GUSD Coin – Whether Is It Really Safe?

31 May 2022

Recently, the collapse of LUNA and its stable coin UST of Terra Network has raised many suspicions about the stability of stablecoin. Are they really safe to keep a peg of 1:1 to the USD dollar? At the time of writing, there are dozens of stablecoins on the market with many different working paradigms, including full reserve, over-collateral, algorithmic, and partially reserve).

When staying on the perspective of users, finding a safe, reliable, and stable cryptocurrency is extremely important. Therefore, if the stablecoin is not stable, that is the problem. Try to imagine you are engaging with the settle down a life full of wealth, and prosperous immediately lost everything in the tomorrow morning.

Today we are going to research information about the stablecoin from the Gemini exchanges, the GUSD. So what is the GUSD coin and how does it work? How secure is GUSD? Whether it will repeat history like UST, together with bePAY, to discover all in-depth information about the GUSD.

Market Overview Of Stablecoin

As a result of the extreme price volatility of cryptocurrencies such as Bitcoin and Ethereum, investors fear holding them. Stablecoins are meant to have a steady value, as suggested by their name.

The majority of stablecoins are pegged to a fiat currency, such as the dollar, or a commodity, such as gold. Investors purchase stablecoins to store funds and conduct transactions inside the architecture of virtual currencies. In addition, stablecoins are utilized for various types of financial transactions, such as borrowing or cross-border payments, without the need for regular bank processes.

Due to the theoretical durability of stablecoins, these unknown cryptocurrencies have become the backbone of the crypto ecosystem. As of March of this year, the overall market value of stablecoins increased to $180 billion, according to statistics from the US Federal Reserve (Fed).

Some stablecoins, like US Treasury bonds, are pegged 1:1 to actual assets, like the Gemini USD coin (GUSD). Some are linked to other bonds, and their prices are very volatile.

Stablecoin market overview

>> Learn more about what are stablecoins?

What Is GUSD Coin?

What is GUSD coin exactly? The Gemini dollar (GUSD) is a crypto stablecoin tied to and guaranteed by US dollars stored in FDIC-insured bank accounts. The monies maintained in reserves are frequently examined by the accounting company, BPM LLP.

GUSD was established by crypto exchange Gemini, which was founded by Cameron and Tyler Winklevoss in 2014. In 2018, Gemini gained clearance from the New York Department of Financial Services (NYDFS) to launch its stablecoin. The firm has claimed that GUSD is the first regulated stablecoin. However, Paxos also introduced an NYDFS regulated stablecoin on the same day. The Gemini Trust Company LLC keeps USD deposits that match the number of tokens in circulation.

The Gemini dollar is an ERC20 crypto coin created on the Ethereum network, and its smart contracts are certified by security firm Trail of Bits Inc.

What is GUSD coin?

>> Related: Let’s check another exchange Stablecoin BUSD

What is GUSD Used For?

Using Gemini dollar to

- Trade on decentralized markets: Trade and invest in DeFi using GUSD.

- Lend and earn interest: High returns in DeFi and via Gemini.

- Provide liquidity: Use with automated DeFi market maker and other liquidity pools.

- Gemini Pay allows you to send funds across borders in a matter of seconds and spend them at your preferred retailers.

How Does GUSD Work?

Gemini Dollars are issued using the Ethereum blockchain. Thus, it is always feasible to check tokens and observe their circulation using the supplied address of the smart contract.

They are created when money is deposited into Gemini’s custodian account and “destroyed” when USD is redeemed. The distributed ledger verifies the availability of coins, while the auditing company verifies the matching quantity of US dollars. Each GUSD token symbolizes a reserve dollar stored in US dollars.

How does GUSD work?

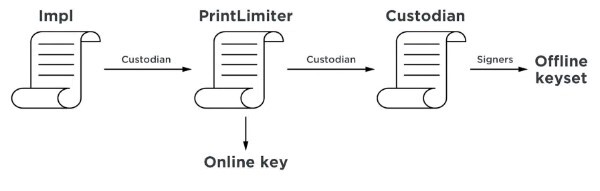

Gemini manages Gemini Dollars via many layers of smart contracts that fulfill distinct duties. In the Gemini system, there are three crucial layers:

- The Proximity Layer and the governance layer determine which on-chain behaviors are permissible. In addition to being responsible for the generation and transfer of GUSD, it also offers a mechanism to halt particular on-chain actions as necessary.

- Implicit Layer: It includes all the necessary data to execute the smart contract. It is responsible for the creation, transfer, and destruction of tokens. Additionally, the implicit layer guarantees that each GUSD token is issued for each USD in reserves. Nonetheless, the rising and decreasing token supply must be authorized by the overseeing custodians.

- Storage layer: The ledger calculates and makes public the balances on the blockchain.

>> Recommend: What is a smart contract?

How Secure Is GUSD?

There is some raised question about how secure is GUSD?. These are GUSD safety measures. Gemini Dollar employs the following security measures:

- Offline Keys: They authorize dangerous acts and are housed in Gemini’s cold storage facility.

- Keys Generation: To create, store, and manage keys, Gemini employs hardware security modules (HSMs).

- Multi-signature: Risky acts need the permission of at least two signers. This method offers security and fault tolerance.

- Time Locking: Identified dangerous activities are also restricted for an undetermined time prior to execution. It allows sufficient time to discover and react to any security breaches.

- Cancellation: Just before the execution, malicious acts may be revoked.

How secure is GUSD?

What Makes GUSD Special?

Traditional institution: Although Gemini is often compared to other exchanges like Coinbase and Kraken, it has carved itself a place among huge financial institutions and high-volume traders. This is because of its comparatively cheap costs, and the fact that trading larger amounts result in even lower rates.

Compliance and regulation: It is also attractive since compliance and regulation are already included. Gemini is legally obligated as a trustee and fiduciary, and customer fiat money is stored in a bank and guaranteed by the U.S. government. This means it must adhere to the state of New York’s compliance, anti-money laundering, and cybersecurity rules.

Licensed custodian: Gemini continues to attract institutions because it is a licensed custodian of digital assets. Numerous US organizations are obliged by law to store digital assets with a qualified custodian, making Gemini the logical alternative for safe bitcoin investments.

GUSD is special

A disadvantage is the limited number of supported nations. Gemini is now only accessible in the United States, Canada, Hong Kong, Singapore, the United Kingdom, and South Korea. It is also restricted to large cryptocurrencies (Bitcoin, Ethereum, Zcash, Litecoin, and Gemini dollars).

FAQs About GUSD

How Does Gemini Profit Off Of GUSD?

Gemini dollars are produced when purchased using U.S. dollars on Gemini and redeemed when sold for U.S. dollars on the same platform. GUSD is also accessible for trading and storage on a number of other exchanges and is backed by a large number of crypto projects.

Is GUSD The Same As USD?

No, the Gemini Dollar (GUSD) is a stablecoin produced by Gemini Trust Corporation, the company that operates the Gemini digital currency exchange. It has a 1:1 peg to the US dollar.

Is GUSD the same as USD?

Where Can I Get Further Information On GUSD?

The website of the currency’s issuer, Gemini, is generally considered to be the most reliable source of information on the Gemini Dollar. Visit their page for more information on stablecoin.

Closing Thoughts

As a government-regulated stablecoin, the Gemini Dollar gives crypto fans a straightforward and safe entry point. The token is ideal for novice investors. However, experienced traders may find the restricted number of trading instruments to be limiting. GUSD’s stringent modulation may potentially alienate crypto-users who want to avoid censorship and excessive control.

The GUSD currency still has enormous growth potential, and the team can make substantial enhancements to the platform and exchange’s present capabilities. GUSD is distinguished by its impeccable security record, which may be just what the coin needs to continue gaining community attention.

What Is Taproot Bitcoin? How Does It Affect Bitcoin?

24 June 2022