Cryptocurrency Explained: What Is PancakeSwap And How Does It Work?

29 March 2022

What is PancakeSwap? Using the Binance Smart Chain, PancakeSwap is a decentralized trading platform. It was created by a group of unidentified programmers. If you’ve ever wanted to learn about PancakeSwap’s Farming, you’ll find all you need to know here, including a detailed explanation of how the service works.

Nevertheless, SushiSwap’s DEX is placed on top of Ethereum’s blockchain, which can be a lot more costly, while PancakeSwap is based on the Binance Smart Chain, which can be a lot more cost-effective. Some UniSwap, PancakeSwap, and/or SushiSwap similarities may also have surfaced.

PancakeSwap is governed by its users. It allows users to farm liquidity, offers tokens, and has many other unique features that set it apart from the competition and enable you to earn incentives for using it.

PancakeSwap’s cost varies, too, because of several variables. Everything that makes PancakeSwap so special will be covered in this article including what is PancakeSwap definition, how it works as well as how to use PancakeSwap and many more. Everything will be shown in this bePAY‘s post.

What Is PancakeSwap?

What is PancakeSwap? A decentralized exchange called PancakeSwap enables you to swap cryptocurrencies and tokens without the need for a third-party-controlled middleman. Binance Smart Chain, a blockchain platform maintained by the crypto exchange Binance, is used to build it.

Despite the fact that Binance runs a controlled exchange, PancakeSwap was created by anonymous developers and is not under the supervision of Binance. Uniswap, a prominent Ethereum DEX, has a striking resemblance to this service. Binance Smart Chain uses PancakeSwap to run BEP-20 coins, but other platforms’ tokens may be transferred to Binance Bridge and “wrapped” as BEP-20 tokens for usage on the DEX using Binance Bridge.

Binance Smart Chain’s Pancakeswap is now one of the most popular DEXs.

Trading on PancakeSwap is made possible via the deployment of an automated market maker (AMM) technology that draws liquidity from user-generated pools. Smart contracts allow users to store their tokens in a liquidity pool rather than dealing with an order book and trying to locate another party willing to exchange their tokens for their desired ones. Thus, any trade is possible, and users who choose to retain their money in the pool are rewarded for their efforts.

What is PancakeSwap?

Trades using trade tokens may now be completed without the need for an intermediary, thanks to a new generation of DeFi businesses like PancakeSwap. Even though Uniswap has a substantially greater average trading volume on Ethereum than Binance Smart Chain, it is one of the major DEXs on the Binance Smart Chain.

>> Learn more: What is a DEX? Top best DEX on market

How Does PancakeSwap Work?

An automated market maker is what PancakeSwap, a DEX, is all about (AMM). Consequently, there are no order books, bid/ask systems, or limit/market orders.

Meanwhiles, users of the platform draw liquidity from one or more liquidity pools, which subsequently rebalance when the transaction is over. As a result of trading on an AMM like PancakeSwap, one side of the pool is reduced in liquidity and another is increased, causing the weights of assets and their relative prices to be shifted.

In order to raise the overall quantity of accessible liquidity, users known as “liquidity providers” (LPs) add equal amounts from both sides of a liquidity pool (e.g. BNB/USDC). In order to track their participation in a pool, users are given LP tokens that represent their portion in the pool.

To get their share of the pool, these tokens must be returned. LPs get a cut of the transaction fees produced by the pools they provide in Pancake exchange for providing liquidity. Making and taking transactions have a fixed 0.25% cost, with the majority of that fee going to the liquidity providers.

How does PancakeSwap work?

A web3 wallet like MetaMask, TrustWallet, or WalletConnect is often used to access PancakeSwap, a decentralized application (DApp). PancakeSwap’s smart contracts may be accessed by these wallets after they have been set up to work with the Binance Smart Chain.

The PancakeSwap treasury, which now gets 15% of all trading fees earned, is responsible for funding the site. There are several ways in which treasury monies may be utilized to support the platform’s upkeep and maintenance, as stated in the official documentation. There are a number of expenses that go into running a business.

How To Use PancakeSwap?

Before using Pancake Swap you need to purchase one of the main cryptocurrencies like Binance Coin (BNB), Bitcoin (BTC), Ethereum (ETH), Tether (USDT), etc

To utilize PancakeSwap, you must first learn how to link your digital wallet (like Metamask) to the exchanges where you acquire your Bitcoin. Here is a quick start instruction for Pancake Exchange.

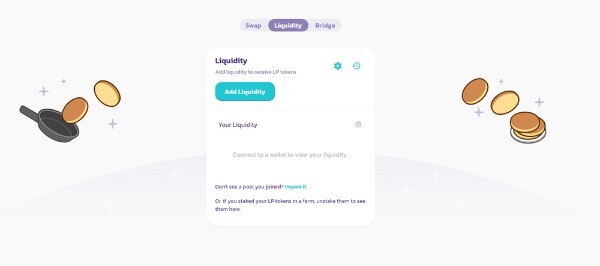

PancakeSwap DEX

Then selects Trade from the menu to access the Pancake exchange. Then you have two choices: Exchange or Liquidity. Toggle the tool in the middle of your screen to Swap. Now you may choose the inputs. In each line, choose the cryptocurrency you wish to trade. Instead of an order book, you trade crypto on PancakeSwap against AMM liquidity pools created by users.

How to use PancakeSwap?

Unlike a centralized exchange, anybody may build a pair, offer liquidity, and so create a new market for the DEX like Pancake Exchange. Once you’ve chosen your assets, click Swap, confirm the transaction in your wallet, and you’re done!

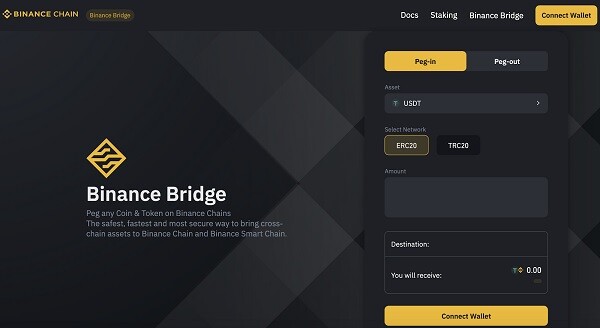

On the PancakeSwap DEX, you may only exchange BEP-20 tokens. PancakeSwap runs on Binance Smart Chain, not Ethereum. If you only have ERC-20 tokens, you may utilize the Binance Bridge to encapsulate them for usage on PancakeSwap.

Binance Bridge

To trade ERC-20 tokens on PancakeSwap, you must wrap them on the Binance Bridge (Binance Smart Chain token standard). To do so, link your wallet to the Binance Bridge. If you connect from a Metamask wallet on the Ethereum main network, you will be requested to confirm the transaction on the Ethereum side, which will cost you ETH.

While this may be costly owing to high Ethereum gas expenses, once wrapped and bridged to BSC, PancakeSwap’s minimal fees will save you a lot of money.

Binance Bridge isn’t simply for exchanging cross-chain assets. It may also be used to bridge Ethereum assets for PancakeSwap’s liquidity and yield farming. After utilizing PancakeSwap, you may convert your BEP-20 assets back to ERC-20 by using Binance Bridge.

Binance bridge

PancakeSwap Liquidity Pools

PancakeSwap, like Uniswap and SushiSwap, rewards liquidity providers. It’s simple and keeps the AMM liquid for users. Make sure your wallet is unlocked before clicking Liquidity. You’ll now be prompted to indicate which tokens you’re facilitating. Remember that supplying liquidity on PancakeSwap requires two tokens.

You may provide liquidity to

- Current Pools

- Your own pool

New projects aiming to launch their cryptocurrency token often create their own pool. If that’s not you, supplying liquidity to an established pool is preferable.

After selecting the pair, deposit by completing the transaction. After depositing, you’ll get FLIP, an LP token representing your pool stake.

Holding the FLIP LP token pays you every time an exchange occurs that uses your pool’s liquidity. In order to get your incentives, you must first redeem your FLIP tokens for the underlying assets.

PancakeSwap liquidity pools

PancakeSwap Yield Farming

Don’t confuse yield farming and supplying liquidity on PancakeSwap! Your initial asset quantities rise when the pool is utilized for exchange operations. Yield farming is depositing one set of tokens to mint another set. Select the Farms tab to generate PancakeSwap farm. Ensure the toggle is set on Live farms to view what is happening now. Several farms with BUSD and BNB base pairs should appear on the website.

Pick your favorite farms, then click details to discover how much CAKE each farm earns. APY for PancakeSwap farming is presently high, with farms like DUSK-BNB earning over 200%. By default, PancakeSwap asks you to unlock the wallet before identifying and depositing your currencies. After depositing, the website will show your CAKE earned.

>> You may also like: “Yield farming” What it is and is yield farming profitable?

PancakeSwap Syrup Pools

So you know how to give liquidity on PancakeSwap and how to yield farming works, but now comes another pool that is unique. PancakeSwap Syrup Pools allow you to bet CAKE tokens for a new Binance Smart Chain token. You put your CAKE token in a syrup pool and get the project’s BEP-20 token back.

In return, the project receives liquidity bootstrapping and a quick listing on the PancakeSwap platform. To join a Syrup Pool, click Pools, choose one, deposit your CAKE, and obtain fresh tokens.

PancakeSwap syrup pools

PancakeSwap Lottery

Winning a cryptocurrency deal may sometimes feel like winning the jackpot. Why not play the lottery? PancakeSwap Lottery lets you use CAKE tokens to accomplish just that.

Then purchase lottery tickets using CAKE tokens. The more CAKE you buy, the greater your chances (because you have more tickets, of course). If two or more of your tickets match the winning numbers, you earn a share of the CAKE pot. Lottery sessions occur six times every day. This increases the likelihood of hitting gold.

PancakeSwap IFO

PancakeSwap is pioneering a new ICO concept dubbed the IFO, or Initial Farm Offering. Tokens from a new project may be bought using an IFO. If you’re already a CAKE-BNB liquidity provider, just deposit your LP tokens on the IFO page.

If you wish to join an IFO but don’t have CAKE-BNB LP tokens yet, you must first get them. Buy BNB and CAKE tokens according to your donation (decide the total contribution amount, then buy 50% BNB and 50% CAKE). Once deposited, you’ll get your LP tokens.

Return to the IFO page, deposit your LP tokens, and wait for the IFO to complete.

PancakeSwap IFO

FAQs About PancakeSwap

How Do I Cash Out Pancakeswap?

To solve how do I cash out PancakeSwap? You need to follow these steps: If you like to stop using the PancakeSwap platform functions. First thing you need to convert to cryptocurrency you like to sell like BNB. Then withdraw it to exchanges that support the cryptocurrency you convert. Now you are ready to cash out your money by selling your cryptocurrency.

Can You Make Money On Pancakeswap?

PancakeSwap lets you stake CAKE in order to earn additional CAKE, which is how the passive income is formed. Farms and Pools are two methods to get CAKE. Two tokens may be supplied with liquidity by means of a farm. You must stake a pair of cryptocurrencies that you hold in Farms.

Can you make money on Pancakeswap?

Is It Safe To Utilize PancakeSwap Exchange?

Certik has audited the smart contract of PancakeSwap, a DeFi-based DEX exchange. Risks and faults are inherent with smart contracts. A smart contract’s vulnerability to defects or mistakes in the platform might lead to asset loss even after it has been adequately vetted.

Final Thoughts

Now you may know about what is PancakeSwap and how does it work including its main features. All cryptocurrency investments are fraught with danger. In a high-risk market, the gains we have experienced over the last several years have been phenomenal. But it is the over-allocation of our portfolio to assets that offer unrealistic returns that should cause us to stop for thought. Cake may be a component of a sound investing plan that is done with caution.

Binance is not without its own set of issues. In the meanwhile, the Justice Department is looking into charges of insider trading and market manipulation against the corporation. An unfavorable conclusion of this probe might have a detrimental impact on Cake and the whole Binance Smart Chain as a whole. As a result, proceed with care while investing.

It is undeniably true that Cake is one of the most liquid and valuable governance tokens on the market, as well as one of the easiest to stake and manage. It is not difficult to see why it has gained such widespread popularity.

What Is Tendermint? What Makes Tendermint Great?

30 July 2022