Cryptocurrency Explained: What Is DeFi And How Does It Work

05 March 2022

What is DeFi? A new term that’s popular recently. However, are you sure you comprehend it? In this post, bePAY will clarify its definition and how can you use it to maximize your opportunities in the Crypto world.

It’s easy to understand that decentralized finance is hard to swallow definition for most people. Excepting to you are the experts in finance or have deep knowledge in the Cryptocurrency market. However, we are here to help. All you need to know about what is DeFi have already synthesized and explained in the simplest way. Now Let’s dive in.

Are you ready, let’s explore the first most important part, what is DeFi and how does it work?

What Is DeFi And How Does It Work?

Decentralized finance (DeFi) is a new financial system that is built on secured distributed ledgers comparable that were used by cryptocurrencies. The system endows banks and organizations with no control over money, financial goods, and financial services.

For many users, the following are the primary benefits of DeFi:

- It does away with the fees charged by banks and other financial institutions for their services.

- Rather than storing your funds in a bank, you store them in a secure digital wallet and have 100% of the right to manage them.

- Everyone with an Internet connection may access it.

- It takes a few moments to transfer money and always 24/7

Moving to the deep explanation of What is DeFi.

What Is DeFi?

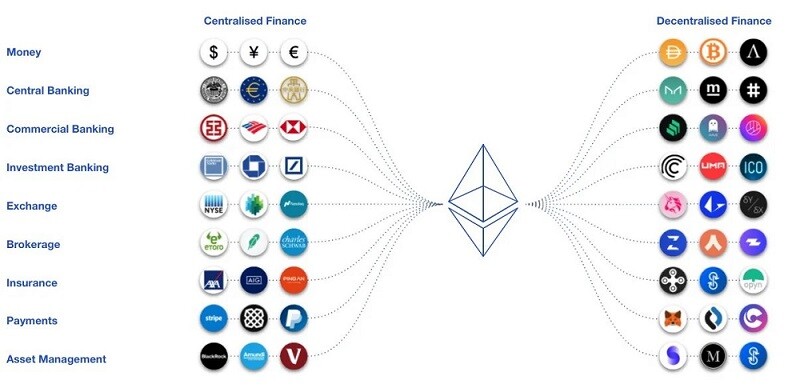

The word DeFi refers to financial transactions that take place via a blockchain. DeFi is a decentralized financial service. It entails taking conventional parts of the financial system and substituting a smart contract for the intermediary. In layman’s words, we can also refer to it as the fusion of conventional banking services with blockchain technology.

DeFi definition

Thus, for DeFi to function properly, it requires a decentralized infrastructure. Here is where Ethereum’s blockchain technology comes in handy. Ethereum is a self-contained platform enabling decentralized applications (DApps).

Although the majority of DeFi protocols run on the Ethereum blockchain, several are now hosted on rival blockchains, such as the Solana network, to benefit from increased speed and scalability. But how does DeFi work?

How Does It Work?

Blockchain technology is used in DeFi, much as cryptocurrencies. If you think of a blockchain as an encrypted database, you’re right. The blockchain is powered by decentralized applications or dApps.

Transactions are recorded in blocks on the blockchain and then cross-verified by other people. In this case, the block is closed and encrypted; a new block is then produced that contains the information from the preceding block.

The word “blockchain” refers to the fact that each block is linked to the previous one by the information contained in the preceding one. There is no method to edit a blockchain since information in prior blocks cannot be modified without impacting the succeeding ones. A blockchain’s safety is ensured by this and other security standards.

>> Learn more: What is COTI and how does it work?

What Are DeFi Applications?

Here are a few prominent uses for this new technology now that we’ve learned about DeFi.

In the next years, DeFi will expand to incorporate a wide range of financial applications. DeFi’s potential is only limited by the quality of the smart contract.

Using contracts to construct prediction markets, users may bet on athletic events and the outcome of elections, among other things. Prediction markets, such as Polymarket, are a kind of market.

DeFi and its utilities

Modern DeFi services and decentralized apps include the following:

- Defi Coins

- Tokens

- Decentralized exchanges (DEXs)

- Wallets

- Borrowing, lending, and saving

- Trading

- Liquidity, mining, and staking

- Prediction Markets

- And many more

Keep reading to know how DeFi can help you?

Is Defi A Good Investment?

Traditional banks are costly and cumbersome. Their strict standards have kept many individuals out of the banking system because transactions take too long. DeFi arrived to help. To solve the question is DeFi a good investment? let’s see a few advantages.

Unlimited

Access to the financial system is enabled through DeFi. All you’ll need is an internet-connected smartphone or PC to get started. DeFi Examples: Globally, many individuals are unbanked. In 2018, the World Bank projected that 20% of the world’s population lacks access to banking. One factor is that the unbanked lack essential KYC documentation like state-issued ID cards.

Others enable people to work without it. For example, a Maker loan requires no ID or credit check.

High-Interest Rates

DeFi enables you to make income as well as save income. Lend your assets to borrowers via Aave or Compound. You receive your interest and money back at a certain period.

Financial Self-Control

You retain financial control with DeFi platforms. While you must put cash into the platform, you control their fate. A smart contract does not rely on human middlemen to qualify for a loan or handle your finances. No one can block you from DeFi. The smart contract is based on law and is blind.

DeFi advantages

Enhanced Transparency

DeFi increases openness & accessibility. Because most DeFi protocols use the blockchain, a public record, all actions are visible. Anyone may observe transactions, but unlike typical banks, these accounts are not linked to anyone. Instead, accounts are pseudo-anonymous and merely list numbers. Because most DeFi products are open source, programmers may audit or expand on them. Because of community participation, open-source programs are more secure and of better quality than proprietary software.

Therefore, DeFi could be taken as a good investment. However, there is a lot of volatility in the market and this area is very new, you need to make deep research before participating in it. To reduce the risk let’s discuss DeFi Drawbacks

Does DeFi Have Any Drawbacks?

Many current talks on decentralized finance emphasize the benefits of DeFi. However, assessing DeFi’s potential requires a balanced view of its benefits and drawbacks. In reality, most issues and hazards connected with DeFi projects are caused by the technology involved. The problems with blockchain are typically accountable for DeFi’s drawbacks. Here are some of the major drawbacks of adopting DeFi.

Scalability

DeFi programs are unquestionably fit for expanded financial inclusion. However, DeFi implementations have several challenges in terms of host blockchain scalability. First, DeFi transactions take an inordinately long time to confirm.

During congestion, DeFi protocol transactions may become quite costly. DeFi examples, at maximum capacity, Ethereum could execute about 13 transactions per second. In contrast, DeFi’s centralized equivalents could handle thousands of transactions every day.

DeFi and its disadvantages

Doubt

Uncertainty affects both the benefits and drawbacks of decentralized finance. In the event that a DeFi project’s host blockchain becomes unstable, the project may automatically become unstable. Currently, the Ethereum blockchain is undergoing modifications. For example, errors made during the switch from PoW consensus to Eth 2.0 PoS might be risky.

Liquidity Concerns

Liquidity is crucial in DeFi-based applications and blockchain technologies. By October 2020, DeFi projects have a total value of over $12.5 billion. So the DeFi market is clearly smaller than the conventional banking systems. So it’s tough to trust a sector that lacks the customary financial resources.

Shared Responsibility

Among all the benefits and drawbacks of DeFi, people dislike the shared responsibility aspect. Your mistakes are not the fault of the DeFi initiatives. They simply remove middlemen, leaving consumers to manage their own finances and assets. Thus, DeFi space needs technologies to avoid human errors.

>> Learn more: What is VeChain?

Some FAQs About DeFi

What Does Decentralized Finance Do?

Getting rid of the middlemen from financial transactions is one of DeFi’s primary objectives.

When Comparing DeFi To More Conventional Forms Of Lending, What Should You Expect?

Traditional finance is heavily regulated and has a lot of costs. While we are more acquainted with conventional finance, DeFi proposes:

- No approvals are required to perform transactions, and agreements may be constructed without waiting periods.

- Transparency in fees and transactions

- Trust in technology rather than middlemen like banks

- These rewards are not without danger. DeFi is still young and less private due to the open decentralized network.

FAQs about DeFi

How To Invest In DeFi?

How to invest in DeFi? – There are many methods to invest in DeFi. In DeFi, you may need DeFi coins like ETH, AVAX, and BNB to get started. Begin with Uniswap and other DEXs. Keep in mind that DeFi is still a new concept with no controlling organization, be cautious with your investments.

What Is TLV Of DeFi?

TVL is the total of all cryptocurrencies staked, borrowed, or placed in a pool throughout the whole DeFi network. Also, it might indicate the total value of a certain cryptocurrency, such as ether or bitcoin, that is utilized for financial transactions.

Closing Thoughts

According to DeFi maximalists, this is merely the beginning of a big DeFi wave if the current trend continues. In the minds of true believers, the benefits of an open and decentralized financial system are just too compelling to ignore.

Financial transactions between users may be made without the need for a third-party intermediary. DeFi and crypto are hot topics right now. Take the time to learn about the benefits and drawbacks of participating before jumping in.

Hopefully, this post will help you understand more about What is DeFi, and how does it work? To learn more about other topics about cryptocurrency, please click here.

What Is QuickSwap? The Main Functions Of QuickSwap

30 March 2022

Ultimate Information About What Is BurgerSwap?

26 August 2022