What Is YFI Crypto? Ultimately Definition About YFI Token

22 March 2022

What is YFI? If you’ve been hanging onto any cryptocurrencies, you’re currently ahead of the competition in terms of preventing the value of your money from declining due to inflation. Therefore, rather than letting your cryptocurrencies lie idle in your wallet, why not put them to work for you?

Yearn.Finance (abbreviated Yearn) is an excellent alternative for people interested in investing in the decentralized financial ecosystem who wish to avoid the complexities.

Yearn allows you to deposit your crypto assets and let the Yearn Protocol algorithm work for you to earn the greatest interest on multiple decentralized finances (DeFi) platforms. Via this post, bePAY’s going to explain everything about YFI.

Yearn.Finance Introduction

What Is YFI Crypto?

Using the Ethereum blockchain, Yearn.Finance is a free and open-source decentralized finance (DeFi) lending system. To optimize the user’s investment, it acts as a yield aggregating platform that moves the user’s assets across DeFi lending protocols, such as Compound or DyDx.

The Yearn project is now one of the most well-known and decentralized DeFi initiatives in the crypto industry. Yearn.Finance’s native cryptocurrency is the YFI. YFI is a governance token that claims to be independent, unlike Bitcoin.

What is YFI crypto?

That means people who use the platform can vote on the protocol’s direction that they think is best. YFI is now one of the major Ethereum-based tokens that prioritize automated yield farming solutions.

Another growing DeFi initiative, Yearn.Finance uses just code to offer its services, eliminating the need for a financial middleman like a bank or custody provider. For this, the Yearn Finanance Governance tokens have developed an automatic reward mechanism.

How Does Yearn Finance Work?

Here is how does yearn finance works. Earn and vaults are the two primary pillars of Yearn Finance’s offering. Yearn Finance’s initial offering is a loan aggregator called “Earn.” Yearn’s Earn page allows users to deposit reliable assets. Using Yearn Finance, users may continually compare the returns given by multiple lending protocols and deposit their cash into the protocol with the greatest yields.

As a passive-investment instrument, vaults may be used. The system automatically creates returns for users who just deposit their assets in the vaults. Vaults have made it possible for even novice investors to benefit from Yearn Finance, even if they have little or no experience in the stock market.

How does Yearn Finance work?

Yearn Finance also provides the following additional services in addition to its two primary products:

- Yearn Labs: Labs feature experimental Vaults with the most up-to-the-minute tactics. As a result, before investing, be certain that you are familiar with the vault’s strategy.

- Iron Bank: For both protocol and non-protocol customers, Iron Bank lends. If a user is using a protocol that is not whitelisted, their loans are not collateralized at all.

YFI Token

Let’s take a closer look at Yearn Finance’s governance token, the YFI token, and see what we can learn. Yearn Finance’s native token is called YFI. It adheres to the ERC-20 standard and serves as the protocol’s primary governance token.

Use Cases:

It’s like owning stock in a corporation when you have Yearn Finanance Governance tokens from the Yearn Finance system. Owners of Yearn Finanance Governance tokens may participate in the protocol’s governance and receive a portion of the money generated by Yearn Finance.

YFI token

According to the following factors, the YFI token’s current value may be explained:

- The total quantity of Yearn Finanance Governance tokens is limited to 36,666. As a result, the token is very rare, with the only variation being demand. This fosters greater YFI pricing.

- YFI may be staked, and holders have the option of participating in the platform.

- The platform’s goods are easy to use.

- The project’s online community is thriving.

- The project’s user base and technological capabilities are both expanding and improving all the time.

- It benefits from a decentralized structure (even taking into account its low emission).

- Beyond that, the YFI token offers you just voting power inside the platform, as we’ve indicated.

- In the long run, platforms such as Yearn.Finance may prosper if Ethereum migrates to Proof of Stake (PoS) and becomes capable of supporting an increased number of DeFi applications without experiencing congestion.

- Yearn.Finance engineers are currently working on numerous new products that they hope will increase user engagement.

- As of present, the yearly return on staking YFI is above 17%, which is greater than the industry average.

What Makes YFI Special?

While many were impressed with YFI’s price increase, the biggest impact of YFI was that it inaugurated a new approach to user development for the protocol. It has been argued that YFI’s launch is “the fairest launch since the birth of Bitcoin”, as anyone can participate in the coin’s creation for a price.

How does YFI differ from other cryptocurrencies?

Instead of using an Initial Coin Offering (ICO) model where users pay a certain price for each new coin, YFI users need to participate in the protocol. This mechanism allows to quickly build a community around the project, as every user has the same ability to influence Yearn.Finance via primary governance token.

Despite experiencing initial price volatility, Yearn.Finance still has one of the most active communities in the decentralized finance space and crypto in general.

>> Read also: What is ICOs? How can investors take profit from it?

What Is YFI Used For?

Certain DeFi operations may be improved using Yearn Finance’s various products.

- Earn – Fund your account with USDC or DAI, and Yearn will look for DeFi exchanges where you can make the most. Earn rebalances itself to provide you with the best possible return.

- APY – Use the Earn lending methods to search for a certain quantity of money, and then estimate how much interest they can anticipate earning yearly for that amount of money.

- Vaults – Different Vault techniques may be used to deposit assets such as USDC and DAI. In various ways, each vault strategy invests funds and shows a return on investment over time.

- Zap – A single click completes several transactions, saving both time and money. For example, on Yearn.Finance and Curve take three steps to swap USDC for yCRV.

Users earn Yearn Finanance Governance tokens by locking cryptos in YFI contracts operating on the Balancer and Curve DeFi trading platforms, utilizing the YFI platform.

YFI platform

A process known as “yield farming,” in which users lock up crypto assets in a DeFi protocol to generate additional bitcoin, is used by YFI. The more assets people lock in a platform, the more tokens they are granted by the protocols.

The YFI platform has already drawn approximately $800 million in assets in its first month of existence, making it one of the fastest-growing DeFi initiatives ever.

How Do You Earn YFI? A Step-By-Step Guide

1st: Earnings

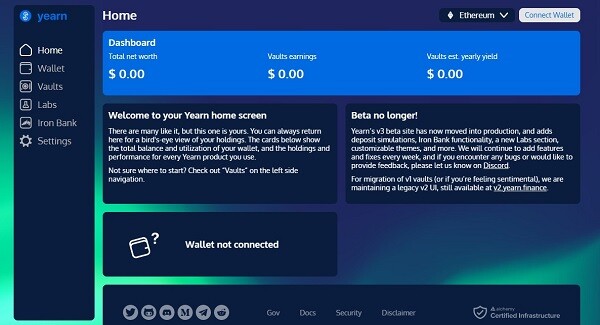

Thus, we’ll begin with the most essential aspect – purchasing ERC-20 tokens. It will be ETH in this situation. The next step is to go to Yearn.Finance, where you’ll find this panel. We have six distinct categories, each of which is accountable for a distinct role. Let us now discuss each of them individually:

- Dashboard: View your portfolio’s growth over time by investing in yearn’s goods.

- Vaults

- Earn

- Zap

- Coverage: Nexus Mutual offers insurance risk protection via Yearn.Finance.

- Stats: Take a brief look at the performance of yearn’s vaults.

After purchasing ERC-20 tokens, you must link your wallet to Yearn Finance. To do so, go to the Yearn Finance website and choose the vaults category. Then, link a suitable wallet to the app.

As a result, they are accessible through web 3.0 wallets. To begin, click the connect your wallet option and pick a suitable wallet from which to transmit money from Guarda to the Yearn Finance website.

After connecting your wallet, you may deposit any of these stablecoins. Yearn will maximize the value of your coins by transferring them across popular pools. Yearning deposit.

How do you earn YFI?

For the time being, we’re going to return to the “Earn” tab and seek for a token to deposit. We’ll use DAI as an example. Thus, for the time being, if we want to join the Yearn.Finance pool using DAI, we just click on the option. We may input any number amount for our investment in the menu, or we can pick a percentage of our total. Yearn Finance accepts DAI deposits.

After you make a deposit, Yearn will automatically distribute your funds to one of three pools. The program will then withdraw money from one protocol and make an automatic deposit to the other, as soon as the system detects a change in the interest rate. Yearn will automatically choose and assign your money to the most lucrative pool.

As with all other pools, you get tokens in proportion to your degree of ownership. To get them, you must click the claim button.

2nd: Vaults

Vaults provide ways for operating the most lucrative Yield farming systems and mitigating all types of hazards. It was created to encourage community cooperation and the development of innovative strategies for determining the most lucrative method to invest one’s money. Yearn vaults are essentially pools of funds with an associated strategy for maximizing return on investment.

Some FAQs About YFI

Where Am I Able To Purchase The YFI?

YFI is present at all of the world’s known main exchanges. Additionally, compliant exchanges enable you to trade YFI DeFi tokens directly for fiat assets like USD, EUR, or GBP, as well as other cryptocurrencies on a variety of platforms. Traders may also take advantage of YFI’s block rewards program.

How To Yearn.Finance Differ From Other Lending Platforms?

Using Yearn.Finance is quite similar to using other online lending services. Stablecoin deposits like DAI, USDT, TUSD, or SUSD may be made into the yToken protocol and users will get the corresponding quantity of yTokens (i.e., yDAI, yUSDC, yUSDT, yTUSD, and ysUSD). You may use yTokens just like any other Ethereum-based ERC-20 token. It is then possible to lend the stablecoin’s underlying currency.

The Yearn Finance platform automatically moves the tokens into a protocol with the greatest return to maximize user profit rather than lending the stablecoins to any specific protocol. All users must own Yearn Finanance Governance tokens to use the network, which has a tiny fee placed into it.

Is YFI A Good Investment?

Indeed is YFI a good investment? Yes in the cryptocurrency market. Yearn.Finance is a cryptocurrency trading platform built on the Ethereum blockchain that enables users to maximize their returns on crypto assets. With a well-thought-out plan and goal, YFI is poised to fundamentally alter the cryptocurrency landscape. It may overcome all obstacles to staying the most popular cryptocurrency on the crypto market.

Is YFI a good investment?

Closing Thoughts

The debut of YFI was a watershed moment in the industry’s understanding of how a cryptocurrency project may distribute its cryptocurrency. By rewarding early adopters, initiatives with a high probability of success may quickly build the community. Because in this manner, the community becomes the owner of the project and is encouraged to do all possible to ensure its success.

Yearn.Finance is an intriguing protocol that is enabling the creation of novel decentralized financial solutions. Yearn.Finance’s future is bright since the project has employed a slew of engineers and marketers, but only time will tell if the business can survive and prosper in the Ethereum-based DeFi world.

Now you understand what is YFI crypto and whether is YFI a good investment? Hopefully, this post will help you to have an overview of YFI.

Cryptocurrency Explained: What Is Meme Coin In Crypto?

22 March 2022