What Is BakerySwap? How Does It Different From Other DEX?

13 May 2022

Developed on top of the Binance Smart Chain, BakerySwap is a DeFi system that provides sweet incentives. It operates as a decentralized exchange (DEX), using the automated market maker (AMM) concept as its foundation.

Take use of this tutorial to stake and bake, make unique NFT combinations, get NFT pets, and much more besides!

That’s a lot of knowledge to take in all at once. In addition, the platform offers both a curated and an open marketplace for non-financial technologies. Bakery Token (BAKE) is the native token that users may earn by providing liquidity, which they can then use to purchase NFT.

This post from bePAY will take a look at BakerySwap, a decentralized exchange based on the Binance Smart Chain.

What Is BakerySwap?

BakerySwap Definition

What is BakerySwap? BakerySwap, which will launch in September 2020, is primarily an automated market maker (AMM) and decentralized exchange (DEX). An AMM is simply an algorithm that offers liquidity to markets, comparable to stock market makers. The fundamental responsibility of a market maker is to quote buy and sell prices for assets. This assures that there will always be a party willing to purchase or sell an asset anytime someone wants to do so.

In AMMs for cryptocurrencies, liquidity pools are offered collectively by exchange users and exchanged using smart contracts. This enables users to trade paired tokens with ease. In exchange for supplying liquidity to these pools, users often earn compensation from the AMM’s fees.

Uniswap, which debuted in 2018 and has been a pioneering platform in the DeFi movement, is perhaps the most notable example of this approach. Decentralized applications, or DApps, provide decentralized and untrustworthy versions of conventional financial services, among other capabilities.

Some of the most prominent DApps are now powered by Ethereum, but DeFi platforms are gradually being created on other blockchains as well. BakerySwap positions itself as a more advanced version of Uniswap. It operates on the Binance Smart Chain (BSC), which has gained a substantial amount of traction because of its very cheap transaction costs.

What is BakerySwap?

>> Do you know about Binance Chain and Binance Smart Chain are different?

BakerySwap’s Cryptocurrency

Users that contribute liquidity to a certain pool in BakerySwap are rewarded with liquidity pool tokens (BLPs). Then, they may stake these pool-specific tokens to “farm” or manufacture BakerySwap tokens (BAKE). BakerySwap imposes a 0.30% fee on every transaction. 0.25% of this goes to users providing liquidity, with the remaining going to BakerySwap token holders.

Additionally, users may stake BakerySwap tokens to acquire additional BAKE. They may contribute to any liquidity pool, the majority of which have a “bakery” or “food” motif. For example, in the “Toast” liquidity pool, a user may stake ETH-BNB BLP to farm BAKE tokens.

Certain pools provide more payouts. The BAKE-BNB pool, in which BAKE tokens are exchanged for BNB tokens and vice versa, compensates liquidity providers with 10 times more BAKE tokens than normal pools. The BUSD-BNB pool provides three times the norm.

Main Features Of BakerySwap And Its Mechanism

Here are the most prominent characteristics of the BakerySwap Exchange Platform:

BakerySwap Exchange

This feature enables BakerySwap users to exchange BEP 20, BNB tokens, and other cryptocurrencies. It enables users to exchange tokens occurring on the Binance Smart Chain (BSC).

Farming

BAKE, the native token of BakerySwap, may be farmed to obtain extra BAKE tokens. By BakerySwap staking BAKE tokens or by providing liquidity to one of the pools and subsequently staking their Liquidity Pool Tokens, users may earn BAKE (BLP).

When users contribute liquidity to the DOT-BNB pool, they will be rewarded with DOT-BNB BLP tokens, which they may subsequently use to stake BAKE.

It is also possible to purchase BAKE without BakerySwap staking on the open market.

Liquidity Pools

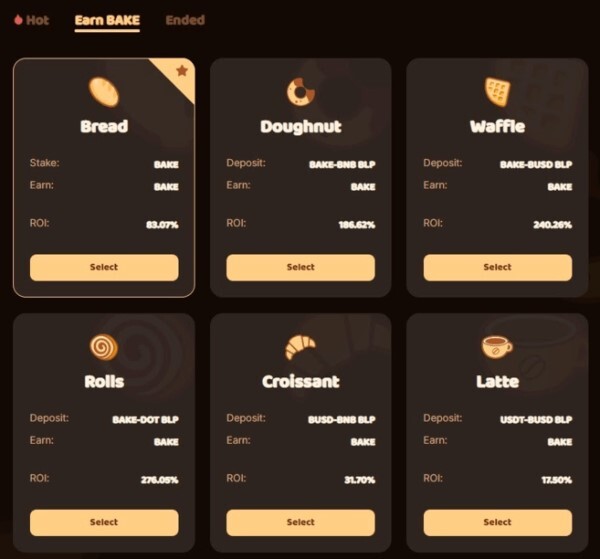

The liquidity pool of BakerySwap enables users to stake BAKE Tokens. The holders of the BAKE token get access to Bakery-Themed Menus.

If the user chooses Bread, he may wager BAKE to gain more BAKE. In addition, users may stake any BLP tokens that correlate to Baked products, such as waffles, rolls, doughnuts, croissants, etc., into pools of Baked goods.

Main features of BakerySwap

The return on investment (ROI) varies significantly across the choices. The BEP-20 liquidity pools provided by BakerySwap are as follows:

Earn BAKE by staking any of the tokens listed below in the liquidity pools.

- Doughnut: BLP token from BAKE-BNB

- Bread: BAKE

- Croissant: BAKE-DOT BLP

- Rolls: BUSD-BNB BLP

- Cake: BTC-BNB BLP

- Toast: ETH-BNB BLP

- Latte: USDT-BUSD BLP

- Waffle: BLP BAKE-BUSD

Integrating Wallets

To utilize the BakerySwap website and have access to all of its features, one must link a supported wallet. Utilizing MetaMask or WalletConnect may facilitate access to all functions. MetaMask is an Ethereum wallet because it easily supports Binance Smart Chain and its Dapps.

>> Let’s explore how to create the Metamask Wallet

Liquidity Addition

The procedure of adding liquidity to the BakerySwap platform is identical to that of Uniswap, PancakeSwap, and any other comparable platform.

In BakerySwap, one must add liquidity to the DEX and then provide both tokens to participate in a particular liquidity pool. When the user supplies the necessary liquidity, he will be allowed to begin BAKE token farming.

How Do You Make Money On BakerySwap?

After exploring BakerySwap features, a question arose: how do you make money on BakerySwap? BakerySwap offers three methods to make money. Users may earn fees and BakerySwap liquidity pool (BLP) tokens by providing liquidity to one of the BakerySwap pools. These tokens indicate a user’s contribution proportion to a pool. Users may also wager their BLP tokens for more BAKE or other tokens.

There are two distinct sorts of pools: those with BAKE prizes and those without. Users may earn additional BAKE tokens using multiplier pools. The pools with the largest multiplier are referred to as “Doughnut” and “Waffle” and symbolize BNB and BUSD.

How do you make money on BakerySwap?

Users may also bet their BAKE tokens to gain extra BAKE, in addition to liquidity providing and token farming. This is accomplished in the ‘Bread’ pool, with no minimum requirement or lock-up time.

How Do I Participate In BakerySwap IDO?

Each project will have different rules to join the whitelist, but most of them are pretty hard to participate in however, there are some basic steps you need to do for joining an IDO on BakerySwap.

Here are steps to solve how do I participate in BakerySwap IDO?

- Connect your wallet to BakerySwap

- Hold enough an amount of BAKE tokens

- Negavitate to Launchpad

- Participate in Launchpad on BakerySwap by committing BAKE

If you are lucky and fast enough you could buy an IDO on BakerySwap.

BakerySwap Vs PancakeSwap In Comparison

The primary distinction between PancakeSwap and BakerySwap is that PancakeSwap utilizes Cake tokens for trade while BakerySwap uses Bake tokens. BakerySwap is mostly used by crypto traders, while PancakeSwap is utilized by decentralized finance traders. BakerySwap provides online help, but PancakeSwap does not.

It functions in the manner of a decentralized exchange. It operates using the Binance Smart Chain. The decentralized functionality acts as an intermediary between the trader and the process. It allows you to receive awards and boost the price of liquidity. The platform is built on Ethereum, and the underlying mechanism is decentralized finance. The trading capital on this platform is quite modest.

BakerySwap vs PancakeSwap

BakerySwap is the first trading platform ever created on Binance’s smart chain. The first model to use an automated market maker. Additionally, it is a decentralized protocol. It has its token, named Bake, for conducting trades. This was constructed after the uni swap, which attempted to make commerce more efficient and affordable.

Let’s see the tables below to have a glance at BakerySwap Vs PancakeSwap:

| Traits | BakerySwap | PancakeSwap |

| Definition | The most extensive decentralized trading platform on the Binance Smart Chain. | Binance protocol is used by the first automated market chain. |

| Compatible with | Binance Smart Chain | Binance Smart Chain |

| Model | The First AMM model on Binance Smart Chain | Cheaper version of Uniswap |

| Token | BAKE | CAKE |

>> Here is the detailed post on PancakeSwap in case of further research

FAQs About BakerySwap

Is It Secure To Utilize BakerySwap?

BakerySwap’s whitepaper and platform’s audit report do not reveal any red flags or security flaws in the protocol. However, experts advise you to monitor your assets. Keep track of the amount you want to invest and benefit from. BakerySwap NFTs are a profitable investment, but you need to keep your eyes on the books.

Is Bake Crypto A Good Investment?

BakeryToken is a potentially lucrative investment. BakeryToken is a component of the BakerySwap ecosystem, which has the potential for exponential growth soon. But always do your research before making any decisions cause this market is always changing and has high volatility.

Is Bake crypto a good investment?

Who Is The Founder Of BakerySwap?

Anonymous engineers created BakerySwap, unlike existing DEX protocols (e.g. Uniswap). One percent of all BAKE tokens awarded (or “farmed”) to users go to the creators. With BAKE’s maximum supply of 2.77 million BAKE, this equates to around $17.6 million.

BakerySwap was created to operate independently and autonomously (DAO). This implies that the BakerySwap community has a voice in every decision. The BakerySwap founders have hired members of the community to fill different positions in the organization.

>> Exploring how Uniswap works

Bottom Up

BakerySwap is excellently positioned to profit from every evolution that the DeFi concept will experience in the comingștii. In addition, its development potential has been shown by the rapid increase of its native currency since its inception. BakerySwap’s tremendous development is significantly less than a year demonstrating that it is a formidable, rapidly-growing competitor.

You have several choices with BakerySwap, including swapping BEP-20 tokens, making passive income by using BakerySwap staking BAKE, and constructing unique NFT Combos.

BakerySwap is a comprehensive DeFi ecosystem on Binance’s Smart Chain. The BakerySwap team is certain that their service is quick, inexpensive, and, maybe most importantly, delicious!

What Is QuickSwap? The Main Functions Of QuickSwap

30 March 2022

Ultimate Information About What Is BurgerSwap?

26 August 2022