Cryptocurrency Explained: What Are Altcoins? Top Best Altcoins For 2022

13 May 2022

What are altcoins? Alternative cryptocurrencies to Bitcoin are known as altcoins (alternative coins). Because they’re an alternative to Bitcoin and standard fiat money, they’ve been dubbed “altcoins.”

First cryptocurrencies appeared in 2011 and there are currently thousands. To improve elements of Bitcoin, such as transaction speeds or energy efficiency, early altcoins were created to do so. The creators of more modern altcoins use them for several reasons.

Every crypto trader should be familiar with how altcoins function, given their prominence on the market. To understand more about what are altcoins, their uses, their advantages and disadvantages, and much more, keep reading this bePAY insight post!

What Are Altcoins Exactly?

Before delving into altcoin-related subjects, it’s necessary to define the word “altcoin.” This term refers to alternative cryptocurrencies to Bitcoin, such as Ethereum (ETH), Cardano (ADA), Polkadot (DOT), Litecoin (LTC), and others.

There are already over 10000 different varieties of the altcoin in circulation. An altcoin is an acronym for Alternative Coins, which refers to the money that will eventually replace Bitcoin. Indeed, whether or not it is utilized to replace Bitcoin, every currency created after Bitcoin is referred to as an altcoin; even the tokens of the Ethereum Blockchain or Polkadot are considered altcoins.

What are altcoins exactly?

How Many Types Of Altcoins?

Speculators searching for altcoins are spoilt for choice since there are so many to choose from. A great deal of the market activity is centered on the biggest names in trading as well as those with the finest technological capabilities, such as lightning-fast transaction speeds.

Coins Based On Mining

Computer networks perform difficult mathematical tasks, frequently using a large amount of energy, to produce mining-based currency. Although Bitcoin, the most popular cryptocurrency in the world, is built on a mining algorithm, many other cryptocurrencies are as well.

Stablecoins

One of the most common types of stablecoin has its value tied to the value of another asset, most often the U.S. dollar. To maintain parity with the underlying currency, stablecoins keep tabs on the price of the underlying asset. As a result, stablecoins frequently have a foundation in real money, such as dollars (but they may also be backed by bonds and other assets). Stablecoins like Tether and BUSD are examples of this kind of currency.

Security Tokens

A security token is a currency that represents a portion of another asset. For example, security tokens might be used to split and confirm the ownership of a piece of art. The ownership of a corporation might also be represented via the use of security tokens. As a result, the securitization of more conventional assets may be enabled by this kind of token.

Types of altcoins

Utility Tokens

These are just user tokens for future access to an organization’s goods and services. Utilities were not established as investments like security tokens. Utility tokens are digital assets designed for use inside a specific blockchain ecosystem.

>> Ensure you know the differences between tokens and coins

Memecoins

The public’s interest in Memecoins may have been piqued by the tweets of celebrities like Tesla CEO Elon Musk. Memecoins typically have a lottery-like quality to them, rising rapidly in value before plummeting rapidly in value. The two most popular meme currencies are Dogecoin and Shiba Inu.

Altcoins Advantages And Disadvantages

Some Altcoins Advantages

Joining Technology – Blockchain technology, the backbone of all cryptocurrencies, is still in its infancy. As breakthroughs and uses arise, early users of blockchain technology may enjoy learning more about the technology.

Cryptography-specific applications – Like conventional money, altcoins may be used for a variety of purposes. For example, token holders may be able to influence the cryptocurrency’s governance via their ownership of altcoins.

Some Altcoins Disadvantages

Volatility An increase in market uncertainty The value of cryptocurrencies, particularly alternative cryptocurrencies, is very volatile. In the early stages of cryptocurrency’s development, the genuine value of cryptocurrencies is still to be established by the market. A cryptocurrency’s value may fluctuate dramatically in a short amount of time, sometimes for no apparent cause.

Some advantages and disadvantages of altcoins

Some of Tesla’s products may be available for purchase using Dogecoin as early as Dec. 14, 2021, according to Tesla creator Elon Musk, who tweeted the news. 9 The price of the cryptocurrency rose by more than 20% on the same day. By the next day, prices had fallen once again.

Utilization may be difficult: However, most cryptocurrency exchanges and brokerages are user-friendly. Buying and keeping bitcoin often needs above-average technical competence.

Altcoin Vs Bitcoin In Comparison

A few factors distinguish other cryptocurrencies from Bitcoin:

Bitcoin is older. It was introduced in 2009, but the first altcoins were released in 2011, and new cryptocurrencies are introduced regularly. This also indicates that Bitcoin has a longer track record, which may appeal to long-term investors, in comparison to altcoins, which may be seen as a riskier investment. Nonetheless, since altcoins strive to be more evolved than Bitcoin, they may be preferred by some.

Except for stablecoins, altcoins have a greater risk and reward profile than cryptocurrency investments. Although Bitcoin is volatile, it is the market leader and has already increased in value significantly. Alternate cryptocurrencies have more growth potential, but also a greater risk of failure.

Altcoins are more innovative. They’ve improved on Bitcoin’s technology since they launched after it. Many alternative currencies outperform Bitcoin in terms of transaction speeds and fees.

Main differences between altcoin vs Bitcoin

Top Best Altcoins For 2022

There are several alternative cryptocurrencies on the market. Among the well-known ones, an example, are here for you to invest in altcoins

- Ethereum (ETH)

Many feel Ethereum has a larger price potential than Bitcoin, making it a popular cryptocurrency to acquire. Many sectors may be revolutionized by the platform’s dApp developers and smart contracts. The next Ethereum 2.0 update will include a Proof-of-Stake mechanism, enhancing performance and cutting costs.

- Litecoin (LTC)

Bitcoin’s silver to Bitcoin’s gold, Litecoin (LTC) was one of the first cryptocurrencies to follow in its footsteps, founded in 2011. Charlie Lee, an MIT alumnus and former Google developer designed it.

- Stellar (XRM)

The Stellar Development Foundation develops and maintains the Stellar blockchain. The network aims to improve cross-border payments. Stellar’s Consensus Protocol is distinct from both Proof of Work and Proof of Stake. To coordinate, transaction validation nodes use quorum slices.

- Ripple (XRP)

Ripple is a payment mechanism that uses blockchain to execute international payments. It has low transaction fees, performs transactions rapidly, and works with hundreds of financial institutions.

- Cardano (ADA)

ADA is a promising open-source blockchain network. Cardano, like Ethereum, allows developers to create dApps and smart contracts. But Cardano’s technology is created by academics using peer-reviewed research. Cardano is therefore a ‘safer’ solution for enterprises than other blockchain networks.

Cardano

- Polkadot (DOT)

Unifying several specialized chains into one universal network is claimed by Polkadot, a new blockchain solution. Polkadot, founded by the Web3 Foundation, aims to disrupt Internet monopolies and empower people.

- Solana ̣(SOL)

Solana is a blockchain network that supports decentralized applications like smart contracts. Solana is a cryptocurrency recognized for its lightning-fast transaction speeds and low transaction fees. Solana is a distributed ledger technology platform used by non-fungible token (NFT) and decentralized financial app developers.

- Polygon (MATIC)

To unblock the Level-1 Ethereum platform, Polygon is a layer-2 network that supports the Ethereum blockchain. MATIC is the network’s native currency and is used for staking and governance. It is an ERC-20 token that leverages proof-of-stake consensus on the Ethereum network.

- Bitcoin Cash (BCH)

Bitcoin Cash BCH is one of the early and most successful hard forks of the original Bitcoin. In the bitcoin realm, a split occurs when developers and miners argue. Due to the decentralized nature of digital currencies, large-scale modifications to the code underpinning the token or coin must be agreed upon by a majority of users.

- Dogecoin (DOGE)

One of the best cryptocurrencies to purchase in 2022 is DOGE. Dogecoin is one of the most fascinating currencies, particularly with Elon Musk constantly tweeting about it. It has one of the most significant futures in crypto, and a strong community behind it. It also has a cheaper transaction cost than other cryptocurrencies like BTC and ETH.

Dogecoin

What Should Be Cared To Invest In Altcoins 2022?

If there is anything riskier than investing in the top few cryptocurrencies, it is purchasing relatively unknown altcoins. Here are some factors to consider before investing in cryptocurrencies in the hopes of a lottery-like payout:

- Cryptocurrency is entirely sentiment-driven

Since cryptocurrencies, unlike stocks, are not backed by the assets or cash flow of an underlying corporation, they are solely influenced by emotion. Alternate cryptocurrencies depend on traders being or growing more optimistic for their prices to increase, given that sentiment may fluctuate between extremes of optimism and pessimism.

- Investors gravitate toward the most prevalent coins

As emotion drives the cryptocurrency market, investors gravitate toward the most popular currencies, concentrating on Bitcoin, Ethereum, and a relative number of others. While sometimes an altcoin gains prominence – Dogecoin and Shiba Inu are prime examples – hundreds of others remain obscure. Therefore, if an altcoin falls out of favor, it may never recover, resulting in the loss of the majority of all of your investment.

- Do you own funds you can afford to lose?

Given the tremendous dangers associated with cryptocurrencies as well as their volatility, it is essential to consider whether you are only risking money you can afford to lose. Cryptocurrency and other financial markets are not appropriate locations to invest rent money or other emergency cash.

Things to care about to invest in altcoins

- Focus on the technological capability of an altcoin

If you want to invest in an altcoin, you should investigate its technological capability. Some cryptocurrencies, such as Solana, have risen in value because, for instance, they provide excellent functionality at a cheap price. The characteristics of a cryptocurrency may help keep it in the forefront of the public’s imagination, making it an attractive trading vehicle that traders can crowd around.

When investing in highly speculative assets, such as cryptocurrencies, it is essential to be aware that your whole investment might be lost. As was the case at the beginning of 2022, investors must anticipate tremendous volatility.

FAQs About Altcoin

What Is the Meaning Of Altcoin Mining?

Altcoin mining is the process of generating new bitcoins by solving complex mathematical challenges. It is a competition between computers equipped with specialized chips to solve mathematical puzzles. The first miner (as these computers are known) to solve the challenge gets awarded with bitcoin. (Do you know how to mine Bitcoin at home?) The mining process also verifies and makes transactions on the cryptocurrency’s network reliable.

Dogecoin is an example of an altcoin available for mining let’s check this article to explore how to mine Dogecoin

What is the meaning of altcoin mining?

How Many Altcoins Exist?

The number of “alternative” currencies has grown to more than 10000 throughout the globe.

Is There A Wide Variety Of Altcoins Out There?

Several altcoins, like “Utility Tokens” or “Security Tokens,” are used for more than just trading the currency for anything of value.

Wrapping Up

Some cryptocurrency industry professionals believe that Bitcoin is the catalyst for the development of other cryptocurrencies and that up to 99% of all altcoins will become worthless in the future.

Over time, a solid cryptocurrency should be built for a very particular use case – to serve a clearly defined purpose and need inside a suitable regulatory framework – with the gradual development of mass acceptance to ensure that its value remains stable in the long run.

To summarize, altcoins are worth investigating for hands-on cryptocurrency investors who are ready to put in the necessary effort. You should keep in mind that taking on too much risk is not suggested, so even if you decide to purchase altcoins, they should only constitute a tiny portion of your overall investment portfolio.

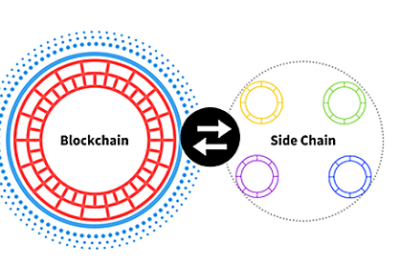

What Are Sidechains? In-depth Compared With Layer 2

10 June 2022

What Are Stablecoins And Why Do You Need Them?

10 March 2022