Cryptocurrency Explained: TVL Crypto Everything You Need To Know About

16 March 2022

TLV crypto also known as Total value locked in crypto – indicates the total amount of cryptocurrency was locked on Decentralized finance protocols of its users for interest purposes. It has become an important statistic for assessing the level of interest in a certain area of the cryptocurrency business. Any cryptocurrency put in any of the DeFi protocol functions, such as the following:

- Lending

- Liquidity pool

- Staking

Importantly, it does not take into account the predicted return on these deposits. It simply refers to the worth of the deposits as they are right now.

The TVL of a project isn’t only affected by fresh deposits or withdrawals. The value of all those assets in the cryptocurrency market fluctuates continuously. Depending on the DeFi protocol, some or even all of its deposits may be made in its native token currency. Whenever the value of its token increases, the protocol’s TVL increases as well.

When evaluating if the native token of a DeFi project is priced adequately, investors might look into TVL. The token’s market valuation may be high or low compared to the project’s TVL. If the link is severe, the token may seem to be over or undervalued. Via this post, bePAY’s going to explain everything about TVL.

What Is TVL?

Total value locked (TVL) is a common reference point if you’ve used DeFi tracking sites in the past. DeFi’s TVL crypto indicates the total amount of assets that are presently staked in a certain protocol: this value is not designed to represent the number of existing loans, but rather the total amount of underlying supply that is being guaranteed by a specific application.

DeFi and yielding market health may be gauged by looking at TVL Crypto. The total amount locked on a variety of services may be tracked.

When calculating and examining the market cap TVL ratio for decentralized financial services, three primary aspects are taken into account: the supply, the maximum supply, and the current price.

Is TVL high good?

For the current market cap, multiply the current supply by its market value, which is equal to the current price. It is necessary to divide the market cap by the TVL of the service to arrive at the TVL ratio.

Theoretically, the lower the asset’s value must be, the greater the TVL ratio; in practice, that isn’t always the case. DeFi assets may be appraised by looking at the TVL ratio, and this can be done to determine whether they are cheap or overpriced. In most circumstances, if it is less than one, it is undervalued.

How Is TVL Determined?

Given that TVL is used to determine the health of a protocol, the TVL crypto of an asset may be understood as the proportion of the asset’s capital that is used across the Defi ecosystem. In other words, you may determine the usefulness of an asset by examining its TVL. The TVL Ratio is often used to normalize the statistic across assets with varying market capitalizations. It is defined as follows:

TVL Ratio = Total market capitalization of the locked asset / Total value of the locked asset

The market capitalization of security is either its entire supply or its circulating supply. One disadvantage of this ratio is that it is not completely precise, since assets might be double-counted. For instance, suppose an investor stakes 10 ETH in a protocol and obtains 10 staked ETH (sETH), which they then use as collateral for lending in another protocol.

TVL in DeFi

The investor injected ten Ethereum into the system, although both protocols will count ten Ethereum for their respective TVL, increasing the system’s true worth. As a result, TVL crypto is not an entirely exact means to determine the number of assets in circulation.

How Beneficial Is TVL?

By defining the TVL ratio as the market capitalization of the locked asset divided by the value of the assets, a lower TVL ratio may be considered preferable, since it means that saturated staking pools will provide a lower ROI (return on investment) per token. As a result, the greater the TVL ratio, the lower the asset’s value should be.

However, not all DeFi tokens are made equal. A token’s value is not the only factor affecting it. For example, utility is critical, since tokens that do not create yield render the TVL measure almost meaningless. In conclusion, despite its limitations as a proxy for protocol health, TVL remains a helpful signal for investors.

As discussed above, TVL is often used to refer to the entire value of tokens locked in the DeFi protocol. The notion of TVL is, however, equally well-known among blockchain networks that use the Proof of Stake consensus algorithm.

TVL useful

>> Read also: What is Proof of stake – Ultimate information for newbies

The Difference Between Defi TVL And TVL Of Proof Of Stake Mechanism

The Proof of Stake blockchain network is summarized as follows: Validators or network Node operators are responsible for ensuring the network’s functionality by verifying transactions. On the Ethereum blockchain. For the Proof of Stake network, each Validator is often required to stake a certain amount of the Blockchain’s native tokens before committing to starting a node.

Staking a fixed quantity of native tokens is required for security and to prevent fraudulent transactions. Because if anything goes wrong, if fraud is uncovered, staked tokens held in smart contracts will be slashed or burned in accordance with system regulations.

Simultaneously, the quantity of staked tokens represents the number of shares or votes that validators have throughout the system when voting on network governance proposals. The incentive for maintaining network validation will be distributed to validators depending on their share commitments.

Curve is Dapp that has the highest TVL

Thus, the TVL value on a Proof of stake blockchain indicates the network’s security and secrecy. Or the degree of confidence users has in validators while staking and delegating their tokens.

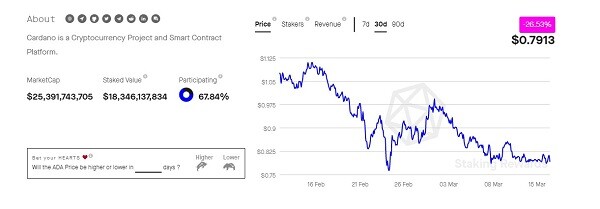

The TVL Cardano Staking Rate chart illustrates the relationship between the value of Cardano staked and the total supply. This value grows with time; now, the staking rate is 67.84% indicating that the majority of the Cardano supply is locked. Additionally, there is a link between the rise of the ETH value and the Staking Rate.

However, the value of TVL on other blockchains that are not yet fully decentralized, such as Binance Smart Chain, is essentially useless. Binance Smart Chain currently has just 21 validators. And we often make comparisons between the projected circulating supply and the overall supply.

TVL Cardano staking rate

Some FAQs About TVL Crypto

Which Crypto Has The Highest TVL?

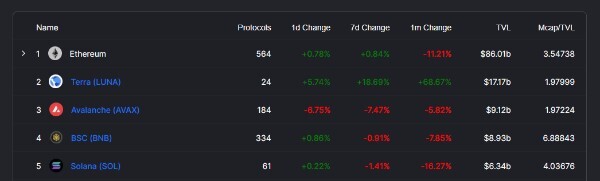

Source: https://defillama.com/chains

Let’s take a glance at the below table to see Which crypto has the highest TVL? Top 5 Smart contracts. In 2022, Ethereum accounted for a significant portion of the DeFi industry’s total value locked (TVL). Meanwhile, Terra is in second place, BSC is in the fourth position after Avalancheat the fifth place TVL Solana is at $6B. TVL Cardano in DeFi is not high evaluated when in the 28th position.

Which crypto has the highest TVL?

In the DeFi realm, TVL is the closest statistic to overall market size. The volatility character of this new market’s growth is also seen in the trading volume of NFT across all categories.

Distribution of DeFi Total Value Locked throughout all chains.

| Ethereum | DeFi TVL Ethereum Share: 52.81% |

| Terra | DeFi TVL Terra Share 10.90% |

| Avalanche | DeFi TVL Avalanche Share 5.79% |

| Binance Smart Chain | DeFi TVL BNB Share 5.67% |

| Solana | DeFi TVL Solana Share 4.02% |

Is TVL High Good?

The TVL is determined by the health of the protocol so Is TVL high good? The answer is yes, the higher number of DeFi Total Value Locked has the stronger the DeFi Protocol performance.

What Is TVL In Staking?

As explained above you can understand what is TVL in staking? In DeFi staking protocols, it refers to the total value of assets placed in the protocols by liquidity providers.

Conclusion

Protocols may operate on a single network or span over several networks, each of which has its own TVL crypto. Ethereum is the world’s biggest network by DeFi TVL, accounting for over half of the global volume.

The amount of Total Value Locked (TVL) reflects the level of trust that users have in the project, depending on which DeFi protocol is used. Having a high TVL is a sign of the potential strength of liquidity, but it also indicates how much supply and demand there is for the native token.

For each protocol, the parameters are approximate because the protocol core structure does not accurately reflect a project’s tokenomic status.