Ultimate Guide Leverage Trading Crypto Vs Margin Trading Crypto

22 June 2022

If you are wondering what the difference between leverage trading crypto vs. margin trading crypto is, bePAY designed this post for you. All the information you need will be clarified in the simplest way possible, including lively examples.

Leverage is sometimes known as margin trading, but they have some differences. Crypto leverage is the use of a smaller amount of cash to gain exposure to greater trading positions. It is applicable to numerous not only fol leverage trading crypto but also many financial markets, including FX, indices, equities, commodities, treasury bonds, and exchange-traded funds (ETFs).

Leverage trading crypto, for instance, is an attractive option for investors who do not wish to pay the full value of the crypto upfront or acquire ownership of the asset. This article by bePAY will elaborate on what leverage trading crypto is, how to leverage trade crypto and an in-depth comparison of margin trading vs leverage trading crypto.

What Is Leverage Trading Crypto?

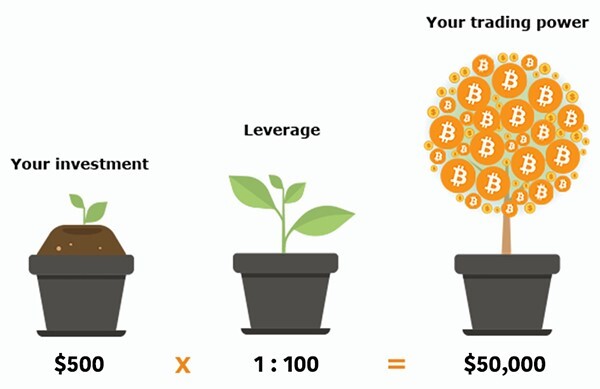

Leverage refers to trading cryptocurrencies or other financial assets with borrowed capital. It increases your purchasing or selling power, allowing you to trade with more capital than you currently possess. Depending on the cryptocurrency exchange you use, you may be able to borrow up to 100 times your account’s balance for crypto leverage trading.

Leverage is expressed as a ratio, such as 1:5 (5x), 1:20 (20x) or 1:100 (100x). It indicates the number of times your initial investment is compounded. Consider that you have $100 in your exchange account and wish to initiate a Bitcoin position worth $1,000 (BTC). With the leverage of 10x, $100 has the same purchasing power as $1,000.

Leverage can be used to trade various crypto derivatives. The most prevalent forms of leveraged trading are margin trading, leveraged tokens, and futures contracts.

What is leverage trading crypto?

What Are Guides For Manage Risks On Leverage Trading Crypto For Beginners?

Here are some tips to manage risk on leverage trading crypto for beginners.

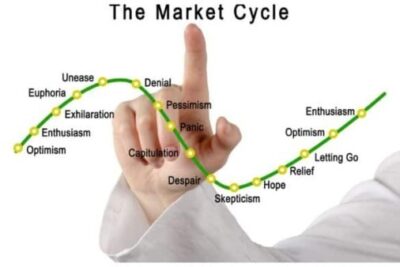

High leverage trading may require less initial money, but it raises the likelihood of liquidation. If your leverage is excessive, even a 1% price shift could result in enormous losses. The more your leverage, the lower your volatility tolerance. Using less leverage increases your trading error margin. Because of this, Binance and other cryptocurrency exchanges have restricted the maximum leverage available to new users.

In leveraged trading, risk management tactics such as stop-loss and take-profit orders help minimize losses. Stop-loss orders allow you to close your position automatically at a specified price, which is extremely useful when the market moves against you. Stop-loss orders can safeguard against substantial losses. Take-profit orders are the inverse; they close automatically when your profits exceed a predetermined threshold. This enables you to secure your earnings prior to a market reversal.

At this time, it should be evident that leveraged trading is a double-edged sword that can massively double both your profits and losses. It is risky, particularly in the unpredictable cryptocurrency market. We encourage you at Binance to trade properly by accepting responsibility for your activities.

We provide you with tools, including an anti-addiction warning and a cooling-off period, to help you maintain control over your transactions. Always take extreme caution, and don’t forget to DYOR to prepare your trading tactics and grasp how to handle leverage effectively.

Tips to manage risk on leverage trading crypto for beginners

>> Recommend: more info about perpetual swap contract

Bitcoin Leverage Trading Crypto Example

This leverage trading crypto example will show how to leverage trade crypto. Suppose a trader has a 20:1 leverage and initiates a position on Bitcoin leverage trading with a $1,000 account. The trader now has a position size with an asset worth of $20,000, giving them trading exposure to 20 times as many Bitcoin as if they had purchased the assets outright with their initial investment of $1,000.

To sustain this position in Bitcoin leverage trading, the account value must remain above the maintenance margin requirement of 50%, or $500 in this case.

Imagine that you opened a long position with your initial fund (collateral) of $1000, if the Bitcoin price goes up 20%, you will gain a net profit of $2000 for the long position of an asset of $20,000; it really good for $200 if you used spot trading.

However, if the Bitcoin price drops by 20%, the amount of loss you must consider is -$2000 which would overwhelm your deposit funds by $1000. You could immediately be liquidated by the exchanges. To prevent getting liquidated, you must enhance your collateral by adding more cash to your wallet. In the majority of instances, the exchange will issue you a margin call prior to the liquidation (e.g., an email requesting further funding). The same is true for a short position in the reverse.

An example of Bitcoin leverage trading crypto

Main Differences Between Leverage Trading Crypto Vs Margin Trading Crypto

Margin

Margin trading is the practice of using an individual’s own assets as collateral for a loan from a broker. The loan is used for business objectives. Margin is the difference between the entire value of securities in an individual’s margin account and the loan amount requested from a broker in order to execute a deal.

Buying on margin requires creating a margin account with a specified initial investment. This initial investment serves as collateral and is known as the minimum margin. Initial margins and maintenance margins relate to the amount of money you put in a trade and the amount that must be held in your margin account as collateral while trading.

In a margin call, the broker will require you to either deposit additional money, pay back the loan using the remaining funds, or liquidate your investment if the account balance falls below a certain threshold.

Difference between leverage trading and margin trading

>> Learn more: What is margin trading crypto?

Leverage

Leverage is the technique of employing borrowed funds in order to increase the possible profits of an endeavor. Investors and corporations utilize this strategy for distinct purposes.

While individuals utilize leverage to maximize their returns through options, futures, and margin accounts, corporations use it to finance assets through debt financing so that they can invest in their operations, increase equity valuations, and avoid issuing new stock.

It is typically stated as a ratio between the amount of money invested and the amount of money permitted to be traded after incurring debt.

If you are permitted to trade $100,000 for every $1,000 you invest, the leverage in this instance would be 1:100. This also increases the potential losses if the deal fails, as the borrower will lose a much bigger proportion of the borrowed funds than their original investment.

Margin and leverage

The Main Difference Between Leverage Trading

Regarding their differing definitions in contexts such as equities or FX trading, the primary distinction between margin trading and leverage is that leverage is typically used to signify the degree of purchasing power provided by incurring debt.

While both margin and leverage include borrowing, margin trading requires the use of collateral in your margin account to borrow money from a broker, which must be repaid-with interest. Leverage, on the other hand, does not always require collateral.

In this instance, the borrowed funds serve as leverage, enabling you to execute greater deals. Both concepts are interrelated, but it is essential to highlight when comparing margin vs. leverage that margin accounts are not the only way to generate leverage, as this can also be accomplished through the use of tactics that do not require margin accounts.

Lastly, when distinguishing between leverage and margin, it is quite evident that cautious leverage tactics over the long term tend to mitigate risks more effectively, whilst short-term investments on margin tend to produce favorable returns in markets with significant liquidity.

| Criteria | Margin Trading | Leverage Trading |

| Definition | Also known as a kind of leverage trading. That uses an individual’s assets as collateral for a loan from a broker. | A larger definition in the techniques of borrowing funds to maximize the profit not only for a margin account can create leverage. |

| Collateral | Yes | Sometimes no (if you can borrow funds without collateral) |

| Beneficial for | Short-term | Long-term |

Pros And Cons Of Crypto Leverage Trading

Pros

- Maximize profits

With leverage trading, you can enter the market with a larger stake, resulting in more profits on successful trades compared to using your own cash alone. Assuming the success of your margin trade, high leverage ratios can help you optimize your returns.

- Facilitation of trading

Leverage trading allows you to swiftly initiate trades without having to deposit more funds to attain the same position size. This also permits you to save time and respond swiftly while timing the market.

- Portfolio diversification tool

With borrowed funds from margin trading, traders are able to open several positions with comparatively smaller amounts of cash, without sacrificing position size. This enables traders to diversify and hedge, minimizing the danger of huge losses by preventing dealers from placing all their eggs in one proverbial basket.

Cons

High-Risk Margin Trading In Cryptocurrencies

Significant rewards are typically accompanied by high risks, and margin trading is no exception. If the tide is not in your favor, the possibility of loss is also multiplied. As your portfolio’s market exposure is increased through leveraged trading, losses can be devastating. In contrast to conventional trading, margin trading can result in losses that exceed the initial investment; even a slight decline in the market price can produce huge losses.

Benefits and withdraws of crypto leverage trading

While margin trading can be a feasible choice for traders seeking to accelerate their trading performance, it is imperative to be aware of the hazards and learn how to use leverage trading to your advantage prior to investing funds. This involves understanding when and where to trade on margin. Before going on a voyage of margin trading, we have provided you with some essential background information.

FAQs About Leverage Trading Crypto

What Does It Mean To Leverage?

Leverage is the method of financing a project with borrowed funds in order to increase its future profits. Several businesses and individuals use leverage to attain their objectives.

Why Do Numerous Investors And Corporations Engage In Leveraged Trading?

Investors use leverage trades to increase their profits through options, margin, or futures accounts, whilst corporations use leverage trades to finance assets with the aid of debt financing to invest in a number of significant operations and to increase share valuations.

Why do many investors and businesses use leverage trading?

What Is The Definition Of Leverage Trade?

Generally, leverage trading refers to the ratio between the amount of money invested and the amount of money permitted to trade after incurring debt.

Closing Thoughts

Initially, leveraged trading may appear quite intimidating. However, if you acquire the necessary abilities, you will be able to trade in high-yield markets. Before engaging in cryptocurrency trading, you must take the time to comprehend its unique characteristics and related risks.

After conducting an extensive study, you can understand the fundamentals of leverage trading from a variety of sources, but you must deposit your hard-earned money on the appropriate platform. Investing in leveraged trading with lower sums would provide you with sufficient learning time and lower the chance of catastrophic losses.

Detailed Guide Of How To Add Arbitrum To Metamask

15 July 2022

Ultimate Guide On How To Use Polygon Bridge

30 June 2022

Step By Step Guide Of How To Add Polygon To MetaMask

16 June 2022

Step By Step Guide Of How To Add Fantom To MetaMask

15 July 2022