What Is Impermanent Loss And How Does It Work?

29 March 2022

If you’ve been doing any research on yield farming and liquidity pools, you’ve probably come across the phrase impermanent loss in yield farming. What is an impermanent loss in yield farming, and how does it impact your cryptocurrency investment?

While high-interest rates may seem to be an attractive prospect, liquidity pools have an often-unknown adverse risk called impermanent loss.

Impermanent loss in a liquidity pool occurs when the price of a token rises or drops after it is deposited in a liquidity pool. This change has been deemed a loss if the monetary value of your token is less than it was at the time of deposit.

You may compute the precise percentage lost for every price fluctuation using an impermanent loss calculator. bePAY will define what is impermanent loss in detail in this tutorial, present an easy-to-follow example, including an impermanent loss chart and discuss the actions investors may take to limit the risk.

What Is Impermanent Loss?

Impermanent loss is a term that refers to the temporary loss of cash that liquidity providers can face as a result of volatility in a trading pair. Additionally, this liquidity pool impermanent loss how much more money someone would have if they had just retained their assets rather than been given liquidity.

Liquidity pools often include two assets – one of which may be a stablecoin like USDT, while the other may be a more volatile cryptocurrency like ETH.

Consider the case when a provider is required to maintain an equal amount of liquidity in both USDT and ETH – but the price of ETH unexpectedly increases.

This presents an appealing arbitrage opportunity since the price of ETH in the liquidity pool no longer accurately reflects what is happening in the real world. To maintain a balanced ratio of USDT to ETH, other traders will purchase ETH at a reduced cost until equilibrium is restored.

What is impermanent loss?

Following arbitrage, a liquidity provider may wind up with a higher proportion of USDT and a little lower proportion of ETH. Liquidity pool impermanent loss compares the current value of their assets to what they would be worth in an exchange if they were left alone. The loss becomes permanent only when a supplier chooses to permanently remove their liquidity.

How Does Impermanent Loss Work?

Consider the case in which you offer liquidity for the USDT and ETH currency pairings. Assume you first offer $1,000 in cryptocurrency. It includes 500 USDT and one 500 USD Ethereum. The price of ETH then fell to $250. At this moment, the value of the cryptocurrency in your liquidity pool has decreased from 1000 to 707.11 USD. In comparison to the absence of liquidity:

Without liquidity, your assets are worth 750 USD (Due to ETH price drop). If you supply liquidity, you have 707.11 USD in your assets. The impermanent loss is the $42.89 difference. Divided by the initial value of the assets, the loss ratio is as follows: $42.89 / $750 = 5.7%

How does impermanent loss work?

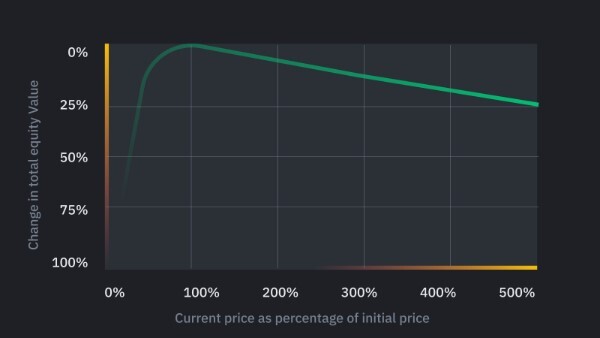

Bear in mind that losses might occur either way. When one cryptocurrency’s price changes in relation to another, you all incur an impermanent loss. If you find the impermanent loss formula too hard, use the worksheet below to determine when impermanent loss:

Impermanent loss calculator

- 1.25x price change = 0.6% loss.

- 1.50x price change = 2.0% loss.

- 1.75x price change = 3.8% loss.

- 2x price change = 5.7% loss.

- 3x price change = 13.4% loss.

- 4x price change = 20.0% loss.

- 5x price change = 25.5% loss.

>> Read also: What is AMM crypto? Its vital roles in cryptocurrency world

How To Calculate Impermanent Loss?

If you have a sense of the future price movement of your asset in the liquidity pool, you may estimate the amount of temporary loss to anticipate. You may use an impermanent loss calculator to estimate the amount of impermanent loss in advance.

Impermanent loss calculator

The calculator works by specifying the starting and future prices of your two assets. This calculator employs the constant product formula, which ensures that the two assets remain in a 50/50 ratio. Utilize the two-step procedure as follows:

- Step 1: Fill in the beginning prices, which correspond to the values of both assets at the moment of deposit.

- Step 2: Complete the future pricing tables. These might be the actual or anticipated prices of both assets at the time of the withdrawal.

In the example below, we construct an asset based on the ratio of asset values in liquidity pools that is a stablecoin, ensuring that its value stays constant at US$1. The calculation suggests that the impermanent loss is 1.03% at such price fluctuation.

Impermanent loss chart

Additionally, the calculator illustrates how this price change may be calculated using real figures. For instance, the calculator displays the price of each asset if you owned just $500 of each and the price of withdrawing both assets from the liquidity pool.

If you want to invest your tokens in a liquidity pool, it is a good idea to utilize an impermanent loss calculator to estimate the level of risk you are taking. We will examine how this calculator works and how the formula was generated in the next part.

Calculating impermanent loss

Impermanent loss formula

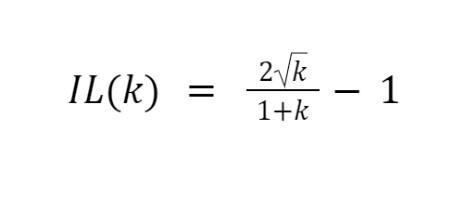

After seeing what an impermanent loss calculator is capable of, the next thing you need to understand is how it works. You may compute impermanent loss using the following formula:

The variable k denotes the change ratio between the original and future prices in this calculation. For instance, if the value of an asset grows by 10%, k becomes 1.1.

Once you get the impermanent loss value for the given change k, you may multiply it by the beginning value to obtain the real dollar amount.

For instance, if my impermanent loss is 0.6% and my asset’s original price is $1000, my real liquidity pool impermanent loss is $1000 * 0.6% = $6.

How Do I Stop Impermanent Loss?

Method 1: Recover The Original Ratio Between The Two Cryptocurrencies

Due to the fact that these are merely temporary losses, they will vanish once the exchange rate between the two currencies is returned to normal.

Consider the scenario presented at the start of the essay. If the price of ETH recovers to its original 500 USD, the impermanent loss rate will reset to 0%. This method, however, is not optimum since, owing to the extreme volatility of cryptocurrencies, the exchange rate between them may never recover to its original value. At this time, the temporary loss is irreversible.

Method 2: When The Market Is Ready To Get Turbulent, Cease Supplying Liquidity

This strategy is quite simple to comprehend. If you do not give liquidity, you will not experience impermanent loss. This measure should be taken when the coin is poised to undergo a period of rapid growth. At this time, the benefit from the liquidity supply will be insufficient to compensate for the temporary loss, and it is prudent to discontinue providing liquidity.

Method 3: Select Liquidity Pools That Provide A Higher Profit Than The Impermanent Loss

You may be surprised to learn that the profitability of providing liquidity is contingent upon trade volume. As a result, the larger the liquidity pool combined with a bigger trade volume, the higher the profit. You may offset losses by using AMM’s most successful liquidity pools.

How do I stop impermanent loss?

Method 4: Select Low-Volatility Liquidity Pools

Due to the fact that temporary losses occur as a result of price swings, crypto pairings with a high degree of stability will have very low temporary losses. You may farm stablecoin pairings such as USDT/BUSD for liquidity; they cannot cause you losses, but their earnings are often minimal.

>> Read also: What is ICOs? How can investors take profit from it?

FAQs About Impermanent Loss

Why Is It Referred To As An Permanent Loss?

Because this loss happens only when the exchange rate between the two assets fluctuates in relation to the date of deposit. They will revert to their original value if the exchange rate between the two assets reverts to zero. Temporary losses, on the other hand, might become permanent if their rates never recover or if you remove cash from the liquidity pool after the rate has changed.

Why Does Permanent Loss Happen?

The essential issue affecting impermanent loss is the manner in which automated market makers operate. As mentioned before, AMMs allow investors to trade digital financial assets such as cryptocurrencies without the token holder’s authorization. AMMs enable this sort of trading by using liquidity pools rather than the more stable and conventional method of asset trading, which is based on the “buyer-and-seller” stock exchange paradigm.

AMMs enable any investor to contribute to a liquidity pool and function as a de facto market maker by matching transactions and charging fees. In such circumstances, the impermanent risk is the negative risk.

With volatile assets such as cryptocurrencies, the value of such assets may depreciate over time. The greater the magnitude of the price movement, the greater the likelihood that the liquidity provider may suffer an impermanent loss.

Impermanent loss FAQs

When Does An Impermanent Loss Become Permanent?

Although the impermanent loss is often irreversible, it just reduces the advantages that a comparable strategy would have generated in a positive situation. Bancor V2 and Mooniswap have included measures to reduce this kind of loss. Uniswap, the consistent product AMM, also discovered an incredible solution around it.

What Are Liquidity Pools?

Liquidity pools are a collection of tokens (or token pairs) that serve as a reserve for certain tokens. These reserves assist trading on AMMs (by providing “liquidity” to these platforms).

Typically, at least one of the liquidity pools’ tokens must be ETH. However, we’ve been seeing significant adjustments in it recently. For example, Uniswap V2 has integrated an ERC20/ERC20 liquidity pool onto its platform. This eliminates the need for ETH to be one of the pool’s coins.

What Is The Definition Of A Liquidity Provider (LP)?

Banks, financial institutions, and primary trading firms (PTFs) function as liquidity providers in conventional markets. Liquidity providers in the DeFi business operate in a similar manner to facilitate trading. They allow traders to utilize digital exchanges by providing liquidity to the market.

Final Thoughts

Any impermanent loss formula excluded the trading commissions you would have received along the road, regardless of impending losses. The majority would claim that profits would ultimately compensate for the price adjustments.

While this is true, the issue is that we cannot utilize our revenue to offset our losses. This is why one should bet their tokens only after doing extensive due diligence, including the risk assessments described before. Begin with a tiny amount and just what you can afford to lose, since the larger your deposit, the greater the potential loss when values fluctuate.

Looking beyond impermanent loss is one of the most effective strategies to overcome it. The cryptocurrency you’ve pledged already have a purpose: they generate trading fees for you. Allow them to perform their work, since the more variables you introduce, the less you may get.

What Is SegWit? And What Does It Solve For Bitcoin

25 March 2022

What Is ICOs? How Can Investors Take Profit From It?

22 March 2022

Private Keys – The Crucial Elements To Save Your Fund

27 April 2022