How Does Crypto Lending Work In Comparison Of Crypto Lending Vs Staking

26 August 2022

Are you looking to maximize the returns on your cryptocurrency investments? Most folks are. In the end, isn’t that the point of investing in cryptocurrencies? And the good news is that you have an abundance of possibilities when it comes to earning money using cryptocurrencies.

Lending out your tokens or coins in exchange for interest payments might be a profitable method to generate returns on them. This peer-to-peer crypto lending, which is conducted on several exchanges, may be an incentive for crypto users who do not require immediate access to their tokens. They may be waiting for a token’s value to improve, or they may be holding it for another purpose, in which case it makes sense to lend the tokens out in the meantime.

In today’s post, bePAY will clarify what is crypto lending and how it works as well as introduce some crypto lending platforms for you to consider. Now let’s jump into the explanation of what crypto lending is.

Explanation – What Is Crypto Lending?

Crypto lending is basically banking for the cryptocurrency community. Similar to how conventional bank customers get interested in their savings in dollars or pounds, crypto users who deposit their Bitcoin or ether with crypto lenders similarly earn money, often in cryptocurrency.

As a result of historically low-interest rates, conventional banks give meager returns on savings, but crypto lenders offer yields as high as 20%, depending on the tokens being deposited.

Crypto lenders earn money by lending digital tokens to investors or crypto enterprises for a charge, often between 5% and 10%, who may use the tokens for speculation, hedging, or as working cash. The disparity between the interest rates paid on deposits and those charged on loans generates a profit for the lenders.

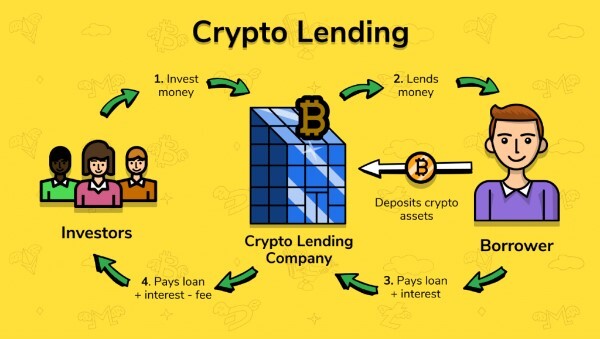

Explanation of what is crypto lending

How Does Crypto Lending Work?

A Bitcoin loan functions similarly to any other loan. You borrow cash for a certain duration and at a predetermined interest rate, then repay the principal and interest over the loan’s term.

Peer-to-peer lending is the underlying premise of several platforms, which operate in a variety of ways. Borrowers utilize Bitcoin as collateral to get loans, while lenders deposit cryptocurrency to finance the loans. Let’s examine the primary characteristics of crypto loans.

Rates

Loan interest rates vary based on the borrower’s circumstances; however, Bitcoin lending businesses may provide cheaper rates than typical personal loans.

How cryptocurrency lending businesses evaluate your capacity to repay a loan differs from that of conventional lenders. Before accepting a loan, conventional lenders evaluate the borrower’s credit score, credit history, income, and existing obligations.

In contrast, crypto lenders adjust their interest rates according to the amount of collateral you provide and the loan duration you choose. In general, your interest rate will be lower if you have more collateral and the loan term is shorter. Some crypto lending services provide interest rate savings if you stake or utilize the native coin of the site.

How do crypto lending operational?

Loan Amounts And Loan-To-Value

Numerous cryptocurrency lending firms merely stipulate a minimum loan amount. This may be as little as $50 or $100 with certain lenders and as much as $10,000 or more with others.

However, your borrowing capacity is restricted by the maximum loan-to-value (LTV) ratio of your lender. The LTV is the ratio of the loan amount to the value of the collateral provided as security for the loan. The LTV ratio may be calculated by dividing the loan amount by the value of the crypto assets and then multiplying the result by 100.

For example, suppose you wish to borrow $1,000 and provide Bitcoin worth $2,500 as collateral. Therefore, the LTV equals 1,000/2,500 multiplied by 100, yielding an LTV of 40%.

The maximum LTV for the majority of bitcoin loan sites is 50%, but there are outliers. If you want to borrow $5,000, you will normally be required to provide collateral worth at least $10,000. If you are ready to provide more collateral in exchange for a lower LTV, you may frequently get a better interest rate.

Crypto lending main characteristics

Collateral Types

When evaluating Bitcoin loan services, the kind of crypto that may be used as collateral is the next thing to examine. Some lenders will solely take Bitcoin, while others will also accept Ethereum and Litecoin.

Several big sites accept several cryptocurrencies as collateral. Celsius, for example, allows over 45 currencies and tokens. Note, however, that you can often only repay your loan using a single crypto asset kind.

Eligibility Requirements

The application procedure for a crypto loan differs somewhat from that of regular lenders. Instead of evaluating your credit score and income, crypto lenders are primarily concerned with ensuring that you can offer sufficient collateral to achieve their maximum LTV.

When you apply for a loan, you may also be required to produce a picture ID and proof of residence, depending on the lending platform you pick.

CeFi Vs DeFi Loans

You must also examine if you will get a centralized or decentralized loan. Centralized lending platforms evaluate applicants and provide loans on their own, sharing profits with lenders. This offers a comparable experience to how banks make loans and pay savings account customers interest.

Decentralized finance (DeFi) lending platforms serve as markets where borrowers and lenders may peruse one another’s offerings. DeFi protocols and smart contracts manage the process of borrowing and repayment.

What Makes You Interested In Crypto Lending?

If you’re more interested in utilizing a crypto lending platform to make a consistent return on your investment, we explain all you need to know below before moving further.

Some facts that need to be considered in crypto lending

Lock-Up Terms

Some cryptocurrency loan services have minimum lock-up periods. Similar to standard Certificate of Deposit (CD) accounts, you will not be able to access your money until the term expires. In contrast, services like Aqru and BlockFi do not impose any lock-up conditions when you lend out your crypto assets. Consequently, this implies that you may withdraw your tokens from the site at any moment.

Then there are services like Crypto.com, which offers a flexible account with a 1-month and 3-month lockup period. Obviously, the longer you lock up your tokens, the greater your APY will be.

Supported Tokens

When learning about crypto interest accounts, the precise digital asset on which you intend to earn a return is the first consideration. This may be a straightforward option, since you may want to earn interest on tokens you already own in a cryptocurrency wallet.

For example, if you own USDC Maple and move it to Aqru, you may earn up to 7% every year. Some sites, like Crypto.com and YouHodler, are well-known for their extensive token support.

Crypto lending considered aspects

APYs

Annual percentage yield (APY) refers to the amount of interest you will get when you deposit cash into a cryptocurrency lending platform. It goes without saying that the more the APY, the greater your earnings will be.

Now, the APY available to you will depend on a number of things. For instance, the APY offered for lending an established, large-cap cryptocurrency such as Bitcoin or Ethereum would likely be lower.

When lending out a small-cap token, though, you should have access to greater interest rates. In addition, we discovered that the majority of crypto lending services provide a higher APY for stablecoins such as Tether and USDC.

Interest Rates

This is so for two reasons. First, stablecoins are tied to a fiat currency, such as the US dollar, so their volatility is minimal. Second, stablecoins are readily convertible into cash, which can subsequently be used to finance loans denominated in fiat currency.

Whether or not you are willing to get into a crypto staking arrangement with your preferred loan website might also influence the APY offered. For instance, both Crypto.com and Nexo provide improved APYs when their native coins are staked.

Interest Disbursement

When you get your interest payments depends depend on the cryptocurrency loan platform you register with. AQRU, for instance, distributes interest payments on a daily basis, but Crypto.com and YouHodler do it on a weekly basis.

This is a crucial consideration while looking for the best cryptocurrency loan website since more regular payouts will enable you to profit from compound interest. This implies that as soon as you get an interest payment, the money will be reinvested into a crypto savings account. Thus, you will immediately begin to earn interest on the extra cash.

Crypto Lending Vs Staking – Which Alternative Is Safer?

Investing and lending are both hazardous. However, it may be “safer” to save your valuables in a cryptocurrency deposit account. For instance, instead of staking in a somewhat volatile coin like SNX to earn 18% – a currency that might lose value and wipe

Crypto lending vs staking – which one is better?

With stablecoin, the price does not change, therefore you are often assured to get the promised return on your investment, regardless of the crypto market’s behavior. Alternatively, you might purchase a more established cryptocurrency, such as Bitcoin, and store it in a yield-bearing account that pays 4% or 5%, in the hope that its value would rise in the future.

But regardless of where your funds are deposited:

- There is no FDIC insurance to safeguard your cryptocurrency against unforeseen losses.

- You are entrusting a platform with complete custody of your assets and relying on it to keep them secure.

- This makes crypto lending and staking less secure than placing your money in a conventional bank, therefore you should only deposit or stake an amount that you are prepared to lose.

>> Learn more ideas on what is crypto staking. Here is a prepared post for you

Positives And Negatives Of Crypto Lending

Positives Side Of Crypto Lending

Both CeFi and DeFi loans have advantages and disadvantages, and none is objectively “better” than the other. Therefore, which one you should utilize is situational and reliant on your own risk tolerance and technical understanding. But regardless of whatever you choose, you should be aware of the overall pros and cons of crypto loans.

They offer low-interest rates compared to the majority of credit cards and certain personal loans. However, mortgage and auto loan interest rates are often lower.

You may generate passive income fast and inexpensively from assets you could not otherwise use. The currency in which you get your loan may be selected from a variety of possibilities, not only the local currency. No credit checks are required to get a loan, and decentralized platforms do not need an account or other KYC checks.

Loaned cash often comes within a few hours, and the majority of DeFi loans arrive within minutes. This is advantageous for both borrowers and lenders, since the former may have access to cash more quickly while the latter can earn interest on their idle assets sooner than they otherwise might.

Some advantages and disadvantages of crypto lending

There is no prejudice in decision-making. The decision to provide a loan is exclusively based on financial considerations. Nobody is refused a loan on the basis of race, gender, religion, or any other protected trait.

All crypto loans are permanently recorded on a blockchain, which reduces regulatory compliance obligations and promotes financial sector transparency.

While CeFi crypto loans need an account and KYC verification, DeFi crypto loans are permissionless; you are not required to provide any identification or banking verification.

Negatives Side Of Crypto Lending

A few crypto lending platforms may not let you access your cash as quickly as you would want. This illiquidity may have a detrimental impact on your financial security, particularly if too much of your wealth is locked up in loans and cannot be withdrawn immediately.

Cryptocurrency lending is mostly unregulated. Therefore, when a platform is shown to be a sophisticated Ponzi scam, your funds are not protected by any financial authority.

When the value of your collateral decreases, your lender will issue a margin call. Then, you must deposit more collateral within a specific period. The lender will liquidate your collateral if you fail to repay. If this occurs, you will experience a loss, but you will retain the borrowed funds.

Negatives side of crypto lending

The high collateral requirements for crypto lending significantly raise the likelihood of loan default. Both CeFi and DeFi financing businesses are solely online, making them attractive hacker targets. Therefore, your money is less safe than it would be in a conventional bank.

Some Blockchain Crypto Lending Platforms You Could Take Into Consideration

Aave

Aave is a market leader in the DeFi lending industry, including marketplaces on Ethereum, Polygon, Optimism, Fantom, Arbitrum, and Avalanche. In addition to conventional cryptocurrency loans, Aave provides uncollateralized flash loans, short-term fixed-rate loans, and an AMM market. It has a high LTV and cheap borrowing rates.

Lenders to the protocol deposit money and get aTokens, which earn interest, in return. The interest rates on stablecoins range from 0.5% to 1.3%.

Aave platform

Compound

Compound was one of the first DeFi lending platforms and has remained a generally secure investment choice. It relies only on ETH, so investors may only lend ten kinds of tokens, a very small quantity compared to many competing services. Additionally, Compound has a somewhat high learning curve due to its unique interest mechanisms. However, it is an excellent choice for people who want to earn compound interest.

The interest rates for stablecoins range from 0.6% to 1.3%.

Compound platform

Mango

Mango V3 is a project for low-latency lending, borrowing, exchanging, and trading on the Solana chain. It distinguishes itself for three reasons: first, it permits leveraged trading, meaning you can utilize borrowed money for up to 10x leveraged transactions on the Serum DEX ecosystem or 20X leveraged trades on Mango’s permanent futures books. Second, it facilitates cross-trade. Mango V3 has a $70 million deposit insurance fund via MangoDAO.

In 2021, Mango’s interest and borrowing rates were extraordinary. Nevertheless, Mango’s leveraged trading should be undertaken with extreme caution; margin trading is dangerous, especially in the unpredictable cryptocurrency market. It is possible to wind up owing far more than you initially invested. Currently, stablecoins provide depositors with returns of between 1% and 3%.

Mango platform

>> Exploring more information about crypto lending and borrowing

Nexo

Nexo is among the most well-known CeFi loan platforms. Because it gives $375 million in insurance on all custodial assets, it may be a smart alternative for more cautious investors.

The platform has assets worth $13 billion and more than three million users. Typically, Nexo’s LTV rates are somewhat higher than those of ordinary CeFi loan providers. Borrowing rates are capped at 13.9%, but lending rates might reach 17% APR.

Nexo platform

Unchained Capital

Unchained Capital stands out among CeFi lenders since it does not rehypothecate (lend out again) cash. In addition, it includes a multisig collaborative custody mechanism, which provides borrowers with more asset transparency and security.

In this arrangement, three private keys are required to access collateralized assets. One is under the control of the borrower, one is under the control of Unchained Capital, and one is under the control of a third-party key agent.

Unchained Capital exclusively lends in the United States and only provides bitcoin loans. In order to use the platform, borrowers must also use a hardware wallet. It offers lower LTV rates and higher interest rates than the majority of CeFi providers, which is a consequence of its greater level of security.

Unchained Capital platform

FAQs About Crypto Lendings

What Cryptocurrencies Lend?

What cryptocurrencies you may lend to earn interest will ultimately depend on the platform you join. Some crypto loan services, for instance, offer a broad variety of digital assets with varying market capitalizations.

Others, on the other hand, will exclusively support large-cap projects like Bitcoin and Ethereum, in addition to prominent stablecoins such as Tether and Gemini Coin.

Importantly, if you possess an emerging cryptocurrency with a modest market capitalization, it may be difficult to locate a platform that provides interest accounts on the corresponding coin.

Is Cryptocurrency Lending Secure?

When participating with crypto loan platforms, several dangers must be addressed. In the end, your savings are not covered by an insurance program like the FDIC. You must also assess the risk associated with an excessive number of borrower defaults.

Some frequently asked questions about crypto lending

Is Crypto Lending Profitable?

Yes, Bitcoin and other cryptocurrencies may be advantageous to lend, since you have the possibility to benefit on two fronts. In addition to profiting from the increasing value of the crypto asset, you will also get a fixed rate of income. However, crypto financing is not risk-free; do an extensive study before starting.

Closing Thoughts

Lenders may gain greatly from crypto lending, particularly in terms of collecting interest on the tokens they supply to borrowers. Additionally, the hazards are normally modest due to the various safety and security procedures in place.

Therefore, users of cryptocurrencies who choose to store their tokens for an extended period of time have this option for earning returns on their coins without having to worry about the security of their tokens. If you choose this path, you must conduct your research ahead to ensure that you maximize your earnings while keeping your tokens secure.

The Ultimate Guide To How To Buy Metaverse Land

30 June 2022