Ultimate Information About What Is BurgerSwap?

26 August 2022

What exactly is BurgerSwap, and how exactly does it function? Also, have you ever pondered how BurgerSwap vs PancakeSwap vary from one another? bePAY will help you figure out all of the information about BurgerSwap as well as many details surrounding BurgerSwap in this article. This piece will also compare BurgerSwap to other platforms.

Many different uses of blockchain technology may be found across the cryptocurrency ecosystem. Although they occupy a significant portion of the ecosystem together, centralized exchanges, decentralized exchanges, decentralized financial applications, and other similar entities are strikingly distinct from one another. Interoperability, on the other hand, is a fundamental component of complete development. BurgerSwap was conceived as a direct response to this observation.

The following is an in-depth look at what sets BurgerSwap apart from its competitors and how to utilize the platform.

What Is BurgerSwap?

BurgerSwap is a decentralized exchange based on the Binance Smart Chain (BSC) that facilitates cryptocurrency exchanges via its automated market maker (AMM).

The expansion of decentralized finance (DeFi) has maintained its speed in recent months. It spawned several projects that provide token exchange services. However, the majority of them have liquidity and slippage problems, making trading costly for their customers. BurgerSwap provides a full range of tools for addressing these issues.

BurgerSwap is equipped with numerous incentive schemes to encourage additional users to provide liquidity to the network. And with a rise in its liquidity, consumers may anticipate more effective transactions without suffering astronomical gas expenses.

BurgerSwap is one of the first DeFi platforms to be installed on the BSC. It is an initiative designed to make DeFi’s goods and services more affordable and dependable. Users have not yet reported any problems with the platform since its inception, which demonstrates its dependability.

What is BurgerSwap?

BurgerSwap’s smart contracts were audited by Beosin, a recognized blockchain business, in order to avoid the mistakes made by other platforms and its customers. This reduces the possibility of rug pulls and buggy smart contracts, which were formerly the scourge of most DeFi systems.

However, it must be recognized that placing assets into smart contracts is not without danger. Those who prefer to transact on DeFi sites must continue to exercise caution.

>> Learn more about some compared traits of BurgerSwap vs PancakeSwap

BurgerSwap Cryptocurrency

BurgerSwap’s (BURGER) token conforms to the BEP-20 token standard and is native to the Binance Smart Chain. BURGER has several applications inside the BurgerSwap ecosystem, such as expressing governance rights in votes on protocol upgrades or proposals. In addition, BURGER tokens are used as incentives for liquidity.

Initially, the BURGER token supply was elastic. However, after the listing of the token, the community decided on a supply limit of 21,000,000 BURGER. Additionally, BURGER tokens may only be produced via the supply of liquidity. Every block generates forty BURGER tokens.

The percentage of rewards earned by a miner is proportionate to the quantity of liquidity offered to the protocol. There is a maximum limit of 120 BURGER per block and a minimum supply of 1 BURGER per block, which may be altered by community governance.

BurgerSwap token

In addition, the BurgerSwap methodology did not include a pre-mine or team allocation. Alternately, 10% of all protocol-generated transaction fees will be given to the vested team account. This demonstrates the project’s long-term aims and reassures users that the team won’t ditch their tokens at the drop of a hat!

The BURGER token closed at $0.60 in December 2020. Since then, however, BURGER has reached a new parabolic all-time high price of $15.52 in February 2021 because to the protocol’s increased adoption. At the time of writing, BURGER costs around $1.59

What Are BurgerSwap’s Distinctive Qualities?

BurgerSwap uses game theory and quantitative formulas to calculate asset prices. BurgerSwap is a decentralized AMM exchange on the Binance Smart Chain Network, despite the fact that it utilizes centralized exchanges to determine prices. You may exchange currencies between the ERC-20 Ethereum network and the BEP-20 Binance Smart Chain network with BurgerSwap.

BurgerSwap charges minimal transaction costs and provides rapid transaction processing. Typically, this is accomplished by allowing Ethereum-based investors to migrate to the Binance Smart Chain and take advantage of its cheaper transaction costs.

If you possess BURGER, you have the ability to vote on issues that might affect the BurgerSwap network’s functionality. These include determining the transaction charge and staking rewards.

The tokens have a trading pair with BNB (Binance Coin) and BURGER. This results in a rise in both liquidity and accessibility. Every new BurgerSwap project is accompanied by a listing charge. The community may vote to either approve or reject the proposal. The listing fee is disbursed to BurgerSwap holders with voting rights via a liquidity pool.

BurgerSwap special features

Who Is Behind The BurgerSwap Project?

Technically, BurgerSwap has no renowned creator, since it is a community project comprised of a collection of developers; hence, this group of developers may be referred to as the founders. Tony Carson, Dr. Mehmet Sabir Kiraz, and Dr. Suleyman Kardas established BurgerSwap.

Dr. Mehmet Sabir is the Program Leader of UG Cyber Security and Digital Forensics and has extensive expertise in cryptography, the Foundations of Cyber Security, Cyber Security Management, C Programming, and Multi-Service Networks.

In 2000, he received a bachelor’s degree from Middle East Technical University’s Mathematics Department. He then began his master’s degree studies at the International Max Planck Research Institute for Computer Science in Germany, which he finished in November 2003. In March 2008, he obtained his doctorate from the department of Computer Science at Eindhoven Technical University in the Netherlands.

Tony Carson and Dr. Suleyman Kardas are both significant figures in the cryptocurrency industry. They have independently devised substantial initiatives that address actual issues.

The three partners want to enhance the execution of ERC-2917 via UniSwap by modifying the incentive and governance architecture. In order to do this, the team conducted research and came to the conclusion that BurgerSwap’s code is completely unique and not a fork or duplicate.

The team behind the BurgerSwap project

Guide To Using BurgerSwap

On BurgerSwap, you may trade multiple BEP-20 tokens (i.e., crypto assets that are being operated on the BSC.). Here you can find a list of possible couples. To exchange BNB for BURGER, for instance, go to Swap, enter the amount of BNB to be exchanged, and then click the Swap button. Before exchanging your tokens, verify the price impact, transaction cost, and other facts.

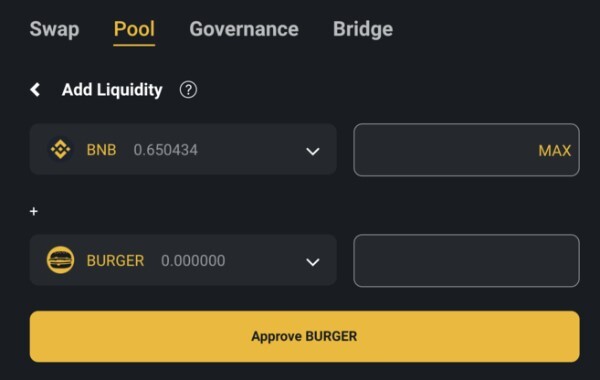

How to increase the BurgerSwap Pool’s liquidity? On the BurgerSwap platform, any user may contribute liquidity (tokens). These tokens may be used to either build a new liquidity pool or augment an existing one.

Using BurgerSwap

To offer liquidity, click “Add Liquidity” on the Pool page and choose the token pair. Before contributing liquidity to the pool and initiating a blockchain transaction, you will be required to click the “Approve” button. This transaction enables the BurgerSwap contracts to use your tokens. After this transaction has been completed, you may increase liquidity.

You earn BURGER tokens according to your pool share when you provide liquidity to a pool. Refer to the BurgerSwap guidelines for further details.

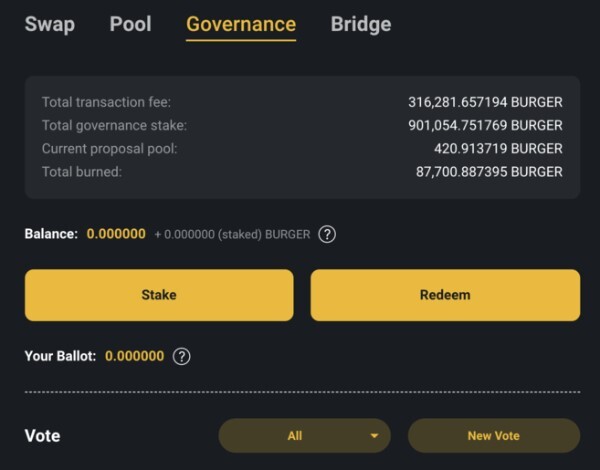

BurgerSwap Governance

On the Governance page of BurgerSwap, you may stake your BURGER tokens. To make new governance suggestions or vote on current ones, you must stake BURGER.

BurgerSwap Governance features

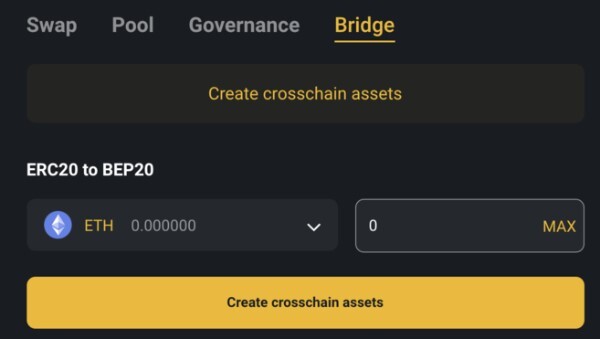

BurgerSwap Chain Crossing Bridge

Since BurgerSwap operates on BSC, only BEP-20 tokens may be used to trade or provide liquidity. BurgerSwap provides a Cross-Chain Bridge service that converts any ERC-20 token into a wrapped BEP-20 version (bTokens). Similar to how certain Bitcoin tokens are produced on Ethereum, although conversions occur between ERC-20 and BEP-20 tokens in this instance.

Bridge feature of BurgerSwap

BurgerSwap Bridge

You’ve likely seen that the Burgerswap exchange contains numerous assets that are not native BSC tokens, like BTC, ETH, BCH, and XRP. Because they were changed to BEP-20 tokens, they can only be traded on the BSC network — either through Bridge (bTokens) or Binance withdrawals.

Consider that you may need to switch your MetaMask network between the Ethereum and BSC blockchains during the procedure. Also, bTokens may only be exchanged if sufficient liquidity is supplied for the appropriate bToken/BNB and bToken/BURGER pairings. Before authorizing a deal, it is thus essential to monitor Price Impact. Trading in pairings with low liquidity will likely result in substantial slippage.

Farming BURGER

When liquidity providers put assets into liquidity pools, they get BLP tokens. In turn, the BLP tokens may also be staked at Burger Farms. They may be un-staked whenever the user desires. BurgerSwap gives incentives in BURGER, USDT, and BNB. In addition to providing liquidity, users may acquire tokens by engaging in governance.

Those who provide liquidity to BurgerSwap will get BURGER tokens according to their pool share. As long as they continue to provide liquidity, they are eligible for awards.

Beginning in November 2020, BurgerSwap will impose 0.3% trading fees on all currency pairings, a part of which will be paid to liquidity providers. In addition, they get a portion of the BURGER created for each new block. Alternately, users may earn incentives by participating in the project’s governance through the voting system.

Additionally, BurgerSwap includes a system that eliminates a portion of the BURGER gained via exchanging fees. In brief, the reward allocation rates are as follows:

- 40% of the incentives are distributed to the platform’s liquidity providers.

- 30% of the incentives are awarded to governance/voting participants.

- 30% of the awards are permanently destroyed.

- The rates may fluctuate as new users submit and vote on new suggestions.

Burger Shack Staking

In addition to BURGER, the protocol’s smart contracts support BNB, BUSD, USDT, BTCB, MDX, HMDX, and ETH as staking assets. In exchange, the user receives both USDT and xBURGER.

Liquidity pool of BurgerSwap

All assets entered into the Burger Shack smart contract are dispersed to yield pools with the greatest yields, ensuring the largest possible payouts for speculators. Likewise, the return for their wager is proportionate to the number of tokens deposited. This option is better for individuals who want to avoid the danger of temporary loss.

xBurger Pool Staking

Additionally, there is the possibility to put assets into the xBurger pool. This simultaneously offers bettors with BURGER and xBURGER. The xBurger pool accepts wagers on the following trade pairs: xBURGER/BURGER, xBURGER/USDT, and xBURGER/BNB.

>> More information about what is liquidity pool

Lending

BurgerSwap enables users to lend their assets to others that are interested. The protocol combines all assets allocated for lending, which other platform users may access for a predetermined rate of interest. The collected interest on the loans made via the pool is then dispersed to the investors in proportion to the amount of their initial investment.

>> Discover lending and borrowing platforms

FAQs About BurgerSwap

Is BurgerSwap Safe?

In September 2020, the blockchain security firm Beosin audited the initial version of the smart contract. As of November 2020, no complaints with BurgerSwap have been reported. Nevertheless, transferring funds into a smart contract is always dangerous, since the code audit may have overlooked problems. Depositing money that you cannot afford to lose should never be done.

Frequently asked questions about BurgerSwap

How Can One Get BurgerSwap?

Visit CoinMarketCap and do a search for BurgerSwap. To access the “market”, you may use the button located next to the price chart. In this view, you will find a comprehensive list of locations where Burger Swap may be purchased, as well as the currencies that can be used to get it.

How Many BurgerSwap (BURGER) Coins Exist?

There are 20.6 million BURGER tokens in circulation, with a maximum supply of 120 million BURGER tokens.

Closing Thoughts

The freshly introduced BurgerSwap platform has already captured the hearts of several investors. Even if, like the rest of the crypto industry, BURGER is taking a tremendous fall, it will eventually recover, particularly given that they have so far accomplished everything outlined in their white papers.

On the Binance Smart Chain, BurgerSwap was one of the first DeFi initiatives to be launched. Despite its similarities to other platforms, BurgerSwap provides distinctive features, including a cross-chain bridge and a governance mechanism.

What Is QuickSwap? The Main Functions Of QuickSwap

30 March 2022